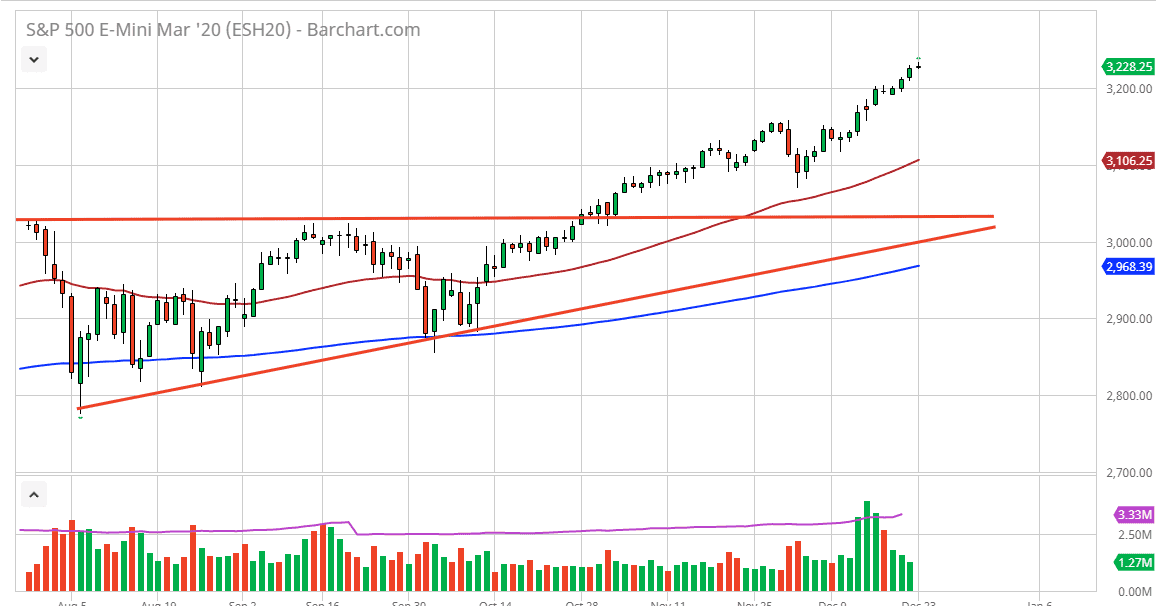

The Christmas Eve session is shortened and basically electronic. There will be almost no volume in the markets and I would not expect the S&P 500 E-mini contract to do much. If we do see some type of major move, it will probably be due to some type of stock announcement. That being said, I’m still bullish of this market and I think we still have further to go but my initial target was going to be the 3200 level which we are above now.

I believe that the next couple of trading sessions could offer a bit of a pullback as it is a lack of volume that will be the big headline here. Beyond that, I think that the 3200 level will have to be retested, and that of course the 50 day EMA underneath at the 3100 level could also come into play. Remember, it’s not about earnings at this point but it’s about what the Federal Reserve is likely to do. If the Federal Reserve is going to follow Wall Street as per usual, they will keep monetary policy loose and perhaps even cut rates into next year. Ultimately, I like the idea of buying short-term dips as it gives me value in a market that is so obviously bullish. Ultimately this is a market that I think has gotten a little bit ahead of itself as traders were trying to jump into the “Santa Claus rally” that heads into the Christmas session.

That being said, it is a partial day on Christmas Eve and volume will be anemic. I suspect that a pullback is possible unless of course we get a lot of short-term “smash and grab” attempts to boost overall returns. I think though that the market is probably best to simply be patient with, because the holiday season does tend to be very difficult to say the least. January 6 is when we get our first “normal trading day”, so I believe that between now and then moves can’t necessarily be trusted, as the volume won’t. I don’t have any interest in shorting this market though, regardless of how far we had extended. The trend is far too strong to try to fight and therefore a little bit of patience may make a huge difference in your returns if you are willing to look for the value underneath that will certainly show itself soon.