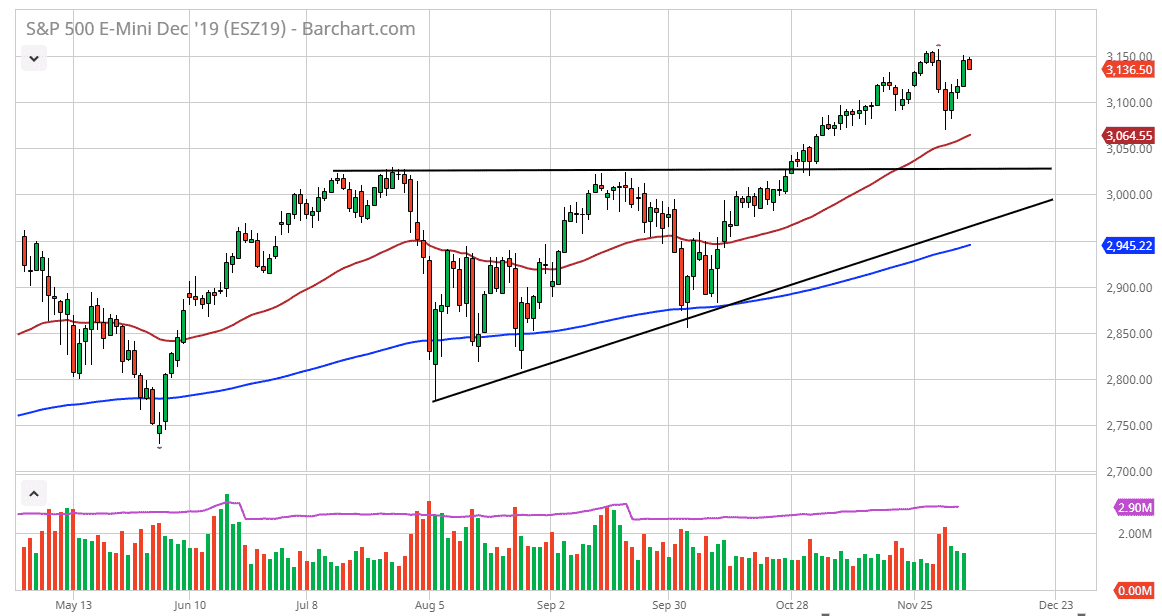

The S&P 500 is pulling back at this point but it’s very likely that it will continue to find buyers underneath. This is a value proposition, and at this point it’s a bit difficult to go against the entire trend, especially as the 50 day EMA has reactively offered so much support in the longer-term trend, and as a result the market is one that should be bought every time it dips.

I think at this point, it’s likely that we will continue to see a lot of value hunting out there, as there has been a consistent move to the upside by traders. Every time this market pulls back, it’s likely that the value hunters will continue to push money into the market as they try to pad their results by the end of the year for clients. Beyond that, we had recently broken above the top of a major ascending triangle which measures for a move to the 3200 level. We have not hit that yet and have found the 3150 level to be a bit difficult to overcome. Ultimately though, that doesn’t necessarily mean that we are going to go straight up in the air. I would not surprise me at all to see this market chop back and forth over the next couple of days with a slightly upward tilt. That being said, keep in mind that the US/China trade situation is going to continue to be a major driver of where we go next, and then we will have a bigger move eventually.

Ultimately, if we can break above the 3200 level, then it’s likely that we could go looking towards the 3300 level after that. I do believe that the S&P 500 continues to rally based upon simple momentum, and that this most recent pullback has been a very strong circumstance indeed. This helps build bullish pressure longer-term, as we can’t simply go straight up in the air and therefore momentum needs to be built in a scenario like this. If the Americans choose not to levy tariffs on December 15, that could be a major catalyst for the next move higher. On the other hand, if they do an act tariffs, it could cause a bit of fear end of the market and send it towards that previously mentioned 3000 region underneath. This is an area that will attract a lot of attention.