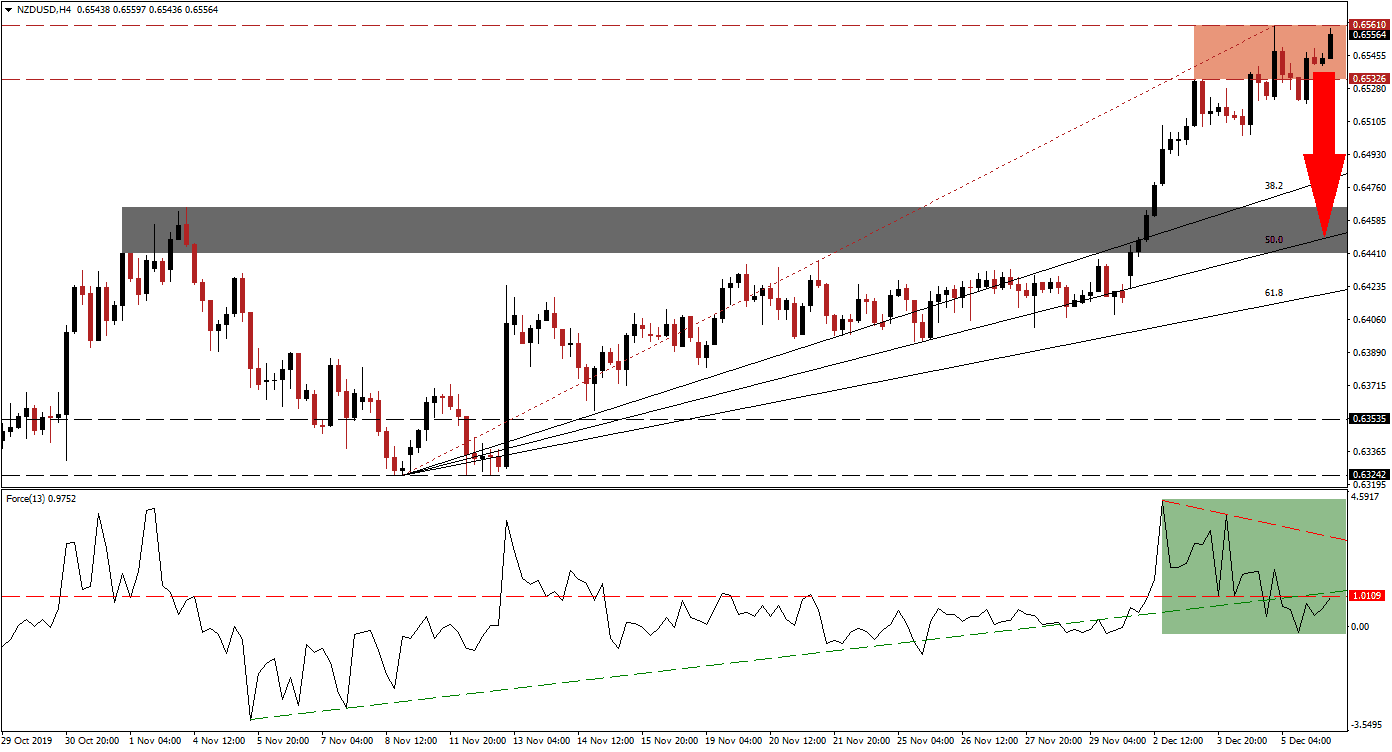

While the long-term fundamental outlook for the NZD/USD remains bullish, the current advance may be in for a pause before it can resume. Weak economic data out of the US provided a catalyst for this currency pair and pushed it through its short-term resistance zone, converting it into support. The ascending 50.0 Fibonacci Retracement Fan Support Level additionally provided a critical boost for price action which is now exposed to a rise in bearish momentum inside its long-term resistance zone.

The Force Index, a next-generation technical indicator, started to descend as this currency pair was closing in on its resistance zone and a negative divergence formed. This bearish trading signal marks an early warning sign for a pending price action reversal. Bearish momentum expanded and the Force Index completed a double breakdown, below its horizontal resistance level, turning it into resistance, and below its ascending support level as marked by the green rectangle. This technical indicator recovered from negative territory, but is anticipated to retrace back below the 0 centerline; this is expected to lead the NZD/USD into a corrective phase.

Price action is challenging the strength of its resistance zone located between 0.65326 and 0.65610 as marked by the red rectangle. A breakdown is expected to result in a profit-taking sell-off and close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. Forex traders are advised to monitor the intra-day low of 0.65030, the low from the first reversal after the NZD/USD initially reached its resistance zone. This currency pair advanced to a higher high from this level and more net sell orders are likely if price action moves below this level. You can learn more about the Fibonacci Retracement Fan here.

Today’s NFP data for November out of the US may provide the next short-term fundamental catalyst for this currency pair. October’s data was soft and this week’s ADP suggests another weak figure. Volatility will increase after the announcement, but a healthy increase in average hourly earnings may suffice to initiate a short-term corrective phase in the NZD/USD. A breakdown can take price action back into its short-term support zone located between 0.64411 and 0.64652 as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level is passing through this zone and this would keep the long-term uptrend intact.

NZD/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.65550

Take Profit @ 0.64550

Stop Loss @ 0.65800

Downside Potential: 100 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 4.00

In the event of a reversal in the Force Index and breakout above its ascending support level, which currently acts as temporary resistance, the NZD/USD may attempt a breakout and extend its rally. This would be in-line with the long-term outlook and a weak NFP report could provide the catalyst for a breakout. The next resistance level awaits price action between 0.66525 and 0.66810.

NZD/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.65950

Take Profit @ 0.66800

Stop Loss @ 0.65650

Upside Potential: 85 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.83