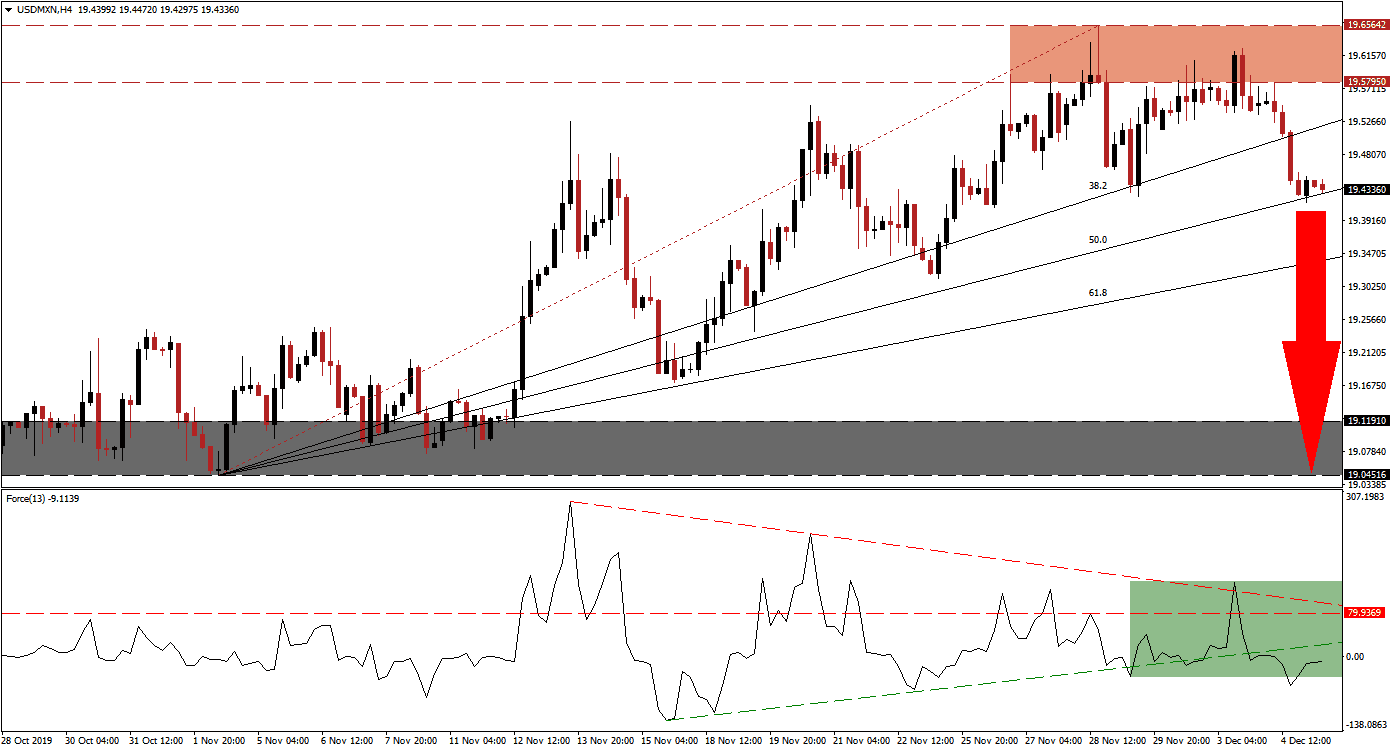

Economic data out of the US continues to disappoint and paints a weaker-than-priced-in economy. December started with a dismal report in the manufacturing sector, followed by a worse ADP employment report, and ended with a weaker service sector than was forecast. The USD/MXN started a breakdown sequence after recording a lower high inside its resistance zone, this represents a bearish development. A breakdown below its resistance zone followed and was extended with a push below its ascending 38.2 Fibonacci Retracement Fan Support Level, converting it into resistance.

The Force Index, a next-generation technical indicator, points towards the increase in bearish momentum following the breakdown. The Force Index was rejected by its descending resistance level, which led to a breakdown below its horizontal support level and turned it into resistance. Bearish momentum sufficed to pressure this technical indicator below its ascending support level, as marked by the green rectangle and turned it into temporary resistance. The Force Index is additionally located in negative territory and bears remain in control of the USD/MXN.

An early sign that the advance in this currency pair reached its end was the lower high that formed inside the resistance zone, located between 19.57950 and 19.65642 as marked by the red rectangle. Price action has now reached its critical 50.0 Fibonacci Retracement Fan Support Level from where another breakdown in the USD/MXN is anticipated, as bearish fundamental events accumulate. The Mexican economy faces economic worries of its own, but the magnitude of issues surrounding the US and the US Dollar trump Mexico. You can learn more about the Fibonacci Retracement Fan here.

One important level to monitor is the intra-day low of 19.31354, this level represents the last support level between an extended sell-off in this currency pair and its support zone. A move below this mark is anticipated to result in the addition of new net sell orders and place the USD/MXN below its 61.8 Fibonacci Retracement Fan Support Level. This will clear the path into its support zone, located between 19.04516 and 19.11910 as marked by the grey rectangle.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 19.43250

- Take Profit @ 19.04750

- Stop Loss @ 19.50000

- Downside Potential: 3,850 pips

- Upside Risk: 675 pips

- Risk/Reward Ratio: 5.70

A triple breakout in the Force Index would be required to reverse the current bearish scenario, elevate this technical indicator above its descending resistance level, and initiate a short-covering rally. Even with such a development, upside in the USD/MXN remains limited to its resistance zone which represents a good short-selling opportunity in this currency pair as the long-term outlook remains bearish unless a fresh fundamental catalyst emerges.

USD/MXN Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 19.55000

- Take Profit @ 19.65000

- Stop Loss @ 19.50000

- Upside Potential: 1,000 pips

- Downside Risk: 500 pips

- Risk/Reward Ratio: 2.00