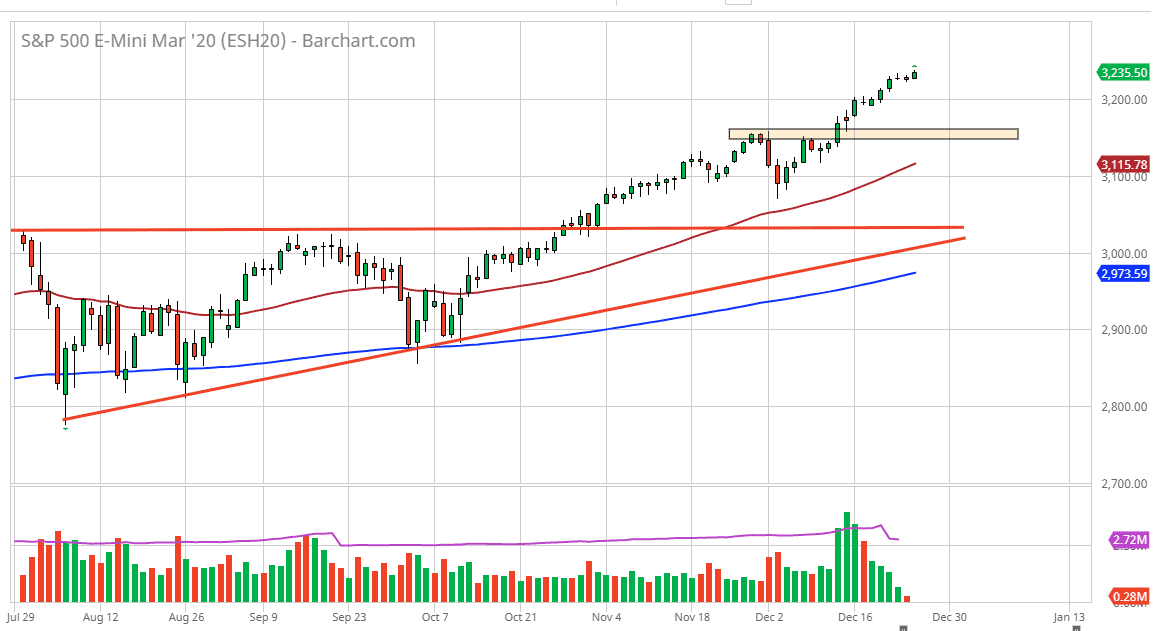

The S&P 500 rallied a bit during the trading session on Thursday as traders came back from the Christmas break. Having said that though, there is still a lack of volume out there, so we could get sudden moves and you could get slipped if you aren’t careful. Ultimately, I like the idea of buying pullbacks though because we have broken out a more importantly have been in a long-term uptrend for quite some time.

The 3150 level underneath is massive support due to the fact that it was previous resistance. I think a pullback to that area would be good value, but we may only pull back towards the 3200 level. Ultimately, this is a market that I think continues to see a lot of buyers due to the fact that we know we have a lot of people out there that have missed the “Santa Claus rally.” At this point, I have no interest in trying to short this market and I think that the further we go to the downside, more likely it’s going to offer plenty of value. The 3100 level features the 50 day EMA as well, and the 3000 level underneath is massive support.

It’s not until we break down below the 200 day EMA that I would be a massive seller. I don’t think that happens without some type of bleak economic announcement or perhaps more importantly something to do with the US/China trade situation. Those headlines have been quite a bit better as of late, and therefore it’s very likely that the bullishness will continue due to that. I don’t expect it to be straight up in the air, but I do think that we will continue to grind much higher, perhaps reaching towards the 3500 level given enough time.

I believe that towards the end of the year we will see traders take profit just ahead of New Year’s Day, so that they can report profits back to their clients. As we get back to work and with full volume at January 6, I think somewhere shortly after that we will see buyers come back in and start picking up value and placing their trades for the year. There is nothing on this chart that looks likely bearish, so at this point I don’t have any real interest in trying to short this market anytime soon.