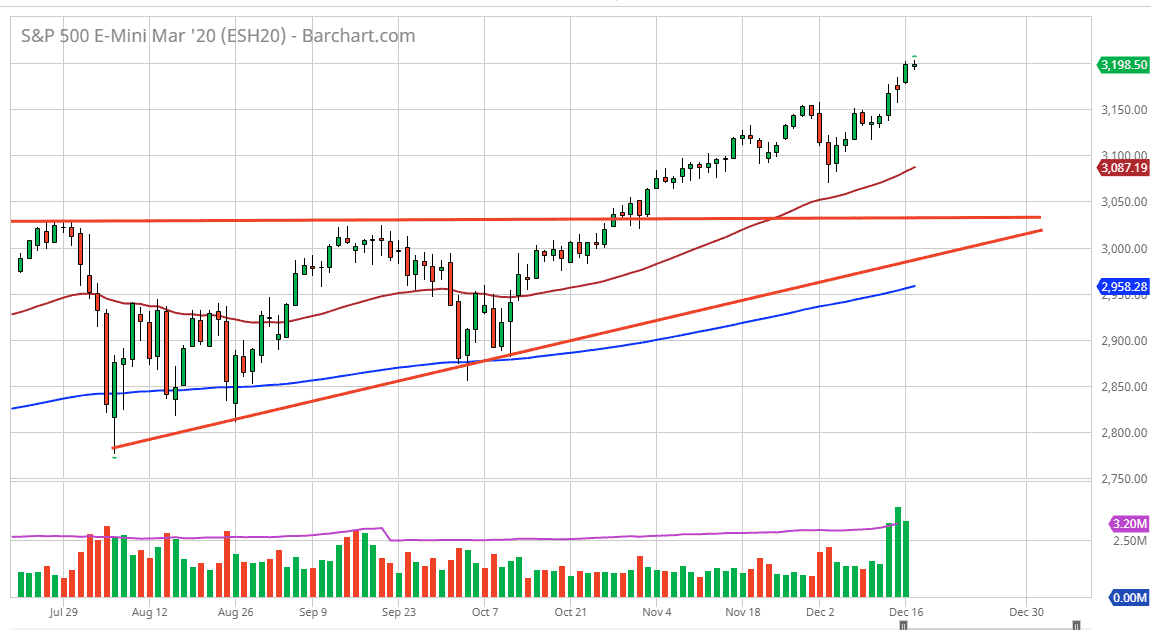

The S&P 500 has gone back and forth during the trading session on Tuesday and relatively quiet trading. Quite frankly, the market looks a little bit exhausted at this point and I would not be surprised at all to see this market pull back a bit in order to pick up a little bit of value. The 3150 level underneath should be supportive, just as the 3200 level above looks to be very resistive. Based upon the ascending triangle underneath, I had a projected target of 3200 but now it looks like we will probably continue to extend this rally into the new year.

I like the idea of buying pullbacks, and quite frankly don’t have any interest in shorting this market as it is so bullish. Overall, this is a market that should continue to see a lot of volatility and opportunities, based upon pullbacks offering “value.” I also recognize that the US/China situation continues to be a major thorn in the side of traders, so that could of course come into play and cause major headaches occasionally. While the “Phase 1 deal” has been essentially agreed-upon, we are light on details as per usual, and of course nothing has actually been signed. In other words, we could see another “almost” moment as we have previously.

If that happens, the stock markets will probably get absolutely clobbered this time as the Chinese have even been more conciliatory in their tone. At this point, it’s very likely that the buyers will continue to come in and pick up this market every time it dips, because quite frankly a lot of money managers out there are trying to chase performance and provide returns at the end of the year for their clients. At this juncture, I like the 50 day EMA as support, and every 50 points below. If we get a daily close above the 3200 level, then the market is likely to go looking towards the 3250 level as the market does tend to move in 50 point increments. Beyond that, several analysts that I respect out there have suggested 3250 could be a target as well, so at this point I am more than willing to accept the fact that we may go that high between now and New Year’s Day. Shorting this market is all but impossible as the bullish trend has been so strong and persistent.