For five consecutive trading sessions, the USD/JPY price is trying not to cross the 108.00 psychological support barrier so that the current downside strength does not increase, and the pair settles around 108.76 at the time of writing, and before the announcement of monetary policy decisions from the US central bank. The dovish tone of the monetary policy and Jerome Powell's statements will not benefit the US dollar much and will remain under downward pressure, especially with markets awaiting the date of December 15, and whether the imposition of more US tariffs on Chinese imports be delayed, or will the United States continue to it threat and impose it, and thus increase pessimism toward The future of global economic growth.

The American administration continues to threaten to implement these tariffs, as it has not been confirmed by both sides of the global trade war of reaching the terms of the Phase 1 agreement.

Important US inflation numbers will be announced ahead of the bank’s decisions. Yesterday, a decrease in productivity was announced in the summer in the United States, the first drop in nearly four years, which underlines the obstacles that American companies face in increasing the efficiency of workers. The US Department of Labor announced that productivity decreased at a seasonally adjusted annual rate of - 0.2% in the July-September quarter, the first quarterly decline since the fourth quarter of 2015. The new report represents a slight revision of an initial low estimate of 0.3% in productivity.

Employment costs rose at an annual rate of 2.5% in the third quarter, in sharp recovery from a slight increase of 0.1% in the second quarter. US President Donald Trump slashed a $ 1.5 trillion tax cut in 2017 as a way to stimulate productivity by increasing corporate investments in computers, machines and other equipment that improve productivity. However, in recent quarters, investment in business has remained weak.

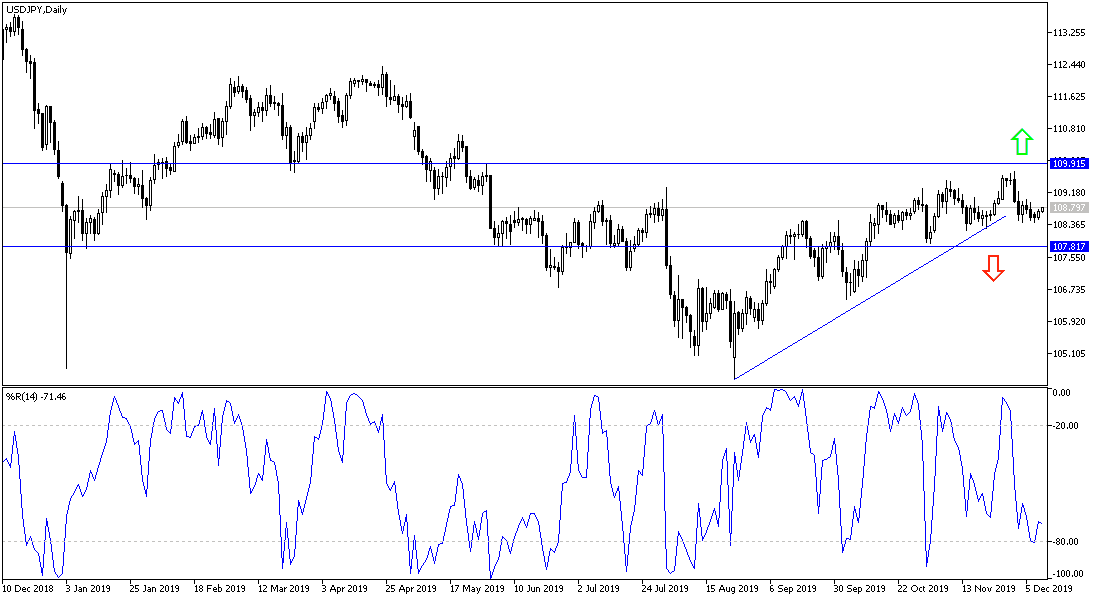

According to the technical analysis of the pair: On the daily chart of the USD/JPY pair, the general trend is still bearish and the trend will gain momentum by moving below the 108.00 psychological support and towards support levels at 107.65 and 106.90 respectively. From the last level, the purchase is ideal for the time being. On the other hand, the correction for the upside will be stronger with the pair's success in breaking the 110.00 psychological resistance. Renewed global trade and political tensions will be in favor of stronger gains for the Japanese yen.

As for the economic calendar data: From Japan, the Producer Price Index will be announced, and from the United States, the most important US inflation figures and Federal Reserve monetary policy decisions will be announced, as well as the important press conference of Governor Jerome Powell.