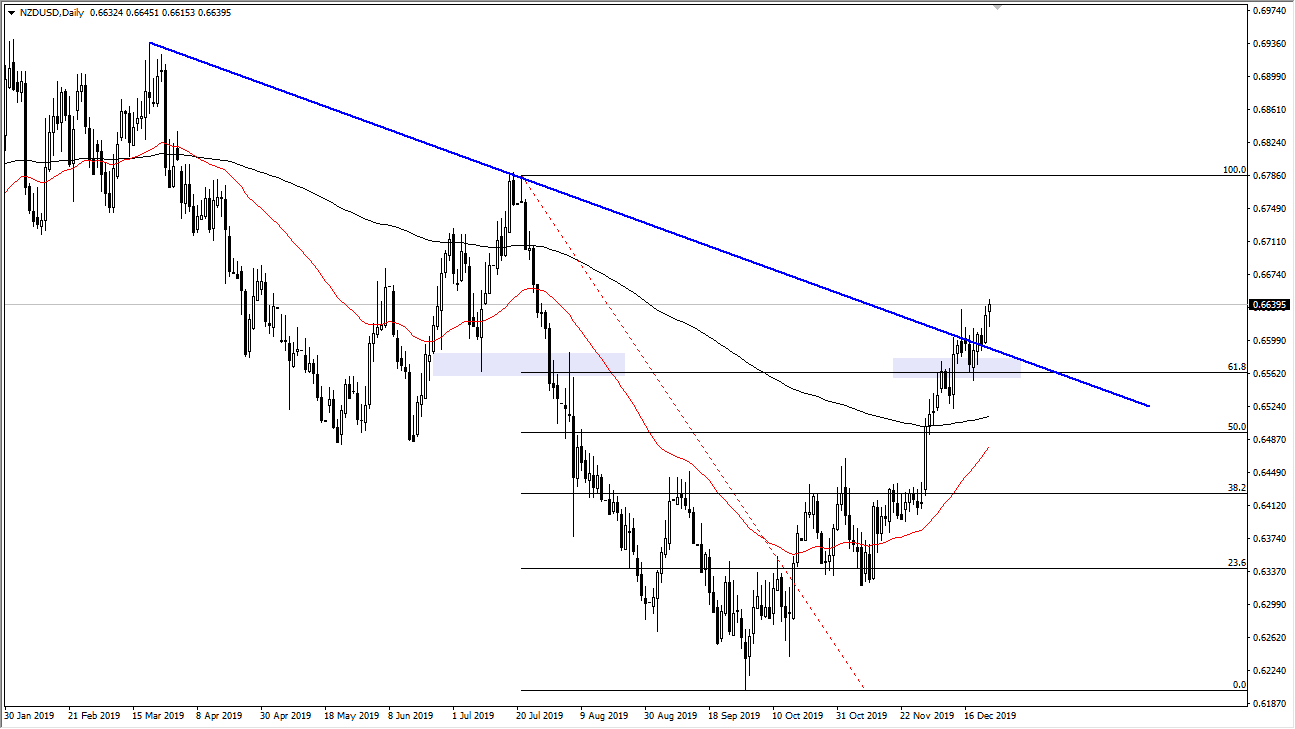

The New Zealand dollar initially fell during Tuesday, but then turned around to form a bit of a hammer. The hammer is at the top of a major move higher, and recently we have seen a major breakout due to a longer-term downtrend line. Ultimately, this is a market that is ready to go much higher, as not only have we broken above the downtrend line, we have also broken above the 0.66 level, an area that has been important in the past.

Furthermore, the 200 day EMA was broken a couple of weeks ago and is now starting to cross to the upside. The 50 day EMA is starting to slope much higher, ready to look to break above the 200 day EMA which is the so-called “golden cross”, something that longer-term traders will pay attention to for a major trend change and therefore more money should be flowing into the New Zealand dollar going forward. We have seen the US dollar lose a little bit of its luster against some of the riskier currencies out there, and the New Zealand dollar certainly falls within that purview.

One of the main drivers of this is going to be the US/China trade relations which seem to be getting better. New Zealand tends to send a lot of agricultural products into China, and there is also the issue with swine flu, which has decimated the poor production of China. Perhaps New Zealand is getting a little bit of a benefit from that as well, but nonetheless as we see commodities in general rally, typically that’s good news for the New Zealand dollar as well.

As a secondary indicator, you can also watch the Australian dollar against the US dollar as the two pairs do tend to move in the same general direction. Now that we are above the 61.8% Fibonacci retracement level, the downtrend line, and significantly above the 200 day EMA, I believe that this market is probably going to go looking towards the 100% Fibonacci retracement level next, closer to the 0.6785 handle. At this point in time, I believe that it is very possible that we are witnessing a trend change for not only the Australian dollar, but over here in the New Zealand dollar as well. I have no interest in shorting this market, unless of course something changes drastically between the Americans and the Chinese.