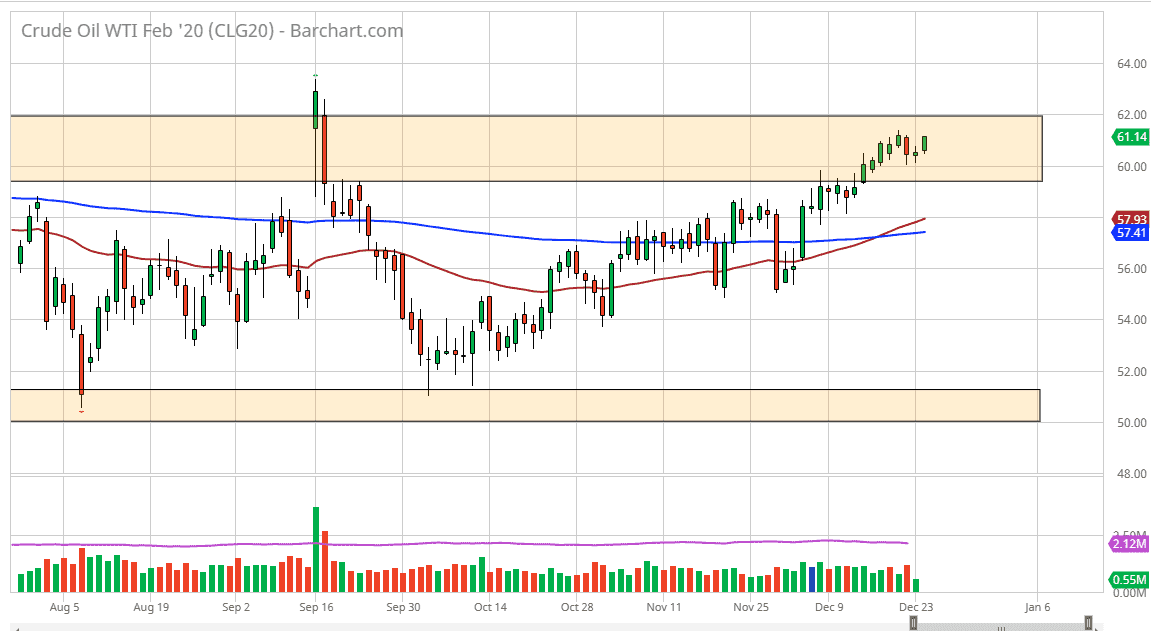

The West Texas Intermediate Crude Oil market has rallied significantly during Christmas Eve, showing signs of extraordinarily bullish pressure again. At this point, the $62 level above will be targeted for a potential break out, and eventually we should in fact see that. That being said though, I had anticipated a pullback in order to take advantage of value when it occurs, but at this point it seems very unlikely to occur based upon what we have seen. Ultimately, if the market can break above the $62 level, then the market is likely to go much higher, perhaps reaching towards the $65 level. All things being equal, a lot of this comes down to a couple of external factors.

While the OPEC production cuts will continue to lift this market, the reality is that one of the biggest drivers might be the US/China trade situation. As the tensions between the two countries cool off a bit, it’s very likely that we will continue to see buyers come in and pick up crude oil because of the perceived expansion of demand. At this point, I think that the $60 level underneath should be massive support, just as the $58 level will as well. Ultimately, I like this market on pullbacks to show signs of value, but the reality is that the market may take off without you. You have to be flexible to not only by pullbacks, but also breakouts.

Looking at this chart, we are at the very outside of the overall sideways consolidation, so it’s likely that we will see a lot of trading at this extraordinarily bullish area, but eventually I do think that the sellers will be overcome. At that point in time, the reality is that the bullish pressure will build up as long as there are good signs coming out of US/China relations, in anticipation of where markets and demand will be in six months, not right now. Ultimately though, if we were to break down below the $58 and the 50 day EMA, it’s likely that the market will break down towards the $56 level, and perhaps even towards the $55 level. All things being equal though, this is a market that I do think that the buyers will continue to reach to fresh highs, and I think that by the time springtime is done, we will probably reach towards $70 based upon the momentum that is building up.