Friday’s unexpected strong NFP report out of the US boosted the US Dollar versus the Turkish Lira, but this move may be a short-term event. Bearish momentum is on the rise after the USD/TRY recorded a marginally higher high. This currency pair is now prone to a price action reversal unless a fresh fundamental catalyst will emerge, and counter the build-up in breakdown pressures. A move in price action below its resistance zone is additionally expected to ignite a profit-taking sell-off, adding more downside pressure.

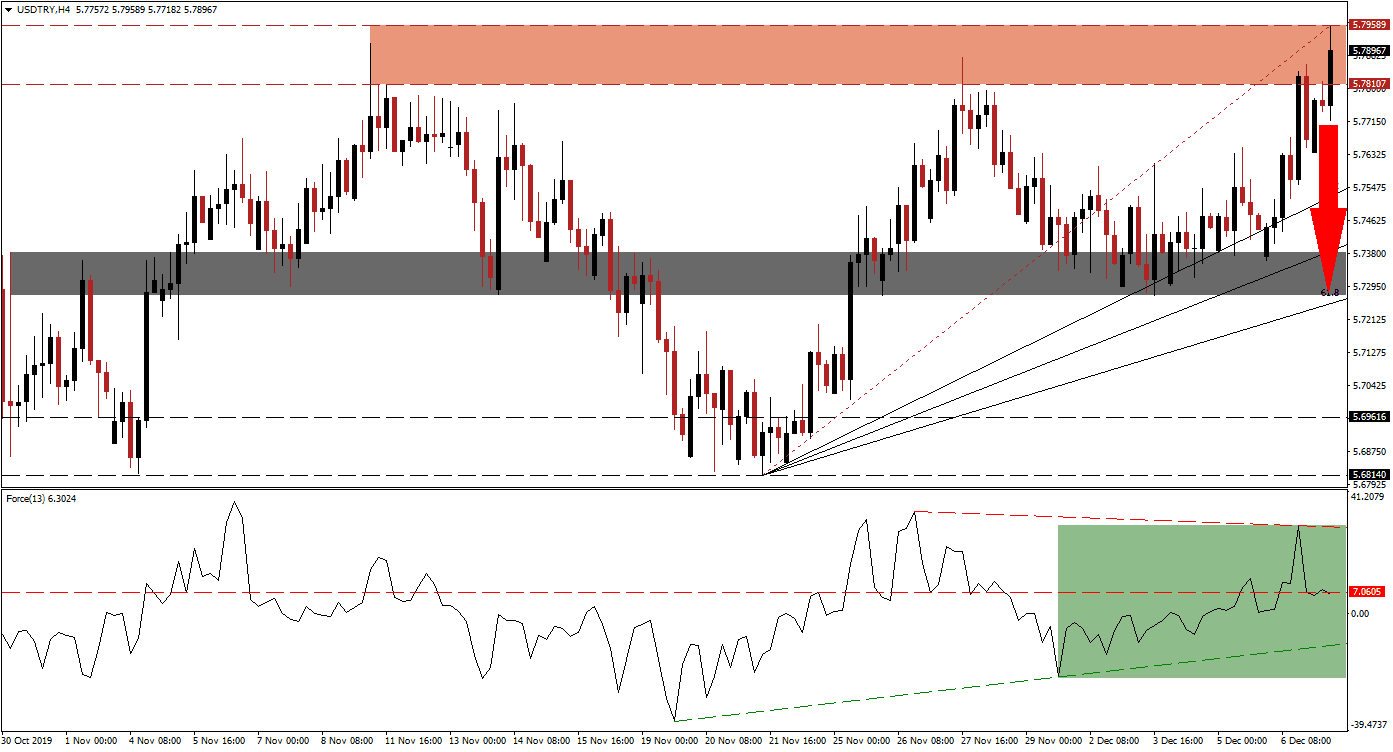

The Force Index, a next-generation technical indicator, failed to confirm the higher high in price action and a negative divergence formed as a result. Bullish momentum plunged as the USD/TRY inched higher, and the Force Index is now in the process of converting its horizontal support level back into resistance as marked by the green rectangle. This technical indicator is anticipated to descend into its ascending support level, which would place it into negative conditions and bears in charge of price action. You can learn more about an ascending support level here.

Forex traders are advised to monitor the Force Index; a push to the downside is expected to lead this currency pair into a breakdown below its resistance zone, located between 5.78107 and 5.79589, as marked by the red rectangle. While Friday’s NFP report surprised to the upside, it contradicts a swath of economic reports that came in significantly weaker. The long-term bearish outlook remains intact, and a breakdown sequence is expected to follow. Uncertainty over what will happen on December 15th additionally remains a wild card for the USD/TRY, as the Turkish economy started to shown signs of a sustained recovery.

Another bearish development emerged as price action remains below its Fibonacci Retracement Fan trendline. The anticipated price action reversal should take the USD/TRY down into its next short-term support zone, located between 5.72727 and 5.73816, as marked by the grey rectangle. With the ascending 38.2 and 50.0 Fibonacci Retracement Fan Support Levels already above this support zone, more downside may materialize if bearish momentum forces a breakdown below the 61.8 Fibonacci Retracement Fan Support Level. The next long-term support zone awaits this currency pair between 5.68140 and 5.69616.

USD/TRY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.79000

Take Profit @ 5.72750

Stop Loss @ 5.80750

Downside Potential: 625 pips

Upside Risk: 175 pips

Risk/Reward Ratio: 3.57

Should the Force Index advance and move into its descending resistance level, followed by a breakout above it, the USD/TRY may follow suit. Any advance from current levels should be considered a solid trading opportunity to the downside, due to the long-term fundamental bearish outlook and the US Fed market interference in its interbank lending market. The next resistance zone is located between 5.84217 and 5.86269 from where more upside remains challenging.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.82500

Take Profit @ 5.86250

Stop Loss @ 5.80750

Upside Potential: 375 pips

Downside Risk: 175 pips

Risk/Reward Ratio: 2.14