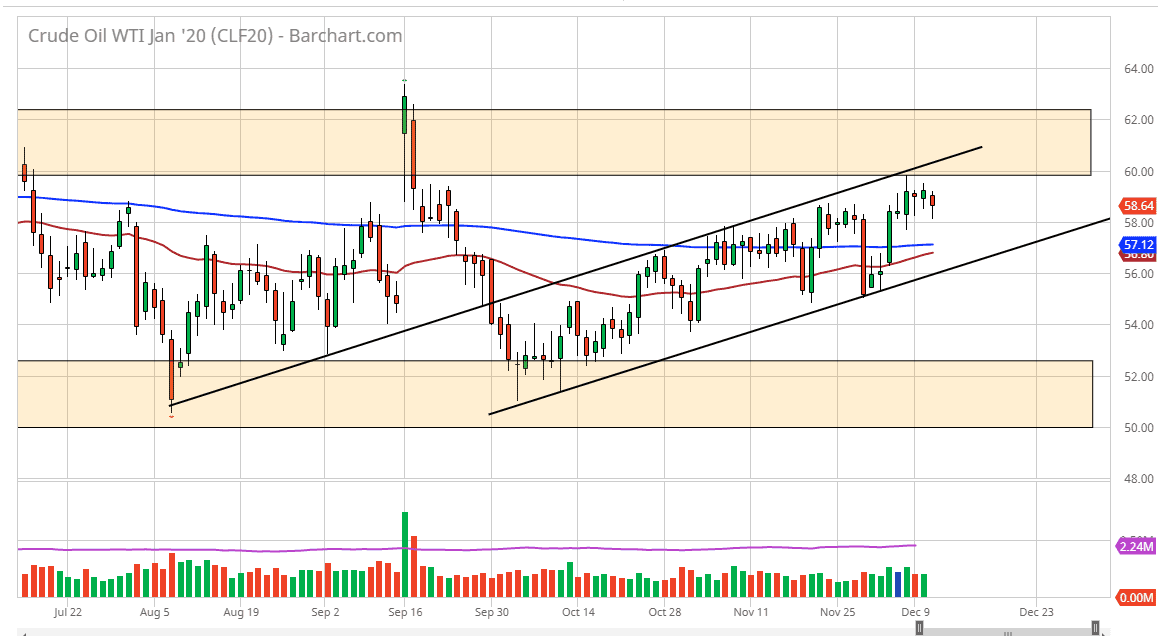

The West Texas Intermediate Crude Oil market fell during trading on Wednesday, reaching down to the psychologically important $58 level. That area caused a bit of buying and support and turned the market around enough to form a relatively supportive looking candlestick. That being said, there is still a significant barrier in the form of $60 above, and that will of course cause a lot of attention. There is significant resistance extending all the way to the $62.50 level, so it’s unlikely that we will be able to simply slice through it. With that in mind it’s likely that we will see a lot of noise above, but it looks as if short-term pullbacks will continue to be bought.

If we were to break down below the $58 level, it’s likely that the 200 day EMA which is closer to the $57 level will come into play and offer plenty of support as well. Ultimately, OPEC has cut production and that puts a little bit of a lift into this marketplace, but we still have to worry about global demand. It’s just not there and unless there is some type of major shift in the attitude of the global markets, it isn’t likely to appear anytime soon.

Looking at this chart, if we were to break down below the 50 and the 200 day EMA, then I think we could make a serious run towards the bottom of the overall consolidation which opens up a move down to $52.50 and possibly even as low as $50. However, that seems to be less likely at this point as we continue to find buyers on short-term dips. With inventory figures coming out, it’s likely that we will continue to see a lot of choppy in this market and eventually make a decision but in the meantime it looks like more sideways back and forth with a slightly upward tilt looks the most likely pattern you will see in this market. Oil has been in a range for some time, and even with the behavior that we have seen as of late, it doesn’t look likely that we are going to break out of it anytime soon, because of OPEC production cuts can do and I’m not sure what will. Without some type of pickup in demand, the upside is somewhat limited, but it does seem to be favored in the short term.