With the US central bank maintaining its monetary policy as is, the USD/JPY pair did not find the momentum needed to correct higher, but rather the pair retreated to the 108.46 support level before returning to stability around the 108.60 level at the time of writing. It appears that the pair is cautiously awaiting the announcement of a postponement or approval of US tariffs, which will be imposed on China's imports by December 15.

Yesterday the Federal Reserve kept the key interest rate in a low range from 1.5% to 1.75% after having cut it three times this year. Bank Governor Powell had previously described those interest rate cuts as "insurance" that would offset the effects of the trade war between the United States and China and the global economic slowdown. Powell boldly suggested that the Fed will not likely reverse these cuts in the near future.

"Inflation is barely rising, although unemployment is at its lowest level in 50 years and is expected to remain so," Powell said at his news conference. "We have learned that unemployment can remain at very low levels for a long period of time without unwanted upward pressure on inflation," he added. In another sign of his confidence, the latest federal policy statement dropped a previously used phrase that refers to the "uncertainties" surrounding the economic outlook. This change indicates that the Fed is now less concerned about economic risks from trade wars or a global slowdown.

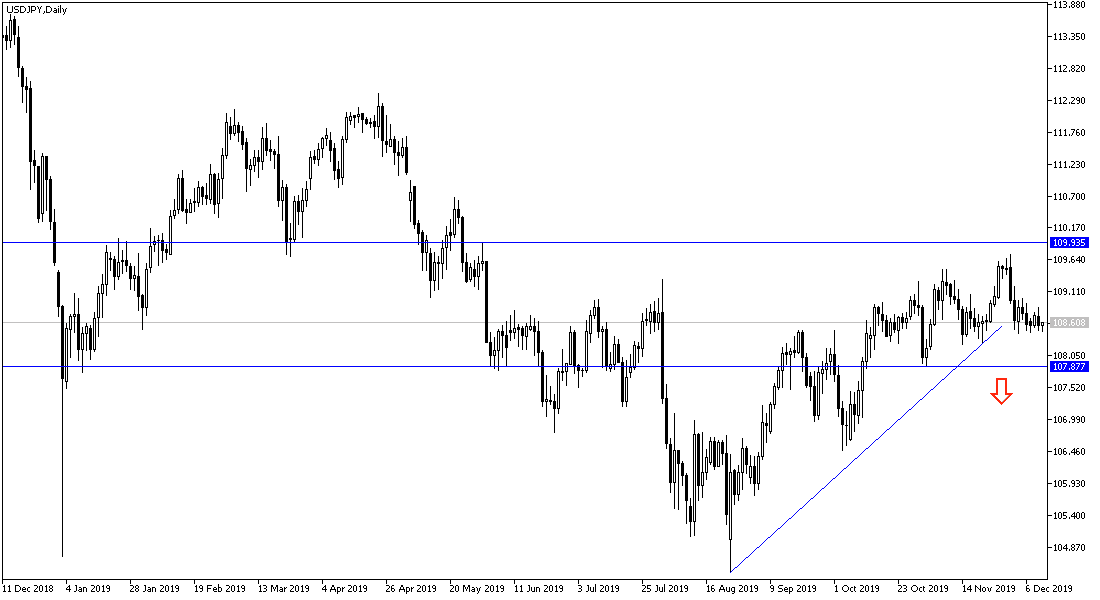

According to the technical analysis of the pair: There is no change in my technical view of this pair’s performance. On the daily chart, there is stability of performance for several sessions, which foreshadows a strong movement coming. Generally the general trend is still bearish, and the trend will get a momentum by moving below the 108.00 Psychological support. From there, it will move to support levels at 107.65 and 106.90 respectively. From the last level, the purchase is ideal for the time being. On the other hand, the upward correction will be strong if the pair succeeded in breaking the 110.00 psychological resistance. Renewed global trade and political tensions will be in favor of stronger gains for the Japanese yen.

As for the economic calendar data: The focus will be on the US economic data; producer price index and jobless claims.