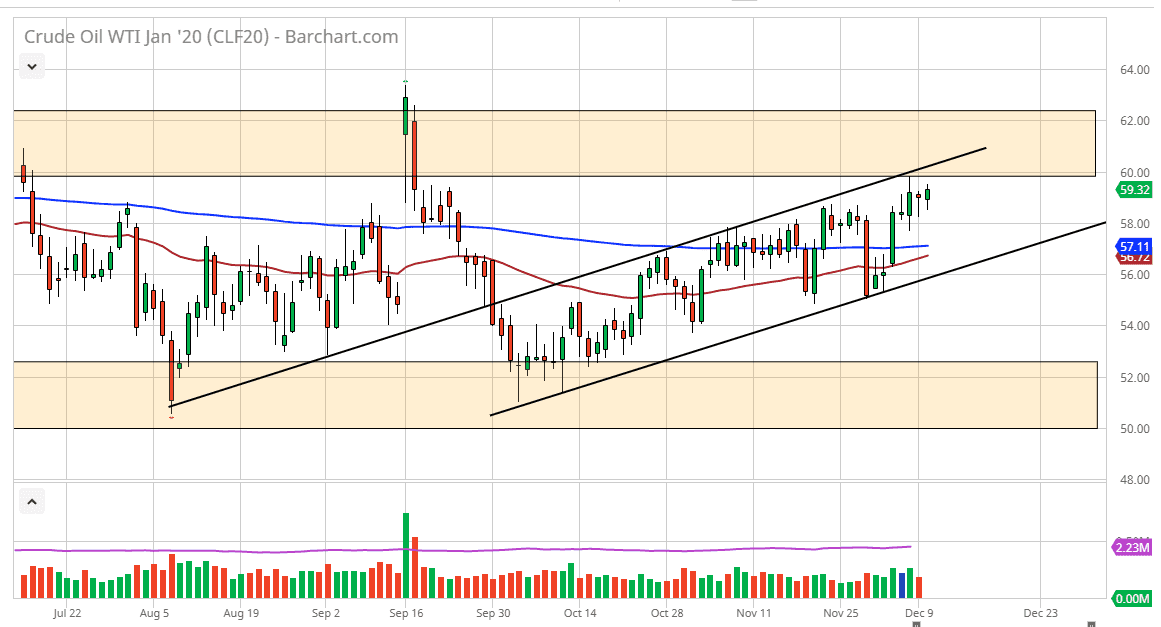

The West Texas Intermediate Crude Oil market initially pulled back during the trading session on Tuesday, but then turned around to rally and slam into the $60 level. At this point, the market is likely to continue to see a lot of resistance at that area that extends all the way to the $62.50 level. Because of this, I think that if we do rally from here it’s very likely that we will continue to have a lot of short-term pullbacks that you can take advantage of.

OPEC has cut production by another 500,000 barrels, after the 1.2 billion barrel cut that is now being extended. Ultimately, this is a market that is basing the next move on potential supply disruption due to production cuts, and more importantly the US/China trade war. If we can get good news out of that situation then in theory, it should drive up demand for crude oil as the global transportation of goods will pick up. Ultimately, the $50 level underneath should be supported, and therefore I think pullbacks at this point are likely to be bought. If we break down below there, the 200 day EMA underneath should offer support, as the 50 day EMA will as well. In fact, it looks as if the 50 day EMA is getting ready to cross above the 200 day EMA, which is the so-called “golden cross”, although I am the first to admit that it’s coming from a very flat type of market, so it isn’t as impressive as a complete turnaround.

We are still technically in an uptrend and channel, and therefore it’s likely that the market will find plenty of buyers underneath. If we do break above the $62.50 level, then it opens up the door for a much bigger move. Alternately, if crude oil was to break down below the moving averages it’s likely that we would reach down towards the $52.50 level which extends resistance all the way down to the $50 level underneath. At this point, I think the one thing you can count on is a lot of choppiness and noisy trading. That being said it seems as if the market is more tilted to the upside, and I think that comes down to waiting on the decision about the December 15 tariffs and whether or not they are implemented against the Chinese.