The US dollar rallied a bit during the trading session on Tuesday to show signs of life again, as there are concerns about the trade war again. Donald Trump stated that the China trade deal might be better solved “after the election.” Anybody who’s been watching the president over the last three years recognizes that the stock market was at the highs, and therefore he felt comfortable and of rattling the markets. That being said though, it will only be a matter of time before they walk it back and try to goose risk appetite.

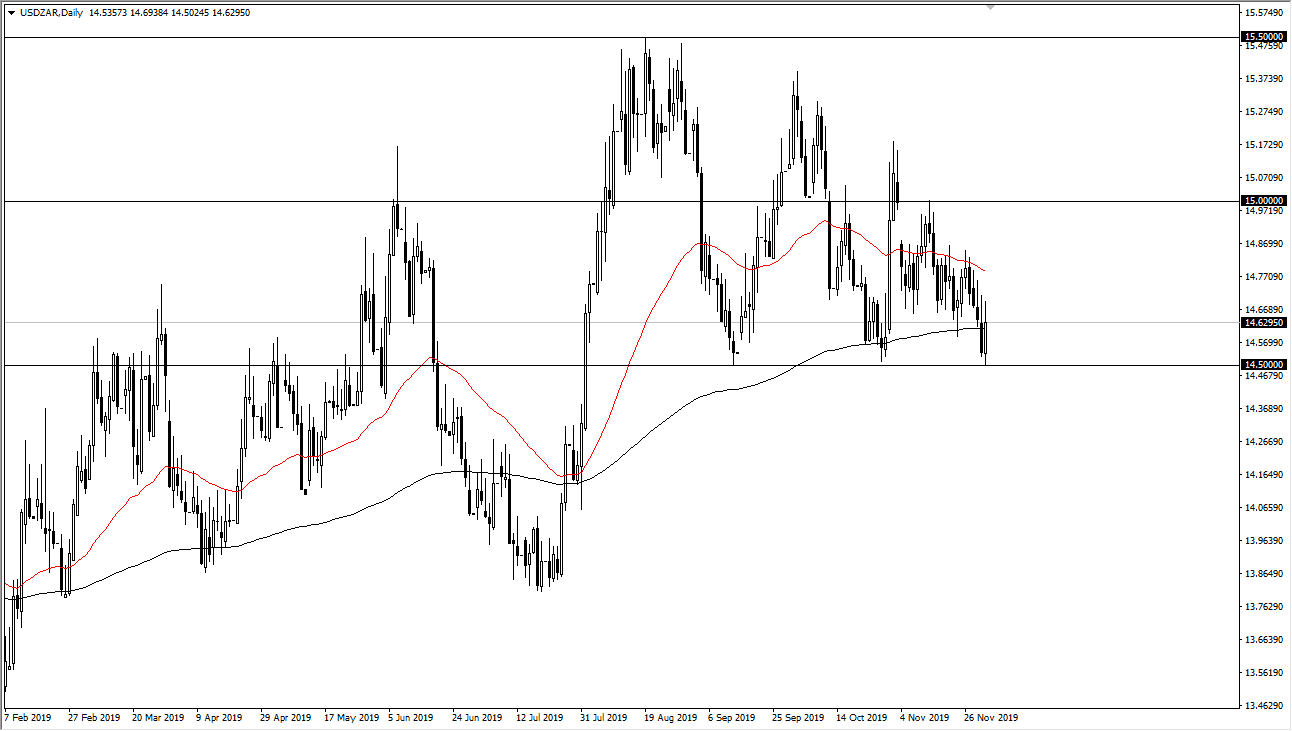

This is a pair the tile the sensitive to risk appetite, as the US dollar is considered to be a “safety currency” while the South African Rand represents not only Africa, but the emerging markets. With that being the case, if this pair falls it’s likely that the market will favor the Rand over the greenback as it allows you to play the emerging markets. Looking at the chart, we are currently trading around the 200 day EMA and that of course is something worth paying attention to. Furthermore, the red 50 day EMA has offered resistance recently, and now I feel as it’s only a matter of time before we try to break down again.

All it will take is some type of “risk on” move. Once we break down below the 14.50 Rand level, it’s likely that the market will open up to the 14.25 level and then eventually the 14 Rand level. I suspect that it’s only a matter of time before the sellers come in and start shorting this market, and in fact towards the end of the day already started to push the market a little bit lower. That being said, headlines will continue to come into play, and most of those probably won’t come from South Africa. This isn’t necessarily the most liquid pair, so if something is going on with the US dollar, it certainly will go a long way here. If we were to break above the 50 day EMA, it could change some things, but we have already gapped lower a couple of weeks ago, fill that gap, and then broke down a bit from there. This is a typical move, and classic technical analysis. All things being equal I believe it’s only a matter of time before we go lower.