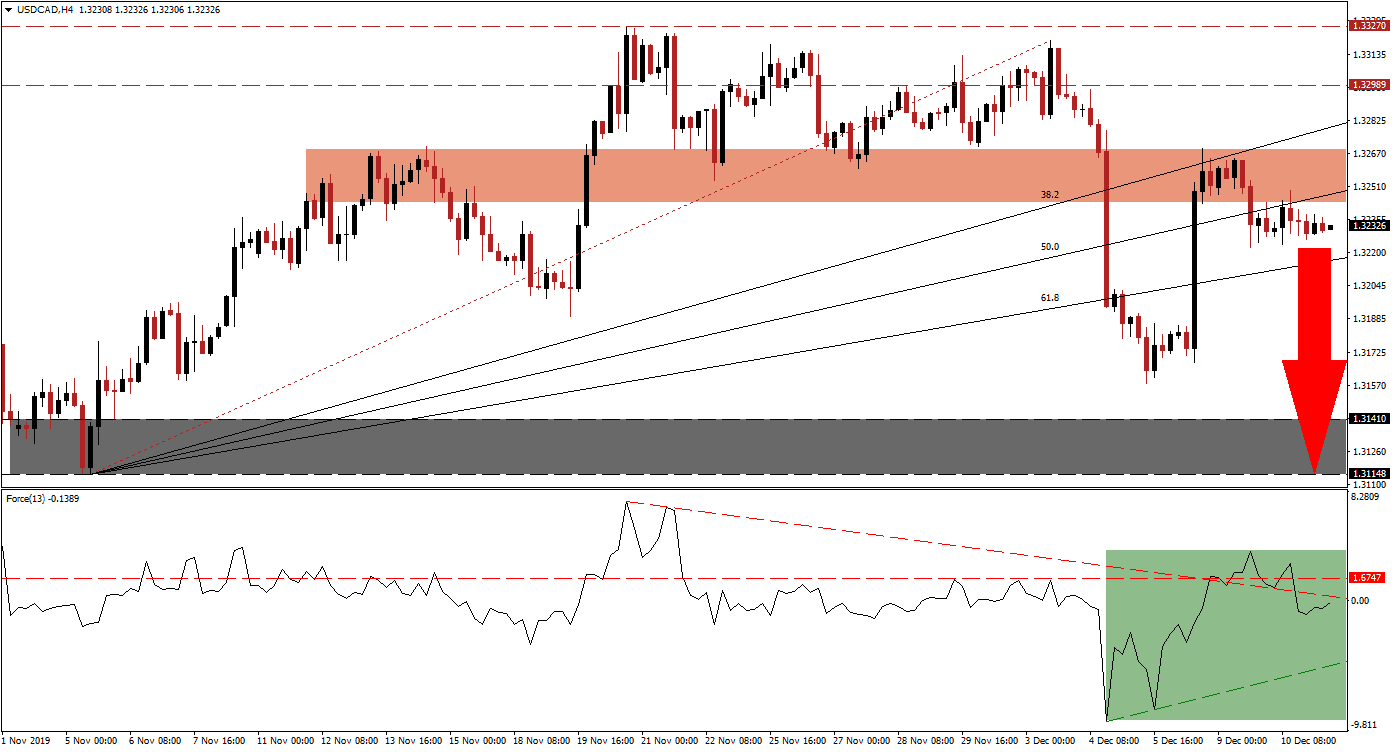

Last Friday’s strong NFP report had a limited short-term impact, as the US Dollar is once again under pressure. Today’s conclusion of the last US Federal Reserve meeting this year is anticipated to keep the central bank in a holding pattern. The press conference following the FOMC announcement may result in a volatility spike, depending on forward-guidance. The USD/CAD was rejected by its short-term resistance zone, and a breakdown materialized. Price action is now vulnerable to a profit-taking sell-off on the back of an increase in bearish pressures.

The Force Index, a next-generation technical indicator, initially advanced with the USD/CAD and pushed above its horizontal resistance level. Bullish momentum faded quickly, and a breakdown followed. The Force Index moved back below its descending resistance level, which additionally carried it into negative conditions, as marked by the green rectangle. Bears are, therefore, in charge of price action and this technical indicator is expected to slide deeper into negative territory until it can challenge its ascending support level.

Forex traders are advised to monitor the ascending 61.8 Fibonacci Retracement Fan Support Level, a sustained breakdown is anticipated to accelerate the pending sell-off. The 50.0 Fibonacci Retracement Fan Resistance Level has entered the short-term resistance zone, located between 1.32437 and 1.32686, as marked by the red rectangle. The USD/CAD remains below the Fibonacci Retracement Fan trendline, which drives bearish momentum. While this currency pair may attempt to push back into its short-term resistance zone, a lower high is favored to emerge, followed by a sustained sell-off.

Markets await official confirmation that new tariffs will be delayed, as some reports in the US media suggested; commentary in Chinese outlets strikes a more skeptical note. The NFP report contradicts a multitude of economic reports pointing towards a weaker economy, and a slowdown in hiring. This explains the fading impact of the strong headline figure and the rise in bearish pressures. A breakdown in the USD/CAD may pressure price action back into its support zone located between 1.31148 and 1.31410, as marked by the grey rectangle. You can learn more about a support zone here.

USD/CAD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.32350

- Take Profit @ 1.31150

- Stop Loss @ 1.32700

- Downside Potential: 120 pips

- Upside Risk: 35 pips

- Risk/Reward Ratio: 3.43

In case of a double breakout in the Force Index, above its descending resistance level and its horizontal resistance level, the USD/CAD may attempt a push to the upside. The long-term fundamental outlook remains bearish, and the upside is likely to remain limited to its next long-term resistance zone, located between 1.32989 and 1.33270. Forex traders should consider this as a great short-selling opportunity.

USD/CAD Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 1.32900

- Take Profit @ 1.33250

- Stop Loss @ 1.32750

- Upside Potential: 35 pips

- Downside Risk: 15 pips

- Risk/Reward Ratio: 2.33