The S&P 500 stalled a bit during the trading session on Friday, as we continue to see a lot of back and forth in the stock markets. Ultimately, we ended up forming a less than impressive candlestick and it is likely that we get a little bit of a pullback. However, that pullback should be thought of as value as the S&P 500 has been very bullish, and of course we have gotten away from the idea of having tariffs slapped on the Chinese during Sunday. If that’s going to be the case, then there should be more of a “risk on rally” coming down the road.

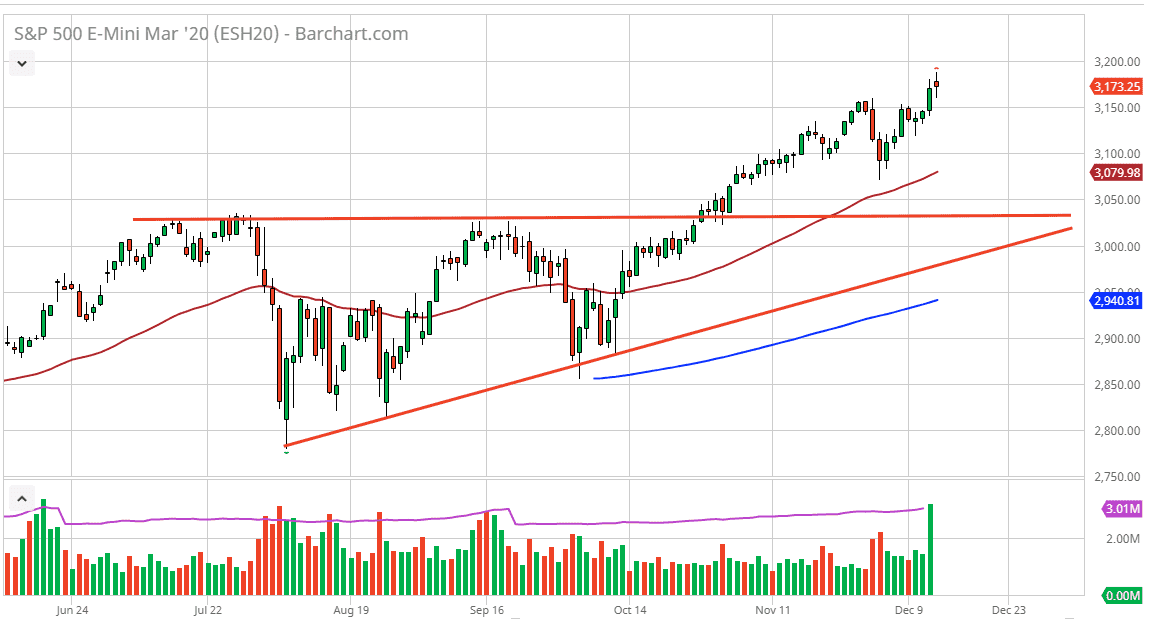

Having said that, the exact details of the agreement seem a bit murky, and therefore it’s really difficult to see that this market go straight up in the air. The reaction has been rather lackluster, but we are in an uptrend and one would have to think that the momentum is still to the upside longer term. The 3100 level underneath is massive support, which also has the 50 day EMA sitting just below there. If we do break down below there, then there would be a significant amount of support near the 3000 handle, as it was the top of an ascending triangle.

Based upon that ascending triangle, the market is looking to go towards the 3200 level, and therefore I like the idea of buying pullbacks based upon value, recognizing that we have not fulfilled that technical target yet. Beyond that, the 50 day EMA underneath will probably continue to offer a significant amount of dynamic support. For what it’s worth I believe that we are going to continue to go higher and break above that 3200 target, as the Federal Reserve is on the sidelines and not looking to tighten monetary policy anytime soon, and we have avoided those tariffs that everybody was afraid of. Retail sales did shock to the downside a little bit on Friday but ultimately, it’s likely that the market will look past that because of the trade agreement. That being said, if we were to break down below the 3000 handle, then this market will break down far too much to continue the overall uptrend in my estimation, and then I would be a seller. However, that seems to be very unlikely to happen anytime soon, and therefore I look at it through the prism of trying to find value.