The US dollar suffered a setback from the preliminary results of the new jobs in the U.S non-agricultural sector, according to the ADP survey, in addition to the recent disappointment regarding the possibility of signing a trade agreement between the United States and China, after sharp remarks from Trump and his team as it neared the imposition of more tariffs on Chinese imports. In light of this pessimism, the price of USD/JPY fell to the 108.42 support before settling around 108.80 at the time of writing. Losses were temporarily halted after Bloomberg reported a US-China deal was close.

President Donald Trump told reporters earlier this week that it might be "better to wait" until after the November 2020 presidential election to conclude the "first phase of the deal" which was reportedly reached on October 11.

The US economy slowed this year, as interest shifted from 2018 tax cuts to the opposite direction. Growth slowed in parallel with the slowdown in global economic growth as the global trade war continued. This has prompted the Federal Reserve to cut interest rates three times throughout 2019. And now awaits the results of these cuts before completing or pausing its policy easing. Yesterday, a total of 67,000 new jobs were announced in the non-agricultural sector, with expectations of 140,000 from 125,000 jobs added in October.

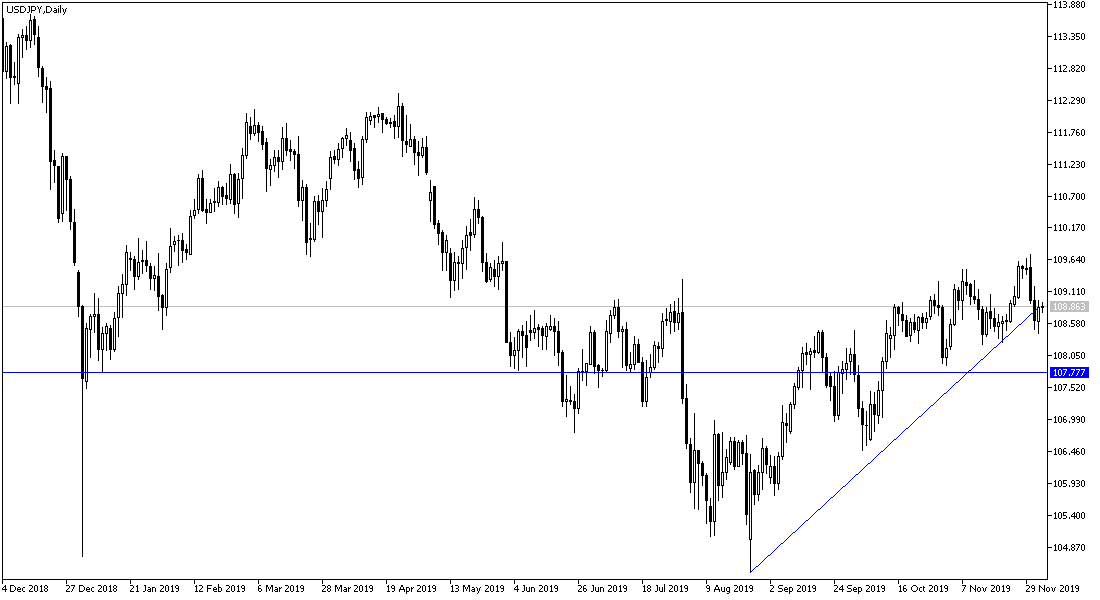

According to the technical analysis of the pair: Continued investor appetite for safe havens will favor the bearish correction of the pair USD/JPY and will push it towards and below the 108.00 support, which will confirm the breach of the trend as shown on the daily chart below. Technical indicators are heading to oversold areas and prefer buying from 108.45 and 107.80 levels respectively. The trend turned bullish and awaits a move towards 110.00 psychological resistance. The trade pact between the United States and China ahead of Dec. 15 will determine the pair's performance in the coming days.

As for the economic calendar data today: All focus will be on US economic releases today with the release of the trade balance, jobless claims and US factory orders.