Following the announcement of a phase-one trade deal between the US and China, that failed to meet even reduced expectations, the USD/JPY spiked into its resistance zone. Bullish momentum faded quickly, and a breakdown emerged which is anticipated to push the USD/JPY into a correction. Economic data out of Japan showed a small expansion in the services sector, and a sharp contraction in the Tertiary Index, but forex traders are focused on the lack of details in the announced trade deal which is likely to lead to a fresh breakdown in this currency pair.

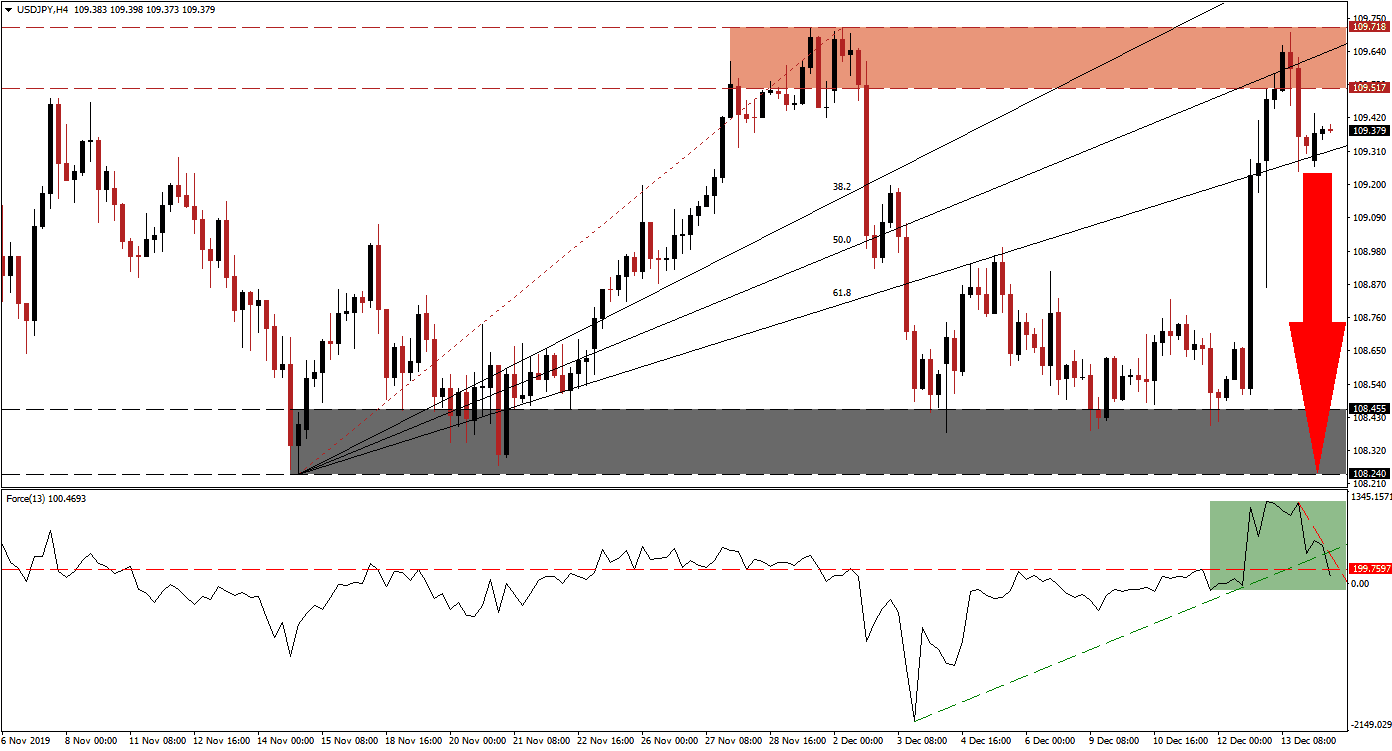

The Force Index, a next-generation technical indicator, shows the build-up in bearish momentum after the USD/JPY completed a breakdown below its resistance zone. A newly formed descending resistance level pressured the Force Index below its horizontal support level and converted it into resistance, as marked by the green rectangle. This technical indicator additionally moved below its ascending support level and is now favored to descend into negative territory, placing bears in charge of price action. You can learn more about the Force Index here.

After the breakdown in this currency pair below its resistance zone located between 109.517 and 109.718, as marked by the red rectangle, a breakdown in the USD/JPY below its ascending 61.8 Fibonacci Retracement Fan Support Level is favored. This is anticipated to initiate a profit-taking sell-off and drive price action farther to the downside. Forex traders are advised to monitor the intra-day low of 109.243, the low of the current breakdown; a move below this level is likely to result in the addition of new net short positions. You can learn more about a profit-taking sell-off here.

With the long-term outlook for the US economy dim, a breakdown in the USD/JPY below its 61.8 Fibonacci Retracement Fan Support Level is favored to push price action into its support zone. This support zone is located between 108.240 and 108.455, as marked by the grey rectangle. The global economy continues to weaken, which strengthens the appeal of the safe-haven Japanese Yen; while the disappointing phase-one US-China trade deal resembles a political victory but does nothing to address the issues leading to the trade war.

USD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 109.400

Take Profit @ 108.250

Stop Loss @ 109.750

Downside Potential: 115 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 3.29

Should the Force Index push through its descending resistance level, the USD/JPY may reverse back into its resistance zone. A breakout may follow, but the upside potential remains limited to its next resistance zone located between 110.668and 110.955. Today’s economic data out of the US may provide a short-term fundamental catalyst, and any breakout should be considered a good opportunity to place sell orders in this currency pair.

USD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 110.050

Take Profit @ 110.900

Stop Loss @ 109.700

Upside Potential: 85 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.43