The S&P 500 pulled back a bit during the trading session on Monday, as traders came back from the weekend. That being said though, this is New Year’s Day week, and it’s very likely that the traders out there will be paying more attention to the holiday than the markets. That being said, there is a lot of profit-taking this time a year anyway. After all, clients will need to see returns at the end of the year that are positive and stronger, so that any money sure that has underperformed has had to throw money into the marketplace over the last couple of weeks. This is the main premise behind the “Santa Claus rally” that we get every year.

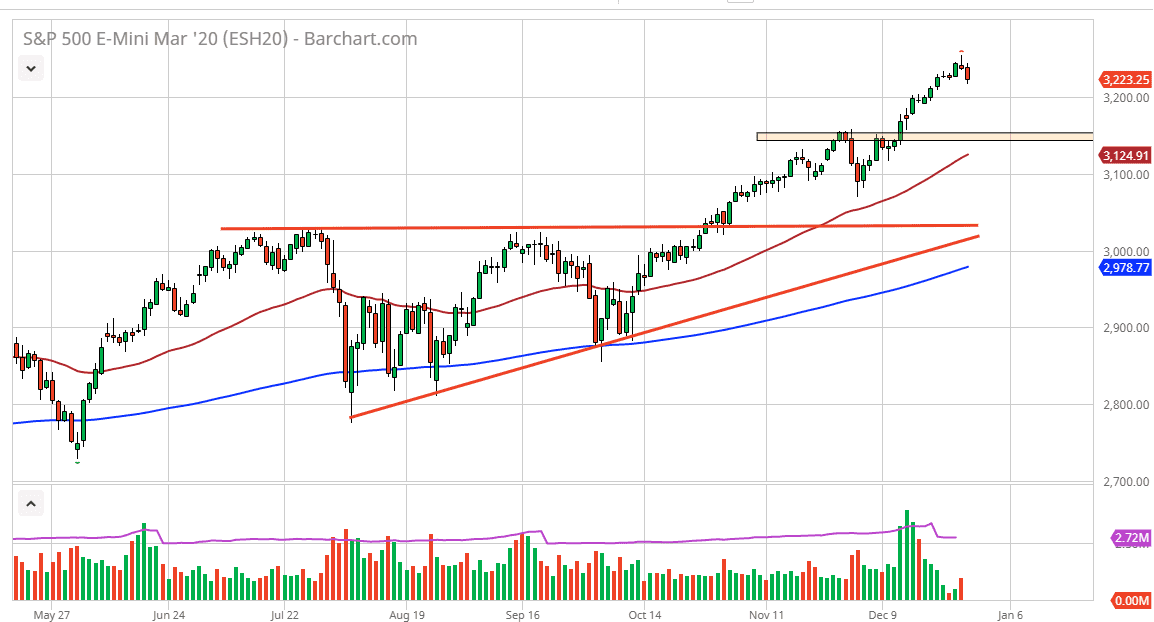

In looking at this chart, I think the 3150 level is a massive support level, assuming that we even break down below the 3200 level. Ultimately, I’m looking for opportunities to take advantage of the market being” cheap”, and I think a lot of traders out there will be as well. It is probably after January 1 that traders will be looking to put money to work obviously, so I think we get another day or two of negativity before buyers get involved. In fact, it would not be surprised at all to see this market wait until early next week to pick back up.

If we were to break down below the 3150 level it would be a bit negative but given enough time, I think that the value hunters would return regardless. The 50 day EMA is starting to approach that same level as well, so I do think that given enough time we will find plenty of reason to get long. I have no interest in shorting this market, at least not anytime soon. Ultimately, I think that there are plenty of reasons to think that the S&P 500 will continue to go higher due to the possibility of loose monetary policy coming from the Federal Reserve. There have been less than strong numbers coming out of the United States as of late, so people may start to price in the idea of the Federal Reserve cutting rates, and that typically will lift the stock markets as well. The 3000 level underneath would be a massive floor, but it’s very unlikely to be tested anytime soon as we have such bullish pressure underlying the trend.