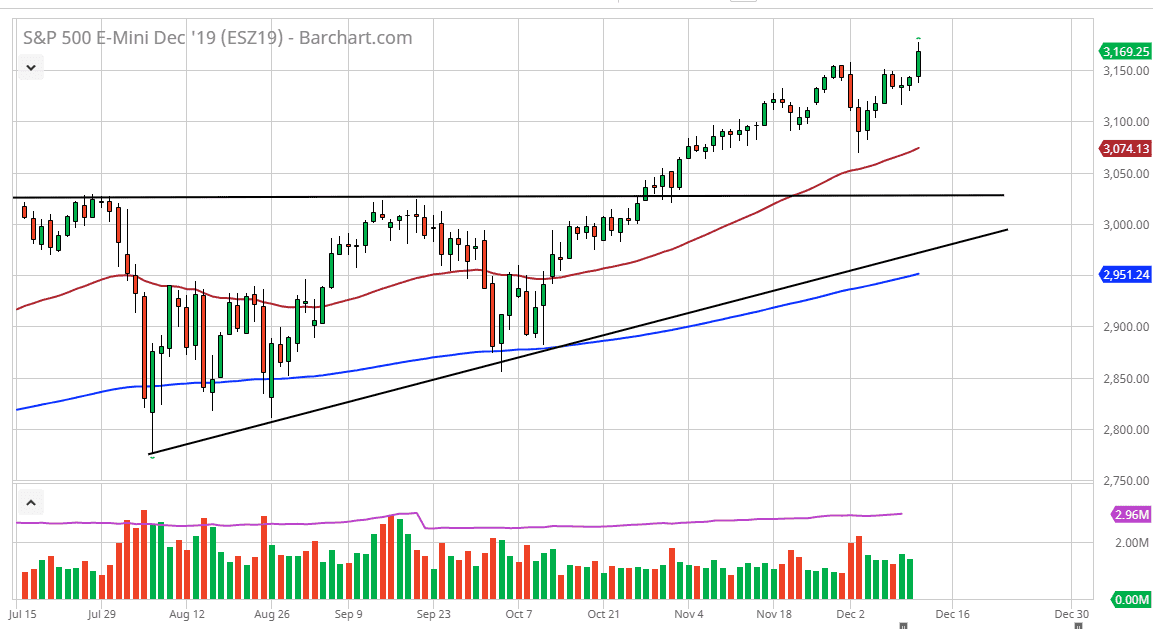

The S&P 500 is likely to see a lot of volatility on Friday, because quite frankly we are waiting to see whether or not the tariffs are levied on the Chinese this Sunday. December 15 is the trade tariff deadline, and so far, nothing has changed. There was a tweet during the Thursday session suggesting that a Chinese deal was relatively close, as stated by Donald Trump. That being said though, he has said this more than once and it always ends up being a full start. There is nothing that suggests this won’t be more of a fall start as well.

The size of the candlestick is very strong, and that of course is a good sign but really at this point unless Donald Trump actually delays the tariffs sometime during the day on Friday it’s very likely that we will get a little bit of a pullback, and therefore I suspect that this is somewhat short-lived. The market is most certainly in an uptrend though, so I do believe in buying pullbacks, but I think that it’s difficult to imagine a scenario where we would be shorting this market for a longer-term move. Quite frankly, the tariffs being levied probably sends this market much lower but that should be thought of as value because we have seen this time and time again, tariffs being levied to send the market lower only to turn things right back towards the upside.

The 50 day EMA is also massive support, just as the 3000 level is. Somewhere between this to levels I think that we will see significant buying pressure, but if we do get those tariffs delayed, that’s probably the thing that sends this market much higher, perhaps breaking above the 3200 level. This is going to be a very difficult market to trade in the short term, because quite frankly were moving on the whim of Donald Trump again. If the Chinese get involved and make a few choice statements, they will be worth paying attention to as well. This is the same game we have been playing for a while now, and therefore nothing has truly changed but that something that you should pay attention to as you watch the market selloff. That doesn’t mean that you should be shorting it, it means you should be looking for stabilization that you can buy based upon value.