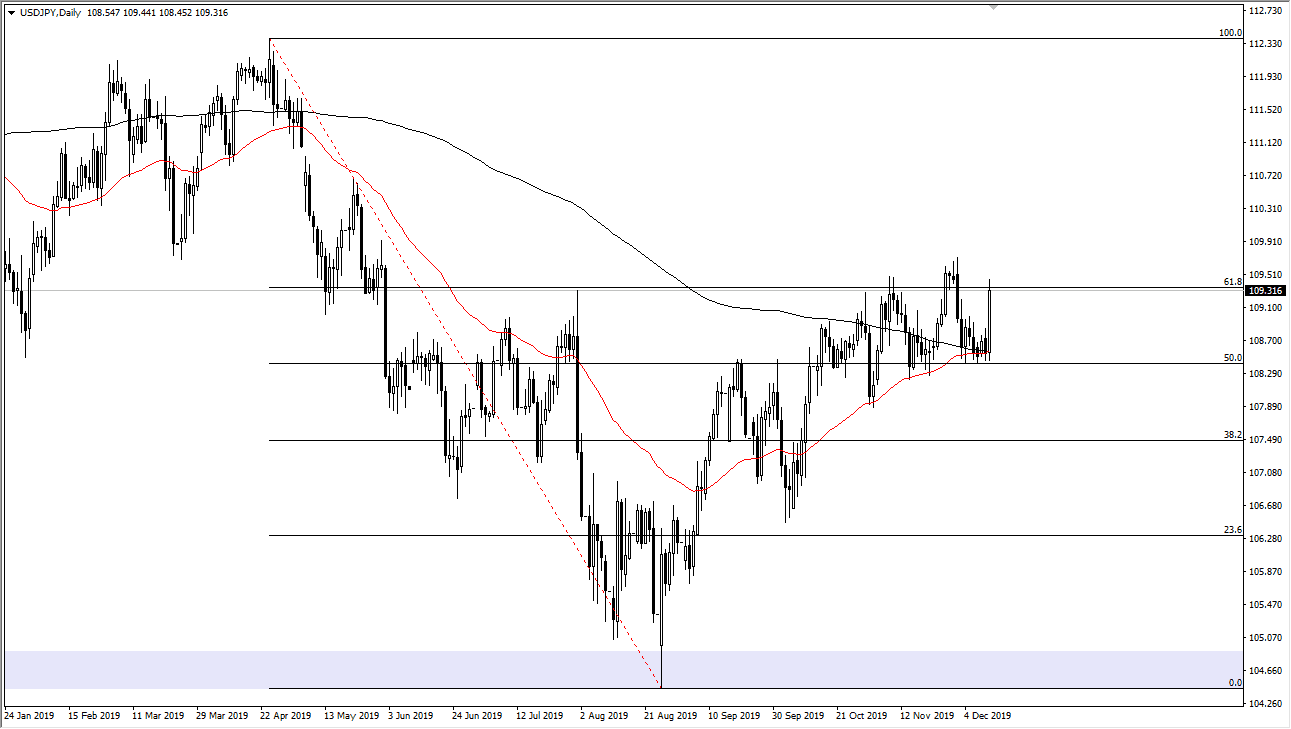

The US dollar has shot higher during the trading session on Thursday, slamming into the 61.8% Fibonacci retracement level. This is a market that is reacting to the US/China trade situation, and even as strong as his candlestick is not overly impressed because of what happened. This was all about Donald Trump suggesting that a trade deal with China was “very close”, which of course we have seen before. At this point in time it’s likely that the market will be on pins and needles for Friday, waiting to see whether or not those tariffs get delayed. If Trump does in fact delay those tariffs that could be the final reason for the market to finally break out and above the ¥110 level.

If we can break above the ¥110 level, then the market is very likely to continue going towards the ¥111 level where we see a major gap. Beyond that, the ¥112.50 level is an area where the 100% Fibonacci retracement level is, and a scene of major selling. I think we will retest that eventually, but it’s going to take a significant amount of effort to get there. The biggest problem is that if we go into the weekend without Donald Trump talking about repealing the tariffs, then we could see a massive gap lower on Monday. Quite frankly, this is a market that probably best left alone until Monday for fear of being trapped in a gap that goes against you.

This is a very bullish candlestick, and all things being equal it would be reason enough to start buying. However, the market is going to be very sensitive to the next headline, and quite frankly we just don’t know what that is going to be. For the next 24 hours I will not be trading anything unless we get confirmation one way or another as to what Trump is going to do, and it’s not in his nature to typically let the world know until he chooses to. I suspect as he likes the drama it’s very likely that the decision won’t be known until Sunday itself, and as a result it’s likely that the markets will be waiting with bated breath. With that, it’s probably best to wait until Monday to put any money to work. By then, we should know what it is that Trump is going to do, and what the next move could be.