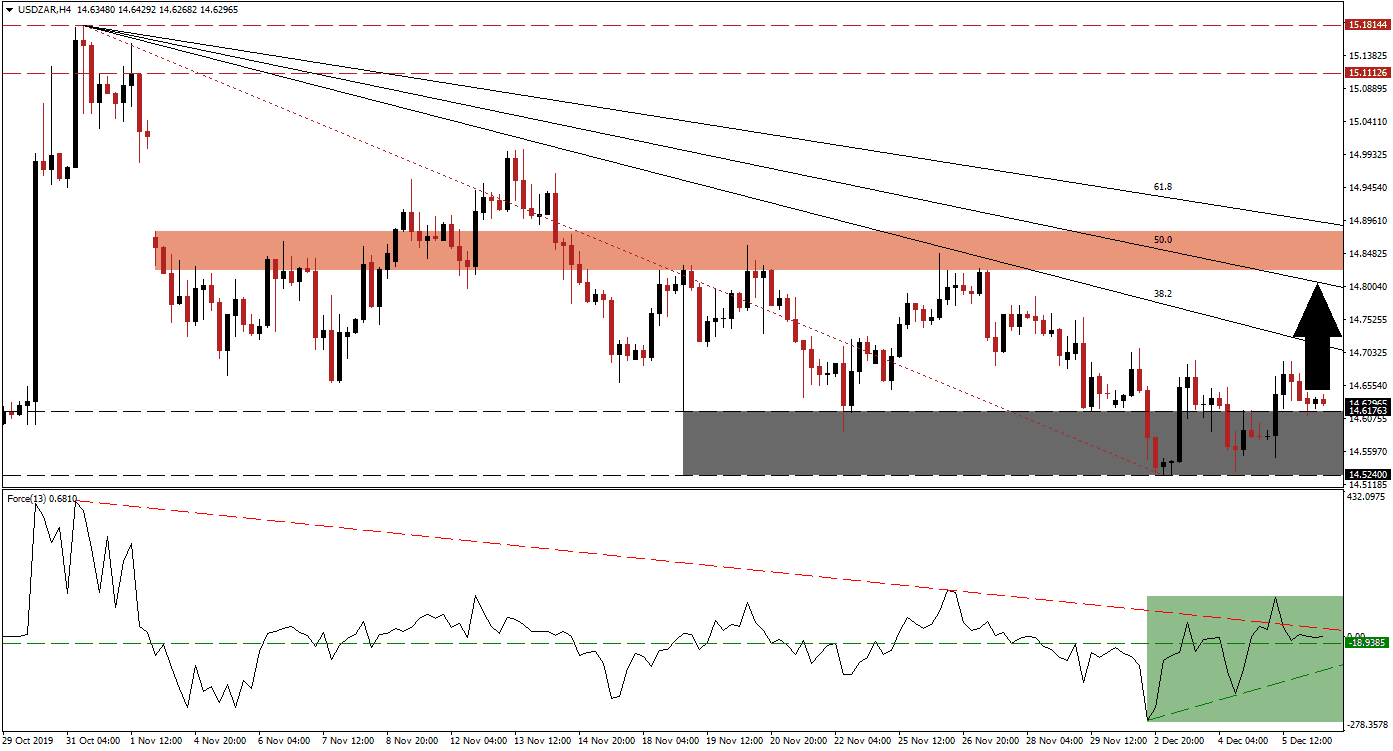

After the USD/ZAR contracted into its support zone, bullish momentum started to recover and pushed this currency pair above the top range of its support zone. Economic data out of South Africa mirrored economic disappointments out of the US, but the unexpected third-quarter GDP contraction of 0.6% halted the sell-off temporarily. As the descending 38.2 Fibonacci Retracement Fan Resistance Level is approaching, breakdown pressures are on the rise. Barring a negative surprise in today’s US NFP data, a short-term reversal in price action is expected before the long-term downtrend continues.

The Force Index, a next-generation technical indicator, points towards the rise in bullish momentum as the USD/ZAR eclipsed its support zone. An ascending support level formed as a result and is adding short-term bullish pressures. The Force Index pushed through its horizontal resistance level and turned it into support. This technical indicator was able to pierce its descending resistance level to the upside but quickly reversed as marked by the green rectangle. Bulls remain in charge of price action as the Force Index holds on to positive conditions. You can learn more about the Force Index here.

Forex traders are advised to monitor the Force Index as a renewed push above its descending resistance level is favored to lead to a short-covering rally in this currency pair. Another bullish development emerged after the USD/ZAR moved above its Fibonacci Retracement Fan trendline inside its support zone; this zone is located between 14.52000 and 14.61763 as marked by the grey rectangle. A move in price action above its intra-day high of 14.69089, the peak of its current advance, is likely to extend a move to the upside. You can learn more about the Fibonacci Retracement Fan here.

While the next short-term resistance zone is located between 14.82443 and 14.88004 as marked by the red rectangle, upside potential for a short-term reversal remains limited to its 50.0 Fibonacci Retracement Fan Resistance Level. The short-term resistance zone emerged following a price gap to the downside; with the long-term downtrend intact, a lower high in the USD/ZAR is expected to form. A significant fundamental catalyst would be required to invalidate the bearish chart pattern in place.

USD/ZAR Technical Trading Set-Up - Short-Term Reversal Scenario

Long Entry @ 14.61750

Take Profit @ 14.79500

Stop Loss @ 14.56250

Upside Potential: 1,775 pips

Downside Risk: 550 pips

Risk/Reward Ratio: 3.23

Should the Force Index complete a breakdown below its ascending support level, the USD/ZAR is likely to follow suit with a push to the downside. The short-term technical picture favors a short-term reversal, but the long-term fundamental scenario remains distinctively bearish. The next support zone following a breakdown in price action is located between 14.19161 and 14.31322.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 14.48000

Take Profit @ 14.31500

Stop Loss @ 14.53750

Downside Potential: 1,650 pips

Upside Risk: 575 pips

Risk/Reward Ratio: 2.87