The US dollar fell a bit initially to kick off the trading session on Thursday, as the Mexican peso continues to pick up a bit of steam due to the idea that Congress and the White House are come to terms with ratifying the USMCA agreement which is essentially NAFTA 2.0 as far as a trade deal is concerned. That being the case, the market is very likely to continue to be very choppy as we have fallen straight down over the last couple of days. This has been given a significant amount of bearish pressure due to Nancy Pelosi and Donald Trump working together on this one specific situation.

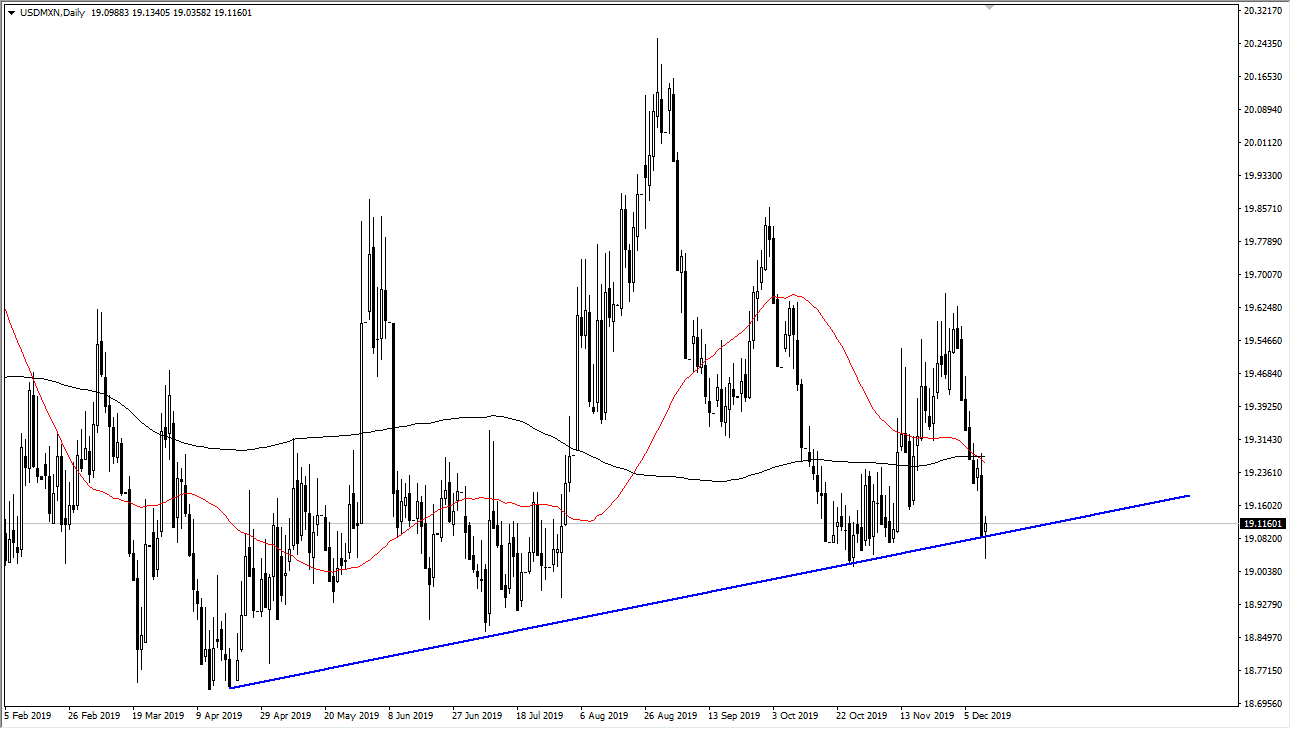

The daily candlestick is forming a bit of a hammer, and that of course is a very bullish sign. The hammer is also sitting on a potential uptrend line so that should be paid attention to as well. From a horizontal standpoint, the 19 pesos level will of course be important as it is not only a large, round, psychologically significant figure, but also an area that has seen buyers previously. Because of this, this is a market that has made “lower highs”, so even if we get a bounce from here, I think at this point it’s going to come down to risk appetite and of course this agreement.

The US dollar has been selling off against the Mexican peso due to this agreement obviously, but then the question becomes whether or not there is a general “risk on” attitude from a higher perspective when it comes to the markets. If we get issues over the weekend in the name of trade tariffs being extended on the Chinese, that might have a knock on effect over here and send a lot of money running from emerging markets. Regardless, due to the technical support in this area I am anticipating that the next move is probably higher. That being said, the highs continue to get lower so it’s very likely that signs of exhaustion will be sold into, but only if the market receives good news due to the trade agreement and/or something good coming out of the US/China trade situation. At this point, looking at this chart I think the one thing you can count on is a lot of choppy behavior. A breakdown below the lows of the trading session on Thursday would signify that perhaps we are ready to go towards the 18.50 pesos level, maybe even the 18 pesos level.