Gold markets will be very quiet this week unless of course we get some type of headline coming out of the US/China situation that moves the markets. This is a market that is very risk sensitive, and we are hanging right around the 50 day EMA. Ultimately, this is a market that also has to deal with a downtrend line, which is the top of the channel, and it looks as if it is likely to cause some type of reaction. That being said though, the most important factor in the market is the fact that it is Christmas week, and therefore it’s very unlikely to see anything along the lines of major movement unless we get a headline.

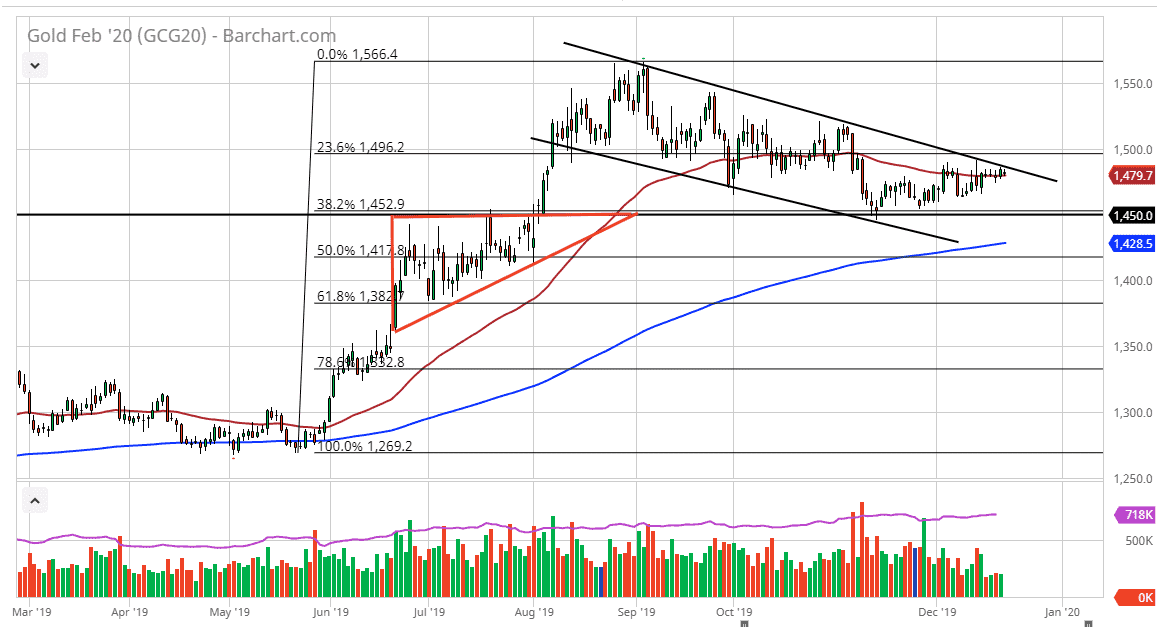

That being said, a headline isn’t that much to ask out of the market considering just how nervous most people are right now. If we get a negative US/China headline, then it probably sends gold much higher. Otherwise, if we get an extraordinarily bullish headline, then it’s likely that the gold market will fall towards the support level underneath near the $1450 level. That is also the 38.2% Fibonacci retracement level, and therefore it should be paid close attention to. We are trading at the 50 day EMA and have the 200 day EMA coming up to this level. That being said, this is a market that is going to be extraordinarily thin so any moves that are done due to algorithm traders picking up headlines will probably be somewhat exaggerated. With that in mind, a lot of professional traders will simply be sitting on the sidelines for the next week or so. However, the technical analysis does suggest that the market is ready to drift lower based upon the downtrend line. It doesn’t necessarily set up for some type of major sell off, just that we are probably going to have a little bit of resistance. With that being the case, short-term I am probably slightly negative on gold but don’t expect much over the next couple of days. The most important thing to keep in mind is that it’s holiday trading, so you should probably focus on your family and friends more than markets but if you do get involved here you should play very small positions as the danger will be rather high. Yes, it’s great that you can get big move is based upon a headline, but those moves cut both ways.