After Singapore reported a surprise plunge in industrial production, the NZD/SGD extended its advance, but signs of exhaustion are evident. Trading volume remains thin, which allowed the uptrend to continue. The New Zealand economy is showing signs of stability at a time many countries print economic data pointing towards more hardship. Since 2020 is a few trading sessions away, volatility is expected to increase as portfolio adjustments will be made. You can learn more about a breakdown here.

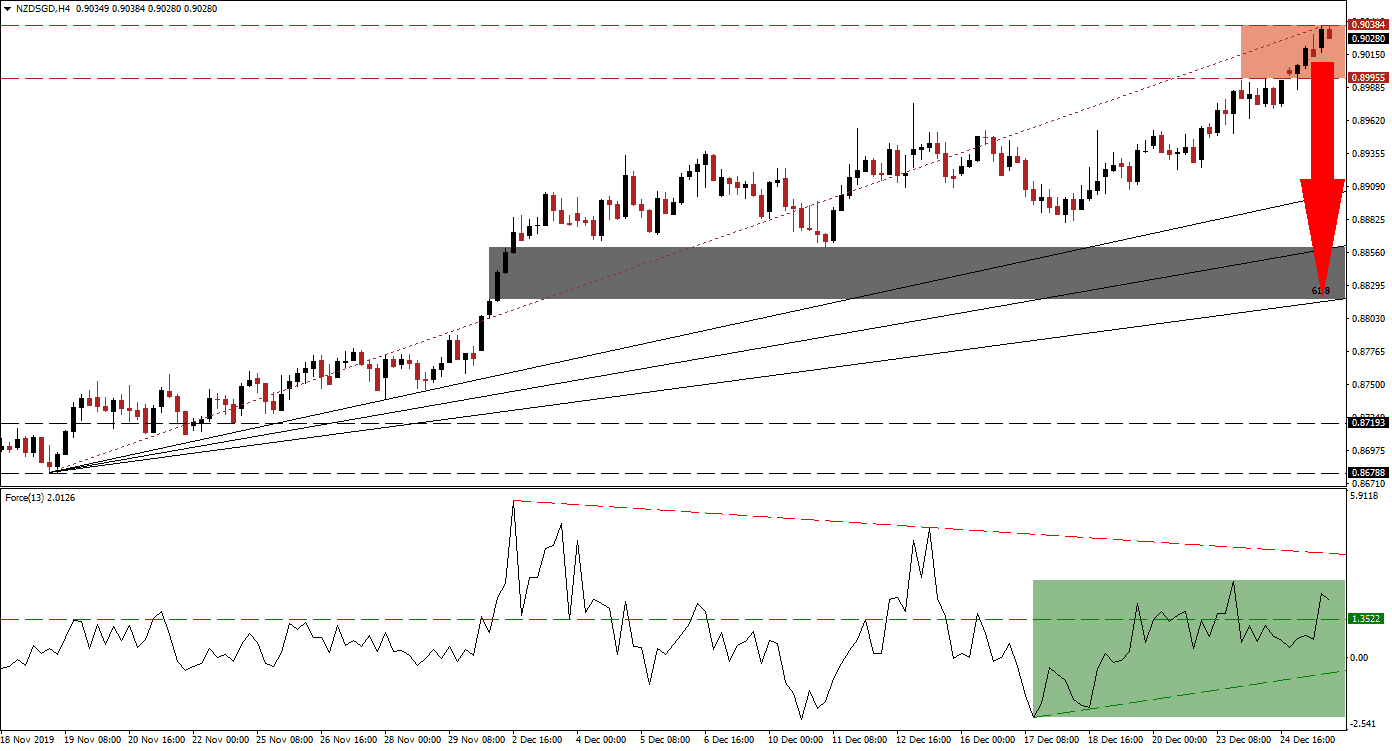

The Force Index, a next-generation technical indicator, confirmed the advance in this currency pair as it recovered from its lows and converted its horizontal resistance level into support. The Force Index additionally moved into positive conditions, suggesting bulls are in charge of the NZD/SGD while an ascending support level materialized. Its descending resistance level is anticipated to end the advance and increase bearish pressures, as marked by the green rectangle. A reversal in this indicator below the 0 center-line is favored to initiate a sell-off in price action.

Bullish momentum gradually decreased while the NZD/SGD advanced into its resistance zone located between 0.89955 and 0.90384, as marked by the red rectangle. Another bearish development emerged after this currency pair moved below its Fibonacci Retracement Fan trendline. Breakdown risks are on the rise, and a push in price action below its resistance zone is favored to result in a profit-taking sell-off. This should close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. You can learn more about a profit-taking sell-off here.

Forex traders are advised to monitor the intra-day high of 0.89760, the peak of a previous advance that led to a drift lower. A breakdown below this mark is anticipated to result in the addition of fresh net short positions in the NZD/SGD. It should also provide the necessary downside volume to take this currency pair into its next short-term support zone located between 0.88182 and 0.8860, as marked by the grey rectangle. The 50.0 and 61.8 Fibonacci Retracement Fan Support Levels embrace this zone.

NZD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.90250

Take Profit @ 0.88200

Stop Loss @ 0.90850

Downside Potential: 205 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.42

In case of a reversal in the Force Index, leading to a breakout above its descending resistance level, the NZD/SGD may attempt to pressure for more upside. While the long-term fundamental outlook remains cautiously bullish, the short-term technical picture favors a breakdown. The next resistance zone is located between 0.91882 and 0.92247, representing an excellent short-selling opportunity.

NZD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.91250

Take Profit @ 0.92200

Stop Loss @ 0.90850

Upside Potential: 95 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.38