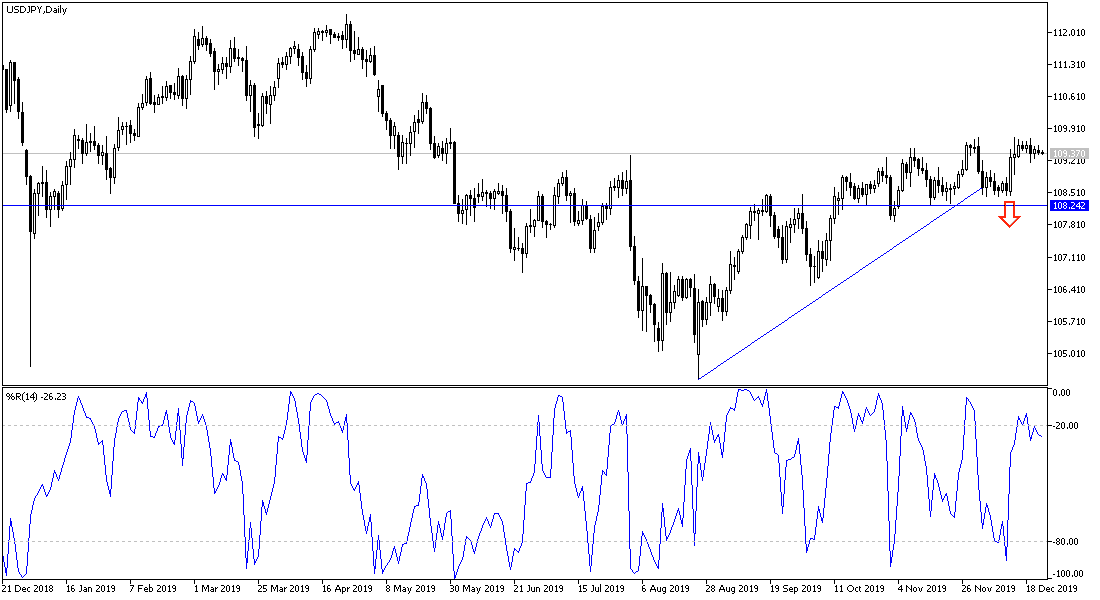

Poor performance of the USD/JPY with investors preparing for Christmas and New Year holidays. The pair is stable around 109.40, and there is no change in our technical point of view towards this pair, as the rally towards 110.00 psychological resistance will stimulate the current upward trend, and the 108.00 psychological support will remain key to the strength of the downtrend again. The daily chart below is the best guide. The pair’s recent performance foreshadows a strong movement ahead. The Japanese yen did not react much to China's recent announcement to cut more tariffs on US products. Beijing has adopted a series of measures to open markets and cut tariffs aimed at helping revive economic growth, which slowed to a three-decade low of 6% in the last quarter.

In a similar context, leaders from China, Japan and South Korea, affirmed their commitment to ending North Korea's nuclear and missile programs, working for free trade and promoting economic integration between them. A Chinese official said that his country sees the protection of free trade as beneficial to the protection of multilateralism and world peace.

We have not witnessed a significant move for this pair after the announcement of the US economic data, which showed a stronger than expected decline in US durable goods orders to the lowest in six months, with the basic orders decreased by -2.0%, the largest drop since last May. Orders decreased during the past two months. October number was revised to 0.2% from 0.6%. Most analysts had expected a recovery in total orders of more than 1% for November.

By the end of last week, the GDP growth rate - the total economic output of goods and services - had been announced, and had increased at a moderate annual rate of 2.1% in the July-September quarter. At the same time, the rapid pace of spending last month is a sign that consumers, who account for about 70% of the economic activity of the United States of America, are helping the economy to offset the obstacles represented by President Donald Trump's trade wars and the global economic recession.

It must be borne in mind that the Japanese yen is one of the most important safe havens for investors in times of uncertainty and the return of global trade and geopolitical tensions will be in favor of its gains.