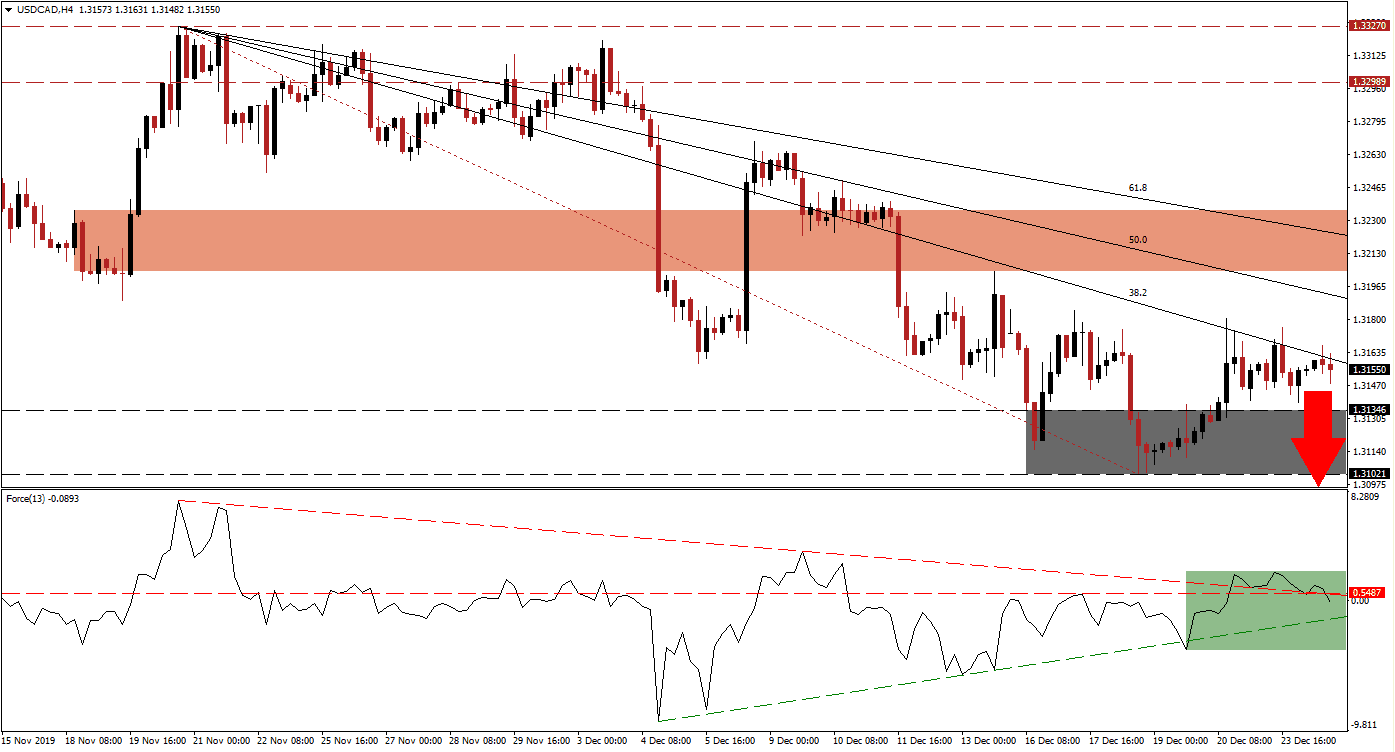

Bearish momentum is expanding once again after the USD/CAD completed a breakout above its support zone. The advance was halted by its descending 38.2 Fibonacci Retracement Fan Resistance Level. Economic data out of the US continued to paint a weaker scenario than what is priced into markets. The US Federal Reserve may find itself forced into more interest rate cuts in 2020 after stating that monetary policy is expected to remain unchanged until 2021. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, initially advanced with this currency pair and eclipsed its horizontal resistance level as well as its descending resistance level. Following the breakout in the USD/CAD and advance into its 38.2 Fibonacci Retracement Fan Resistance Level, the Force Index reversed. This led to a double breakdown and move into negative territory, as marked by the green rectangle. Bears are now in charge of price action, and a renewed push to the downside is anticipated. A breakdown in this technical indicator below its ascending support level is likely to precede a bigger sell-off.

After the USD/CAD converted its short-term support zone into resistance, long-term downside pressures increase. This zone is located between 1.32042 and 1.32347, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is moving across this zone and favored to keep the downtrend intact. A series of lower highs and lower lows further confirm the bearish chart pattern, and fundamental developments suggest more downside potential for this currency pair. You can learn more about support and resistance zones here.

As bearish momentum is expanding, a move by the USD/CAD into its support zone, located between 1.31021 and 1.31346 as marked by the grey rectangle, is expected. A breakdown is favored to follow and extend the corrective phase in this currency pair. The next support zone awaits price action between 1.30149 and 1.30401, just above the next psychological support level of 1.30000. The bottom of this support zone additionally represents the 2019 intra-day low. An extension of the breakdown sequence is possible, but a fresh catalyst is necessary.

USD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.31550

Take Profit @ 1.30150

Stop Loss @ 1.31850

Downside Potential: 140 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 4.67

In case of a sustained double breakout in the Force Index above its horizontal resistance level as well as its descending resistance level, the USD/CAD is expected to advance into its short-term resistance zone. A breakout remains extremely unlikely given the long-term fundamental outlook, supported by the technical picture. Any advance by this currency pair into its short-term support zone should be taken advantage of with sell orders.

USD/CAD Technical Trading Set-Up - Limited Breakout Extension Scenario

Long Entry @ 1.32000

Take Profit @ 1.32300

Stop Loss @ 1.31850

Upside Potential: 30 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.00