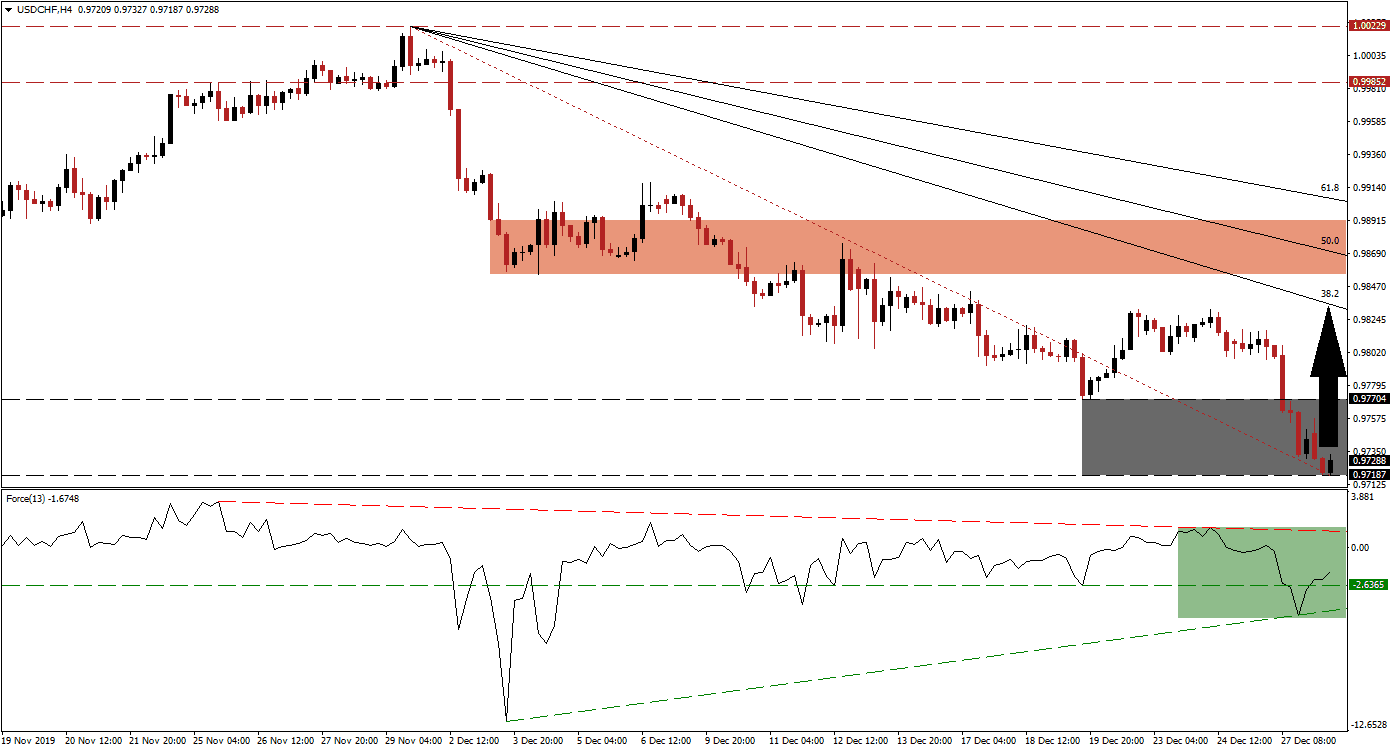

US Dollar weakness may be one of the key trends in the forex market for 2020, but the current sell-off in the world’s top reserve currency appears ripe for a short-term bounce. The beginning of 2020 could see portfolios adjustments as well as profit-taking, and the USD/CHF is ideally positioned for it. Bullish momentum is on the rise after price action reached its support zone. A breakout is anticipated to elevate this currency pair out of extreme oversold conditions, initiate a short-covering rally, and keep the long-term downtrend intact.

The Force Index, a next-generation technical indicator, recorded a higher low and a positive divergence materialized. With the accumulation in bullish momentum, the Force Index was able to bounce off of its ascending support level and convert its horizontal resistance level into support. More upside is favored to close the gap between this technical indicator and its descending resistance level, as marked by the green rectangle. The Force Index will temporarily cross into positive territory from where a renewed breakdown is expected to lead the USD/CHF farther to the downside.

Another bullish development emerged after price action moved above its Fibonacci Retracement Fan trendline. This developed inside of its support zone located between 0.97187 and 0.97704, as marked by the grey rectangle. A breakout in the USD/CHF above it is anticipated to result in a short-covering, which will close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. More upside will be challenging, especially given existing fundamental conditions. The Fibonacci Retracement Fan sequence is expected to enforce the long-term downtrend.

Forex traders should keep the long-term intra-day high of 0.98315 in mind, the peak of previous bounce off of the top range of its support zone that was reversed to a lower low. This level is also close to the 38.2 Fibonacci Retracement Fan Resistance Level, which may end the pending short-term counter-trend advance. The USD/CHF may attempt a push into its short-term resistance zone located between 0.98551 and 0.98917, as marked by the red rectangle and enforced by the 50.0 Fibonacci Retracement Fan Resistance Level. Any such advance would present a sound short-selling opportunity, leading to a fresh breakdown.

USD/CHF Technical Trading Set-Up - Short-Term Breakout Scenario

Long Entry @ 0.97300

Take Profit @ 0.98250

Stop Loss @ 0.97000

Upside Potential: 95 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.17

Should the Force Index reverse below its ascending support level, the USD/CHF is anticipated to follow with a breakdown below its support zone. This will extend the long-term bearish development in this currency pair, but short-term technical indicators favor a minor advance which will ensure the longevity of the long-term trend. The next support zone awaits price action between 0.95419 and 0.95792. A breakdown will require a fresh fundamental catalyst.

USD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.96850

Take Profit @ 0.95550

Stop Loss @ 0.97300

Downside Potential: 130 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 2.89