The Japanese Yen is still the strongest according to the recent performance of the USD/JPY pair, even with the announcement of stronger US jobs results than expected for the month of November. As investors prefer safe havens in times of uncertainty, and with the delay in announcing the trade agreement between the United States of America and China, especially as time runs out for the 15th of December, during which the rest of the tariffs will be imposed on the rest of Chinese imports. This means expanding the scope of the global trade war and threatening to continue slowing global economic growth. The price of the pair is moving in a very narrow range, with a greater tendency to fall, and is stable around 108.62 at the time of writing.

The latest US labor market numbers are in favor of the path of the US Federal Reserve’s policy led by Jerome Powell. The bank has suspended the pace of the US rate cuts until the reaction from the three rate cuts that occurred throughout 2019 appeared. Tomorrow the bank will announce its monetary policy amid strong expectations that the bank will keep interest rates unchanged at the last meeting of 2019 and the content of the monetary policy statement and Jerome Powell's statements will have a greater affect, as investors want to know the future of the bank's monetary policy.

From Japan, the Cabinet Office announced that Japan's gross domestic product was shocked, reaching a seasonal annual rate of 1.6 percent in the third quarter of 2019. This was a sharp upward movement from 0.2 percent gains last month for the third quarter. On a seasonally adjusted quarterly basis, GDP increased to 0.4 percent from 0.1 percent in the first reading. In general, the Japanese economy is still suffering and is awaiting further stimulus from the Japanese government and the Central Bank of Japan.

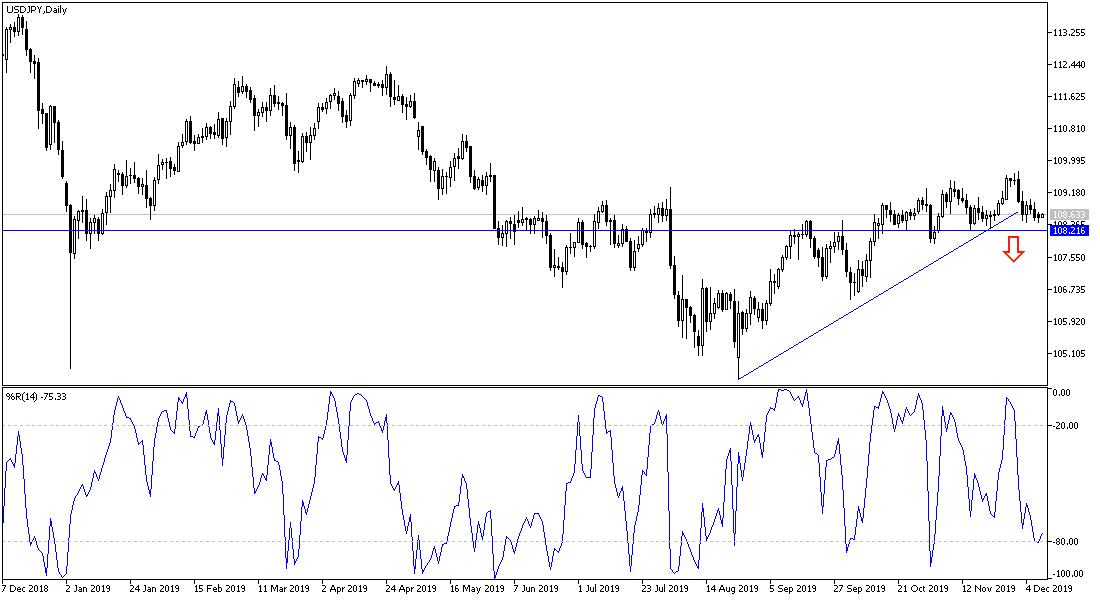

According to the technical analysis of the pair: the current downward stability supports the currency traders' question about the most appropriate buying levels for the USD/JPY pair, which are 108.25, 107.75 and 107.00, respectively. Where the rebound from was strong. And if Trump abandoned the imposition of US tariffs on December 15, even if no agreement was announced to allow more time for negotiations, the pair might get the momentum to move higher and the closest resistance levels would currently be 109.00, 109.75 and 110.25, respectively, and the last level is a new impetus for bullish correction.

As for the economic calendar data today: There are only US non-agricultural production and unit labor costs. In addition to the extent of investor risk appetite.