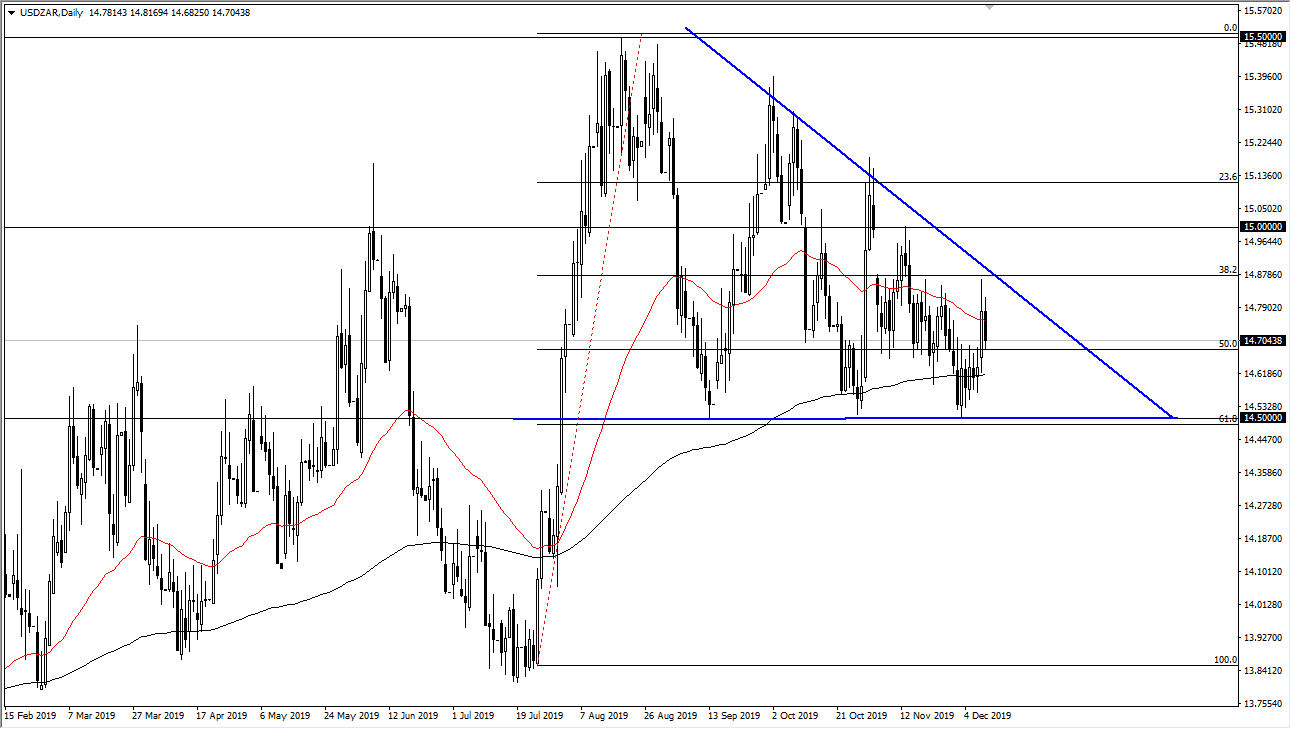

The US dollar initially tried to rally during the trading session on Wednesday but found enough resistance against the South African Rand to rollover again at the 50 day EMA. When looked at from a longer-term perspective, you can see that we have gradually been making “lower highs, while forming a massive support level and the 14.50 Rand level. Ultimately, this is a sign that we are trying to break down, and that it’s only a matter of time before the 14.50 level gives way.

It should also be noted that the 61.8% Fibonacci retracement level is there, so it will continue to offer a certain amount of support. The 200 day EMA being broken through of course would also be negative but at the end of the day we have sliced through it slightly in the past. I think at this point the market is likely to continue finding plenty of reasons to sell off, if nothing else more of a “risk on” type of move. Recently, we have seen concerns about South African debt, but the South African government is in the process of trying to work on those issues, and therefore there have been several movements in the right direction. Beyond that, noone cares about South Africa, this is more or less about risk appetite in emerging markets.

If it’s more of a “risk on” type of market this pair will continue to follow we will eventually break down below that crucial 61.8% Fibonacci retracement level. Once we do it opens up the door to the 100% Fibonacci retracement level longer-term, meaning closer to the 13.85 South African Rand level. I do not have any interest in buying this pair, unless of course we were to break above the downtrend line, closer to the 14.90 Rand area. With the way the relentless grind lower has gone, it seems very unlikely to happen anytime soon and I do believe that we will eventually get that breakdown. If we get some type of trade deal between the Americans and the Chinese, that could possibly be reason enough bullish momentum when it comes to riskier assets such as the South African Rand, and other emerging market currencies, such as the Mexican peso. At this point, selling the rallies has worked for several weeks now, and that appears to be the case at this point as well.