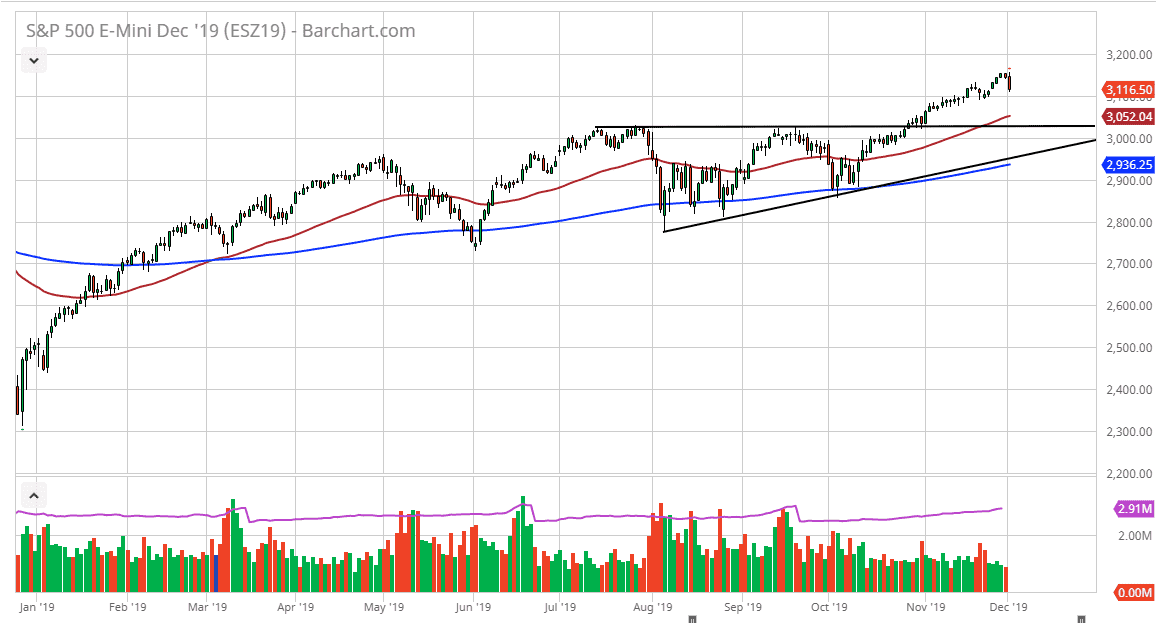

The S&P 500 has fallen a bit during the trading session on Monday, kicking off a negative candlestick for the week. However, I think there is plenty of support underneath, and of course there is always the potential of a “Santa Claus rally” going forward. That being said, the 3100 level is still holding as support, and most certainly the 3000 level will cause a lot of support as it was the top of a massive ascending triangle.

Based upon the measurement of the ascending triangle, it’s likely that the market will try to get to the 3200 level. This has been my target for some time, and I think that it’s only a matter of time before we reach it. In fact, I think that we will probably reach that level between now and the end of the year and would not be surprised at all to see buyers jump into this market rather soon, if not right away. We have the 50 day EMA at the 3050 level, and of course the psychologically significant 3000 handle.

I don’t know if we can break above the 3200 level in the short term, but it certainly makes a nice round figure to aim for. I even believe that if we break down below the 3000 level it’s likely that there is still plenty of support underneath at the uptrend line and of course the 200 day EMA under there. Looking at the S&P 500, it has been very bullish for some time and a lot of the negativity would have been due to a shock in the ISM Manufacturing PMI figures. Over the course of the day, the markets ended up selling off quite drastically. At this point though, I do think that eventually traders will look beyond this as they tend to focus on the Federal Reserve and whether or not they will loosen monetary policy. At this point, the Federal Reserve looks very likely to be stable, and at the very least will not tighten at all.

With this I like buying dips, and I think at the first signs of a bounce there will be plenty of people looking to get involved in what has been an extraordinarily bullish sign. If we were to break above the 3200 level, then the market could go much higher. That being said though, enter the market slowly.