The United States dollar has rallied significantly against the Japanese yen over the last couple of months, and it should continue to do so during the month of December. There are multiple reasons for this to happen, starting with the fact that it is a cyclical move based upon risk appetite. There is the so-called “Santa Claus rally” that happens on Wall Street, which is a major risk on type of move. Traders and more importantly, money managers will start to try and pad the results of the year so that they can report better results to their clients.

Furthermore, we are starting to see headway being made in the US/China trade situation, as tensions have not risen much lately. This is despite the fact that Donald Trump just signed a congressional bill that backed the Hong Kong protesters. Yes, China did raise anger about it, but they didn’t actually do anything. This shows that we are definitely getting closer to some type of initial deal, because quite frankly the Chinese government can’t afford new tariffs based upon the economic numbers that are being released.

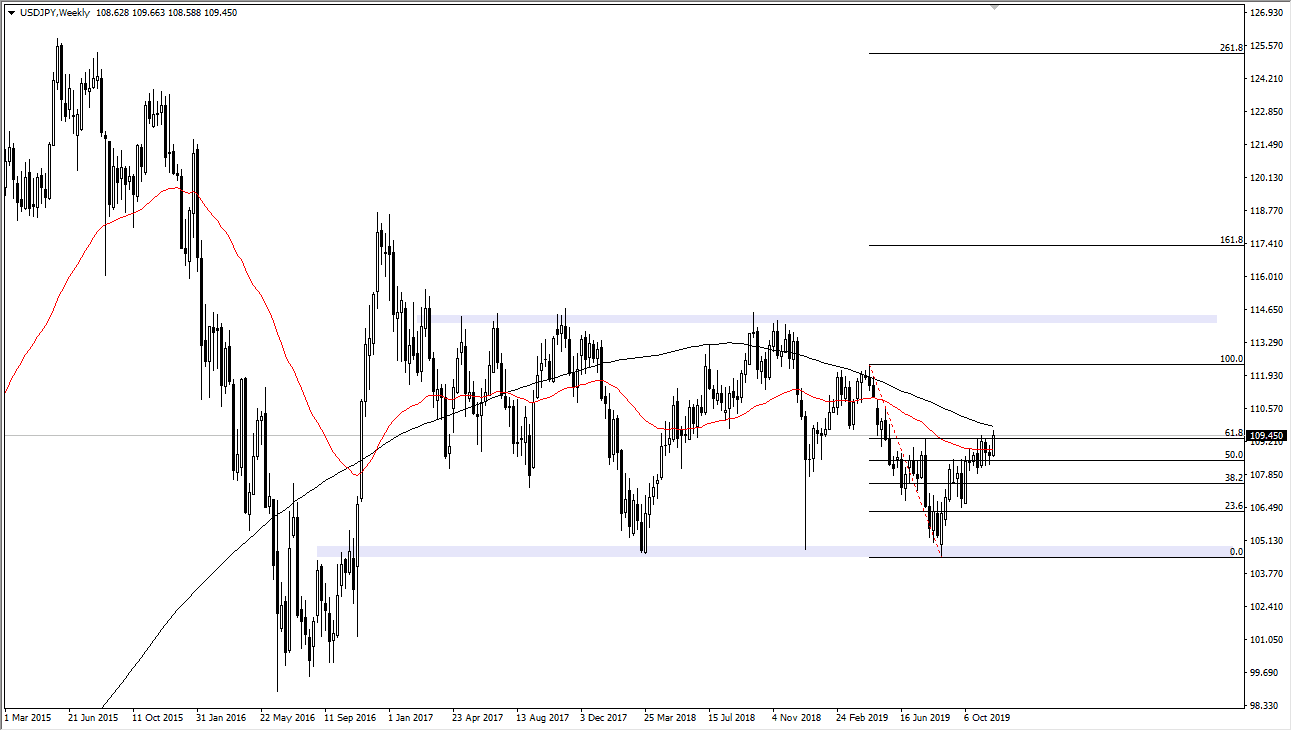

From a technical analysis standpoint, the USD/JPY pair has broken above the 61.8% Fibonacci retracement level, and at this point it’s likely that if we can break above the highs from the month of November, the market is likely to go looking towards the 100% Fibonacci retracement level. That is closer to the ¥112.50 level, and when you zoom out even further, you can see that we have seen quite a bit of consolidation between the ¥115 level and the ¥105 level. Essentially, we are simply bouncing around in that area from a longer-term standpoint. Now that we have broken above the ¥109.50 level, the key level is ¥110 in the short run. If and when the market gets above there, it will be the signal that we are getting ready to go much higher. Ultimately, I think that the month of December should be good for the USD/JPY pair, but we may get the occasional short-term pullback. At this point, it’s obvious that we have built up a strong base and have even formed a “V bottom” over the last several months. At this point, it certainly looks as if the buyers are still very much in control. With that, I anticipate the next couple of months to be relatively positive as we are not only seeing strength here, but we are seeing strength in quite a few other currencies against the Japanese yen.