After a strong advance in the NZD/USD, which took it into a strong resistance zone, a short-term correction is expected. New Zealand economic data suggests a strong consumer, aided by a rebound in the housing sector. This has boosted consumer confidence as well as spending, and the trend is anticipated to accelerate in 2020. US economic data has been mixed, and the announced phase-one trade truce lacks substance, which hasn’t been priced into the market yet. You can learn more about a resistance zone here.

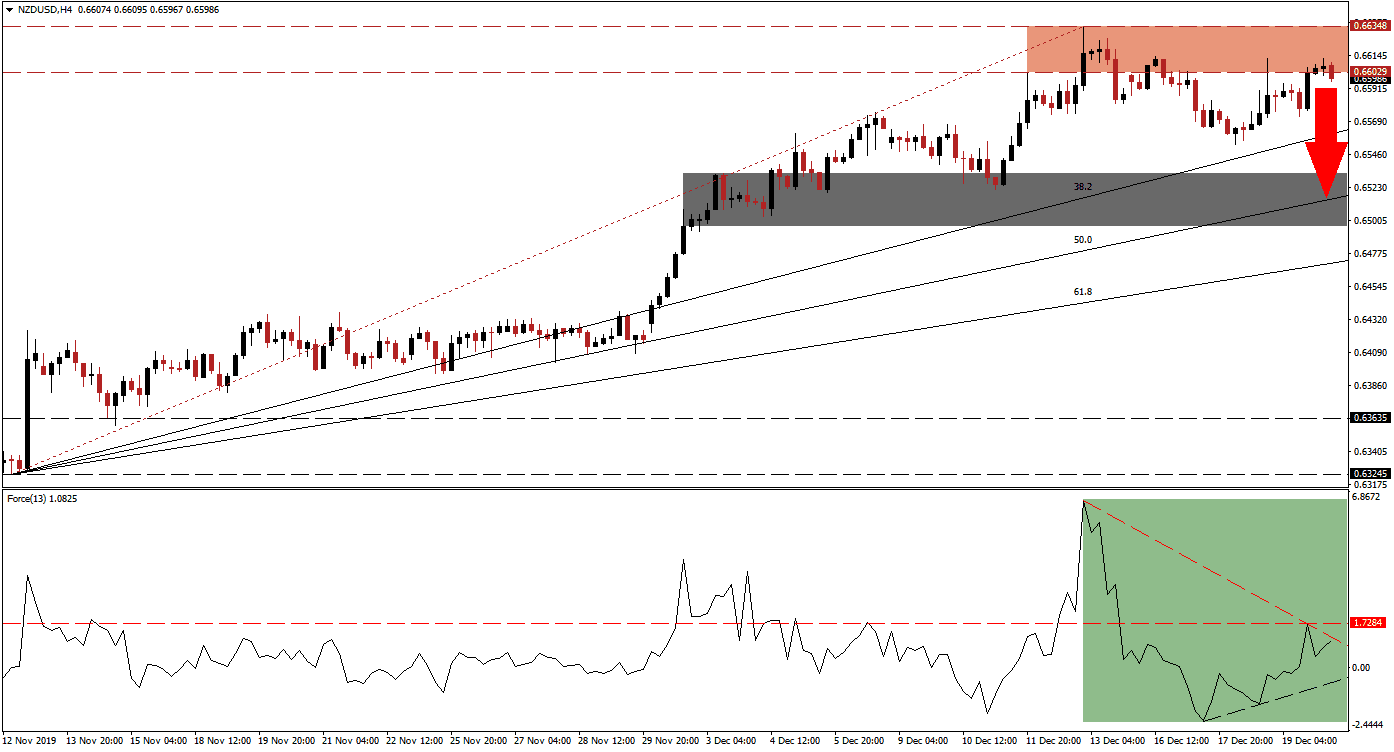

The Force Index, a next-generation technical indicator, confirmed the fresh high in price action with one of its own. As the NZD/USD reached its peak, the Force Index reversed and moved below its horizontal support level, which turned it back into resistance. Adding to short-term bearishness was the lower low in this technical indicator before it advanced together with this currency pair. An ascending support level formed, and the Force Index is now faced with its descending resistance level, as marked by the green rectangle. A move into its ascending support level is expected, from where a double breakout is favored to follow.

Following the breakdown in this currency pair below its resistance zone located between 0.66029 and 0.66348, as marked by the grey rectangle, the NZD/USD recovered but recorded a lower high. Another bearish development materialized after price action moved below its Fibonacci Retracement Fan trendline. The expected short-term correction is likely to be fueled by a profit-taking sell-off, which will close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. You can learn more about a profit-taking sell-off here.

With the long-term outlook for the NZD/USD bullish, the downside potential remains limited to its next short-term support zone. This zone awaits price action between 0.64960 and 0.65328, as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level is passing through this zone and may end the corrective phase. A breakdown below this zone remains unlikely unless a major fundamental catalyst emerges. China kept its prime loan rates unchanged this morning, in another sign of stability for the Asian economic region.

NZD/USD Technical Trading Set-Up - Short-term Correction Scenario

Short Entry @ 0.65950

Take Profit @ 0.65200

Stop Loss @ 0.66200

Downside Potential: 75 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 3.00

In the event of a breakout in the Force Index above its descending resistance level, the NZD/USD is favored to avoid a short-term correction and push for a breakout. The next resistance zone is located between 0.66913 and 0.67258, from where more upside is possible. Volatility is expected to increase as more details about the phase-one trade deal will be announced.

NZD/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.66400

Take Profit @ 0.67100

Stop Loss @ 0.66150

Upside Potential: 70 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.80