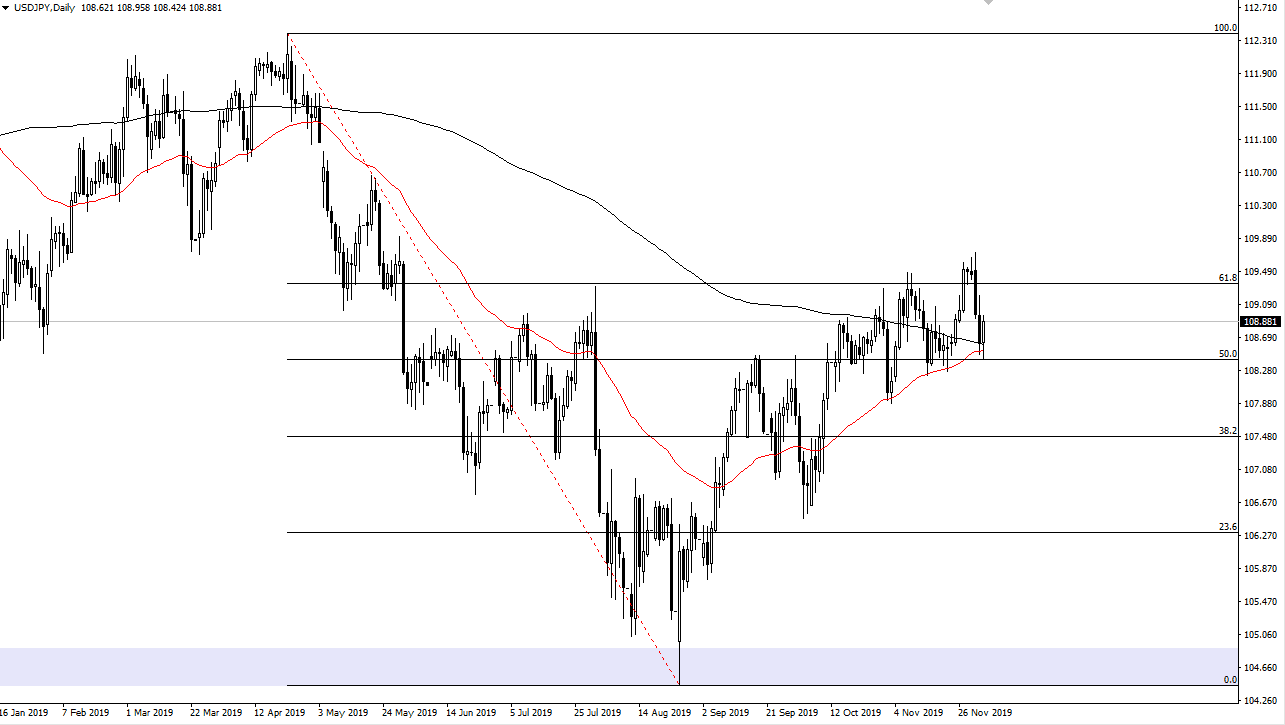

The US dollar has initially pulled back against the Japanese yen during the trading session on Wednesday but found enough support at the ¥108.50 level again to turn around and bounce. Beyond that, we have also seen a lot of support at the 50 day EMA as well is the 200 day EMA. At this point, we are getting ready to see the 50 day EMA cross above the 200 day EMA and what would be known as the “golden cross”, which is a very bullish sign for longer-term traders.

Remember, a lot of what sent the market lower during the previous session was Donald Trump suggesting that perhaps the Chinese trade agreement could wait until after the election, and it had people worried about tariffs on consumer products in the United States coming out on December 15. What it’s worth noting is that consumer staples were some of the strongest stocks during the trading session on Wednesday, as we have clearly forgotten about that already. As that into being the case, the Japanese yen is considered to be a “safety currency”, so it makes sense that the US dollar would gain against it if all of a sudden, we have a little bit more risk appetite out there.

At this point, I believe that the market will probably go looking towards the ¥109.50 level again, and perhaps even higher than that. The ¥110 level is the gateway to much higher pricing and breaking above their opens up the door to the ¥111 level, and then eventually the ¥112.50 level. That would be the 100% Fibonacci retracement level, completely wiping out the entire downtrend. Now that we have seen the market test the 61.8% Fibonacci retracement level, if it can finally break through there that would be an extraordinarily bullish starting. With this, I do believe that the buyers will continue to show up, and that short-term pullback should be buying opportunities in thought of as “value.” It’s not until we break down below the ¥107.50 level that I would be concerned about the pair, and then perhaps look to start selling it. Once that happens, the market could go all the way back down to the ¥105 level but at this point I suggest that it is a roughly 10% chance of happening as we have seen such a tenacious and driven uptrend over the last several months.