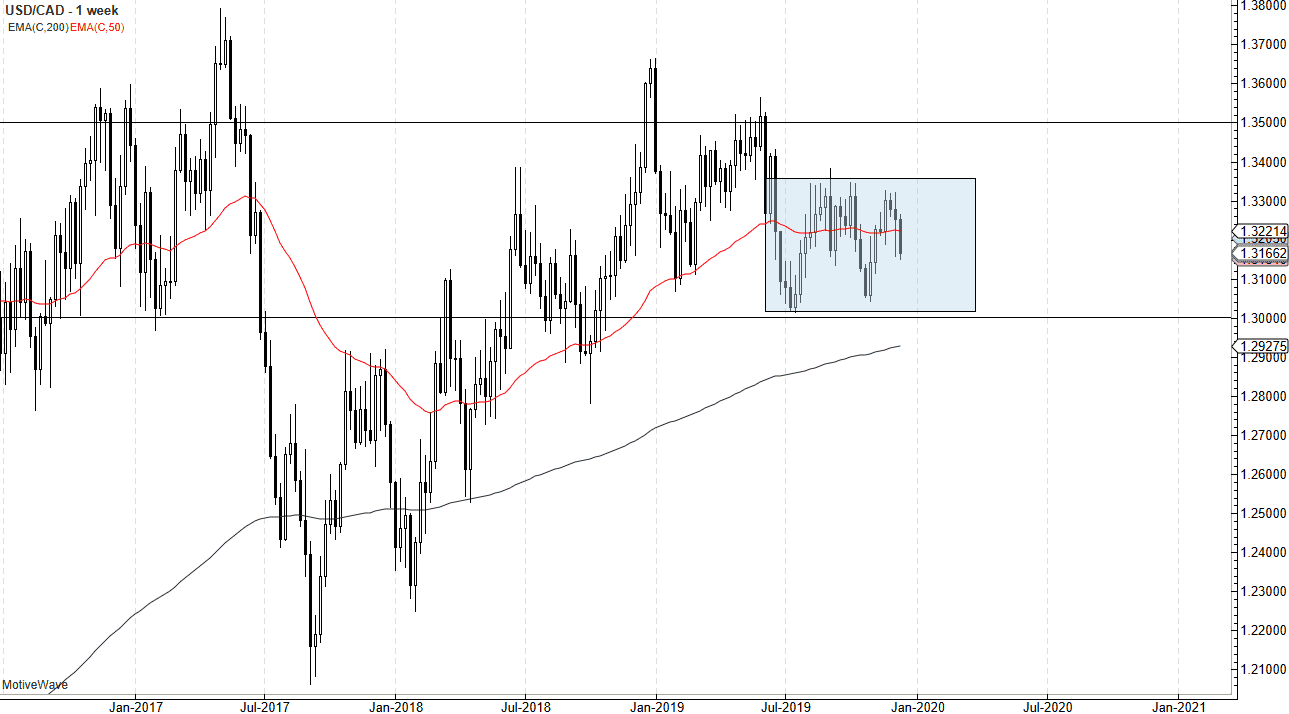

The US dollar has been very choppy against the Canadian dollar over the last several months, and most of 2019 has been simple consolidation. At this point, there’s not a huge reason for this to change. Most of this comes down to the fact that the oil markets are slightly bullish but have a ton of resistance just above them and even with OPEC production cuts, oil could not break out of the range between $50 and $60. (West Texas Intermediate Crude Oil) Because of this, it’s very likely that oil will stay within its range, not giving the Canadian dollar much of a boost.

Beyond all of that, the Canadian economic numbers have been failing a bit. After an absolutely miserable miss in the employment market, the Canadian economy certainly looks as if it is suffering. There are a lot of moving pieces in Canada right now, and the continuing deflation of the housing bubble in places like Vancouver and Toronto certainly don’t help the situation either. As Chinese money flows out of Canada, this has had a negative effect.

On the other side of the equation is the United States and although some of the economic figures haven’t been necessarily stringent over there as well, keep in mind that Canada exports to the United States 80% of its goods. In other words, if the customer is starting to struggle a bit, that’s a bit of a “double whammy.” However, there is strong structural support at the 1.30 level, and it does tend to be a bit of a fulcrum for price. Historically speaking, somewhere in this general area is “fair value.” There is simply nothing out there that should move this market around and out of the range of 1.30 on the bottom and 1.35 on the top. In fact, I suspect that we will probably constrict a bit, and trade between 1.30 on the bottom and 1.3350 on the top. This of course could change if the oil markets make a move massive move in one direction or the other, but even with those OPEC production cuts and the so-called “phase 1 deal” being agreed to by the Americans and the Chinese, demand for crude oil simply hasn’t translated into much higher prices. Furthermore, the EIA has suggested that there should be a major glut in oil supply for this coming year. If that’s going to be the case, it will keep the Canadian dollar somewhat suppressed, but on the other hand, I do not expect a lot of disruptive behavior. If the market were to break down below the 1.30 level though, it probably opens up the door to move to 1.28 underneath.