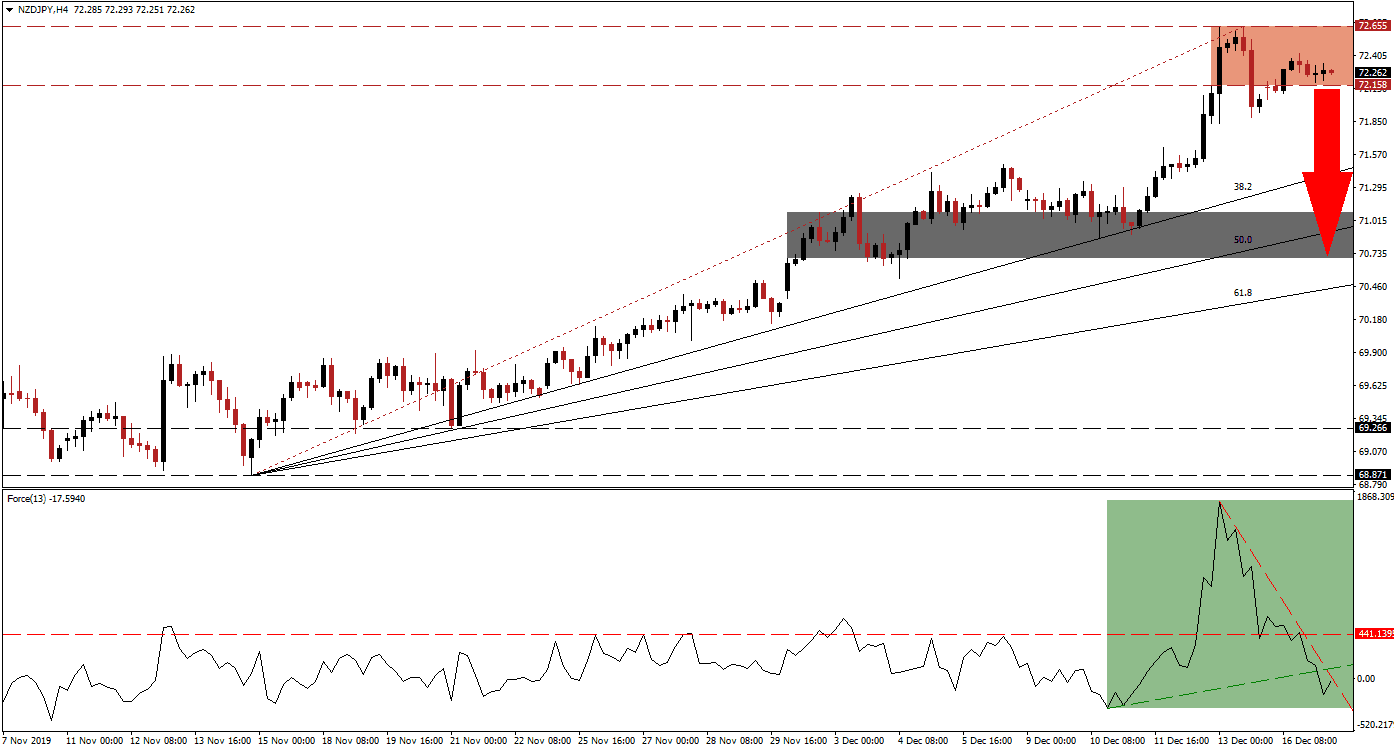

Upside potential in the NZD/JPY is exhausted, and this currency pair is now exposed to a corrective phase. Encouraging economic data out of New Zealand failed to extend the advance, while bearish momentum is on the rise. A breakdown below its resistance zone is expected to follow and close the gap between price action and its ascending 38.2 Fibonacci Retracement Fan Support Level. The Japanese Yen may attract bids as the year is winding down, due to its safe-haven status. You can read more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, initially surged with price action and confirmed the rally. After this currency pair moved into its resistance zone, the Force Index quickly reversed in a sign that bullish momentum is fading; this served as the first warning that the advance is ending. This technical indicator converted its horizontal support level into resistance and plunged through its ascending support level, as marked by the green rectangle. The Force Index is now in negative territory with bears in control of the NZD/JPY, while its steep descending resistance level is adding more downside pressure.

Another bearish development materialized after this currency pair moved below its Fibonacci Retracement Fan trendline. The NZD/JPY is now favored to attempt a breakdown below its horizontal resistance zone located between 72.158 and 72.655, as marked by the red rectangle. A move below the intra-day low of 71.881, the low of a failed breakdown attempt, is additionally expected to result in a profit-taking sell-off. Economic data out of the UK and US may provide the spark for the anticipated correction.

Price action will face its next support zone between 70.692 and 71.087, as marked by the grey rectangle; the 50.0 Fibonacci Retracement Fan Support Level is currently crossing this zone. While the long-term outlook for this currency pair remains cautiously bullish, a further deterioration of the global economic picture may result in a breakdown and more downside. The long-term support zone awaits the NZD/JPY between 68.871 and 69.266. You can learn more about a support zone here.

NZD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 72.250

Take Profit @ 70.700

Stop Loss @ 72.750

Downside Potential: 155 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.10

A sustained breakout in the Force Index above its ascending support level, leading to a push above its horizontal resistance level, may result in a breakout attempt in the NZD/JPY. A fresh fundamental catalyst would be required to sustain an extension of the advance. The next resistance zone is located between 73.455 and 73.977; this would close a previous price gap to the downside.

NZD/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 72.900

Take Profit @ 73.900

Stop Loss @ 72.550

Upside Potential: 100 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.86