As global markets await US President Trump to approve what many consider an insignificant phase-one trade deal, the NZD/USD spiked into its resistance zone. China is set to purchase more agricultural goods for a partial rollback in existing tariffs, which would also delay new tariffs; the legal text is not yet finalized. It is unlikely to delay the slowdown in the global economy, but both parties will gain political points with their domestic audience. The upside in this currency pair is exhausted, and a short-term correction is anticipated to emerge. You can learn more about a resistance zone here.

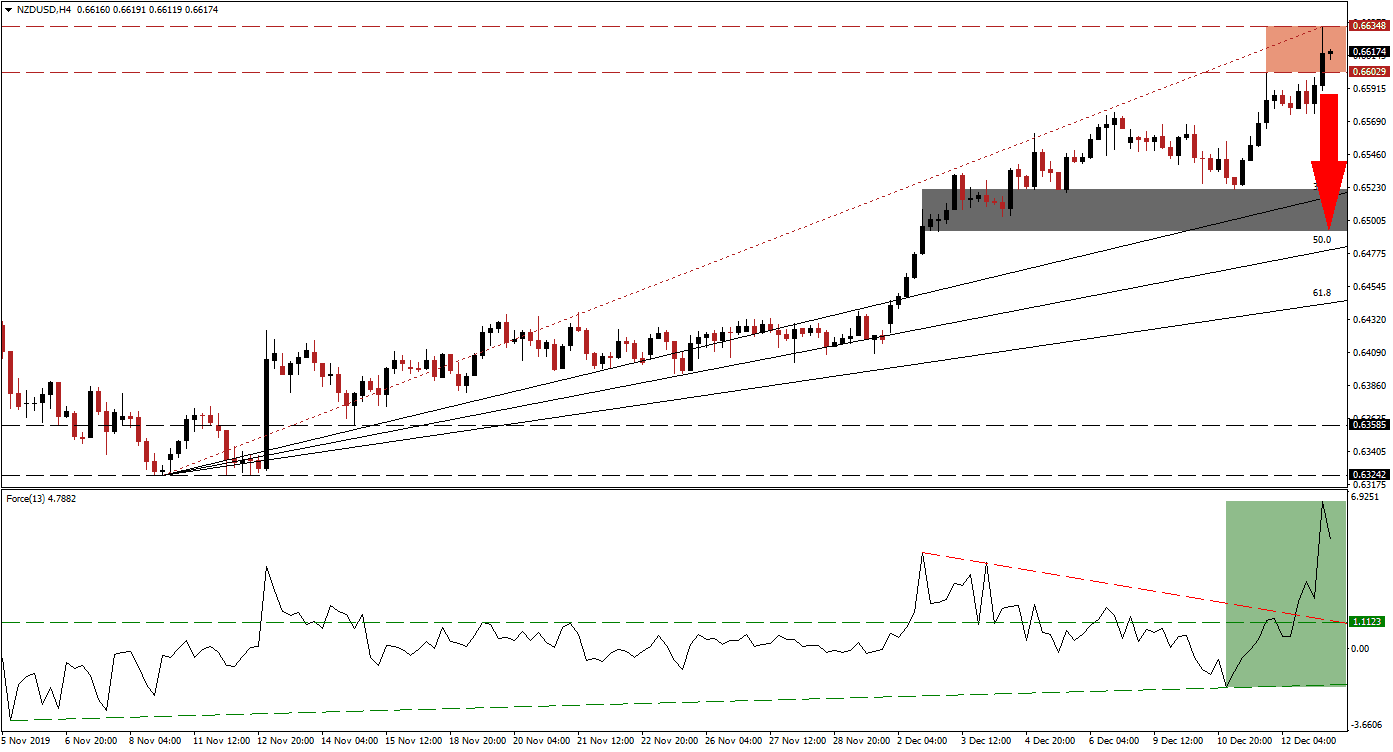

The Force Index, a next-generation technical indicator, spiked to a fresh high and confirmed the advance in price action. Bullish momentum started to weaken, and the NZD/USD is expected to follow through with a breakdown. The Force Index accelerated from its ascending support level and pushed through its horizontal resistance level, converting it back into support. This technical additionally completed a breakout above its descending resistance level, as marked by the green rectangle, and turned it into temporary support. Bulls are firmly in charge of this currency pair with the Force Index in positive territory, and the long-term uptrend is favored to remain intact.

Given the firm advance, the NZD/USD moved below its Fibonacci Retracement Fan trendline, which represents a bearish development. A breakdown below its resistance zone located between 0.66029 and 0.66348, as marked by the red rectangle, is anticipated. This will additionally close the gap between price action and its ascending 38.2 Fibonacci Retracement Fan Support Level. A profit-taking sell-off is expected to ignite, once this currency pair moves below its resistance zone. You can learn more about the Fibonacci Retracement Fan here.

One essential level to monitor remains the intra-day low of 0.65744, the low of a minor reversal before the push into its resistance zone; a breakdown below this level is expected to attract new net short positions in the NZD/USD. The expected corrective phase is favored to take price action into its next short-term support zone, which is located between 0.64927 and 0.65217, as marked by the grey rectangle. The 38.2 Fibonacci Retracement Fan Support Level will soon exit this zone with the 50.0 Fibonacci Retracement Fan Support Level approaching the bottom range of it. A further breakdown remains unlikely and would require a new catalyst.

NZD/USD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 0.66150

- Take Profit @ 0.65000

- Stop Loss @ 0.66500

- Downside Potential: 115 pips

- Upside Risk: 35 pips

- Risk/Reward Ratio: 3.29

In the event of a renewed push to the upside by the Force Index, the NZD/USD is likely to attempt a breakout. The fundamental outlook for this currency pair remains bullish, but the short-term technical scenario points towards a minor corrective phase. The Force Index is expected to move back down into its descending resistance level. A breakout can take price action into its next resistance zone, located between 0.66934 and 0.67258.

NZD/USD Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 0.66700

- Take Profit @ 0.67250

- Stop Loss @ 0.66500

- Upside Potential: 55 pips

- Downside Risk: 20 pips

- Risk/Reward Ratio: 2.75