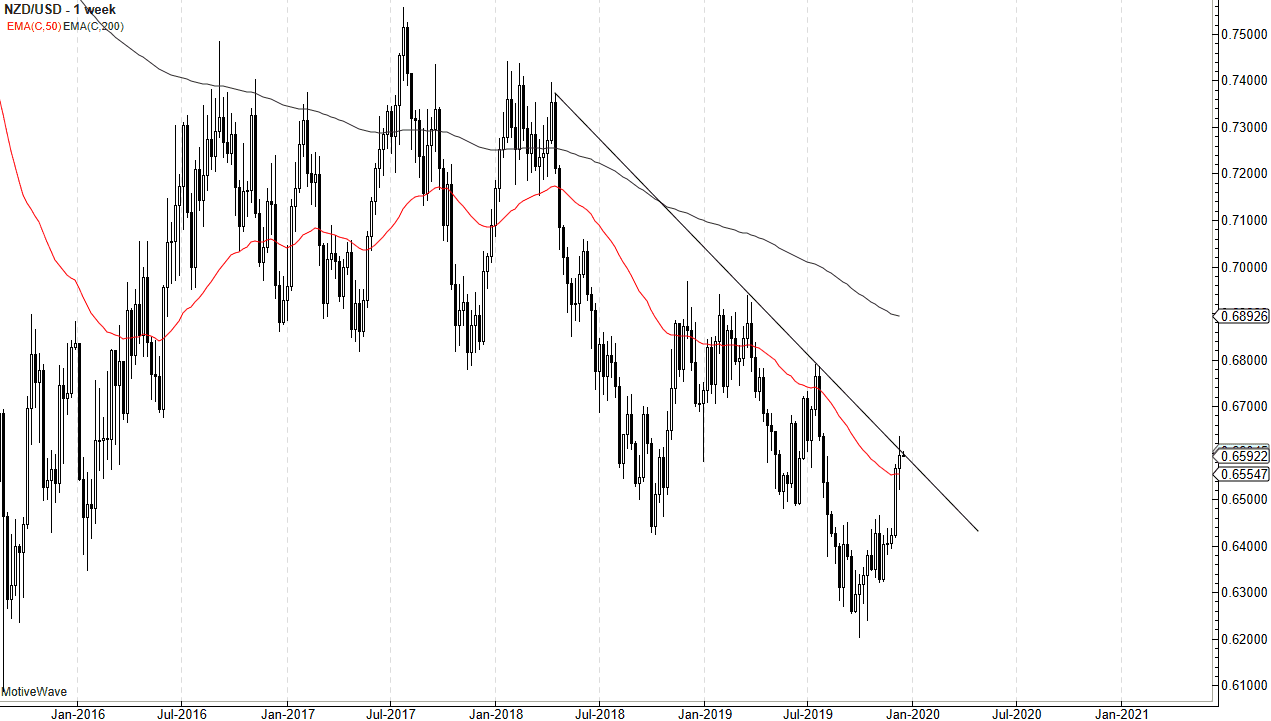

The New Zealand dollar has been very bullish over the last month or so, slamming into a longer-term downtrend line. The market has reached above the 50 week moving average, which of course is something to pay attention to as it is essentially a one-year moving average on a weekly chart. That being said, during the beginning part of December we have seen the New Zealand dollar trying to break above that trendline. This trend line that I have marked on the chart will probably be one of the most important things to pay attention to.

Now that the “phase 1 deal” has been agreed to, it’s not necessarily signed so we will have to see how that agreement plays out over the longer term. At this point in time, the downtrend line is the most important thing that I will be paying attention to, and a follow-through move above the 0.6650 level should send this market much higher, reaching towards the 0.68 level. This is what we would anticipate seeing, because the New Zealand dollar is highly sensitive to the Chinese economy, so therefore the US/China trade war takes front and center. Now that the agreement is supposedly agreed-upon, if something was to work against signing the actual paperwork, the New Zealand dollar will get absolutely crushed because it is not only sensitive to China, but it is also a commodity related currency so therefore it could get very ugly if people don’t agreed to the potential deal.

If the market does break to the upside then it’s very likely that the 0.68 level will be resistive, but if we can break above there then it’s likely that the market goes looking towards the 0.70 level which is a large, round, psychologically significant figure. To the downside, the market could go looking to the 0.64 level initially based upon a break below the 0.65 handle, and then possibly even the 0.62 level after that. Unfortunately, this is a currency pair that is going to be held hostage by the US/China trade situation, and while it does look positive so far, it’s only a matter of time before we need some type of certainty to get involved. Because of this, it comes down to a couple of levels being broken to decide where we go next. There are just far too many questions out there still left to be answered.