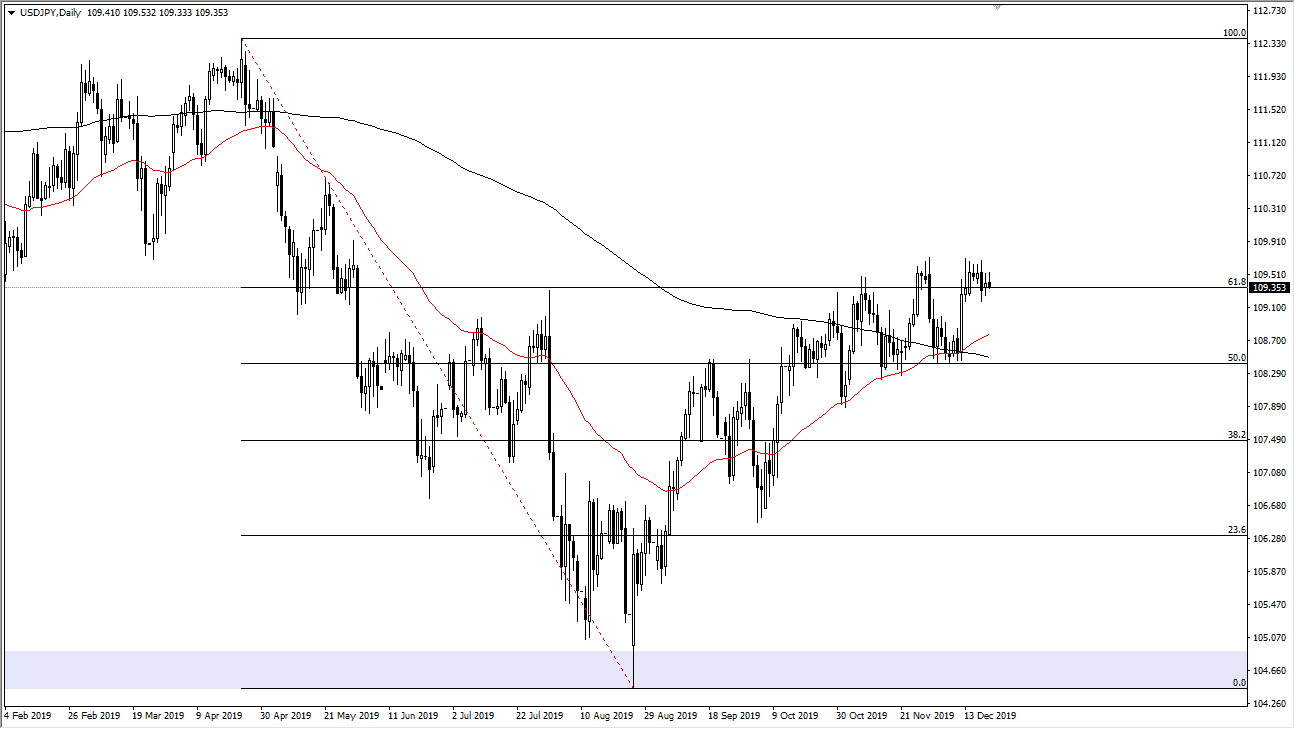

The US dollar has tried to rally initially during the trading session on Monday against the Japanese yen but then pulled back a bit to show signs of weakness. At this point, the market looks as if it isn’t ready to go further to the outside at this point, as the ¥110 level has been a tough nut to crack. If we can break above that level then the market is likely to continue going higher, perhaps reaching towards the ¥111 level which is the scene of a minor gap. Above there, I would anticipate that the market will probably continue towards the ¥112.50 level which is the 100% Fibonacci retracement level. This has been my stance for some time but the market has failed to break out several times now, and I think that during the holiday season it will be very difficult for this currency pair to make a move above there and unless of course there is some type of headline that comes into play.

There is the possibility that the US/China situation does something to move the markets, as this pair is extraordinarily sensitive to risk appetite not only in the United States but in Asia. At this point it’s probably somewhat likely we grind sideways but we could pull back just a bit. Pulling back to the ¥108.50 level is certainly possible, that would be a simple continuation of the overall choppy and sideways attitude that we have had. I do think that we are building more pressure to go to the upside but right now it’s a bit difficult to break out in thin trading and of course all of the moving pieces that make up the US/China trade and several other geopolitical issues. Pullbacks at this point should be buying opportunities, and I will take a look at using those for short-term trades. I think we are going to stay in some type of range going forward, over the next several sessions. It should also be noted that the Christmas Eve trading session isn’t exactly known for high-volume, so I’m not expecting much over the next couple of days. However, I believe that ¥110 is the key for the entire move, so leaving that in the rearview mirror is a great sign to start going long. Once we get that move, it will probably be a somewhat obvious headline that moves it.