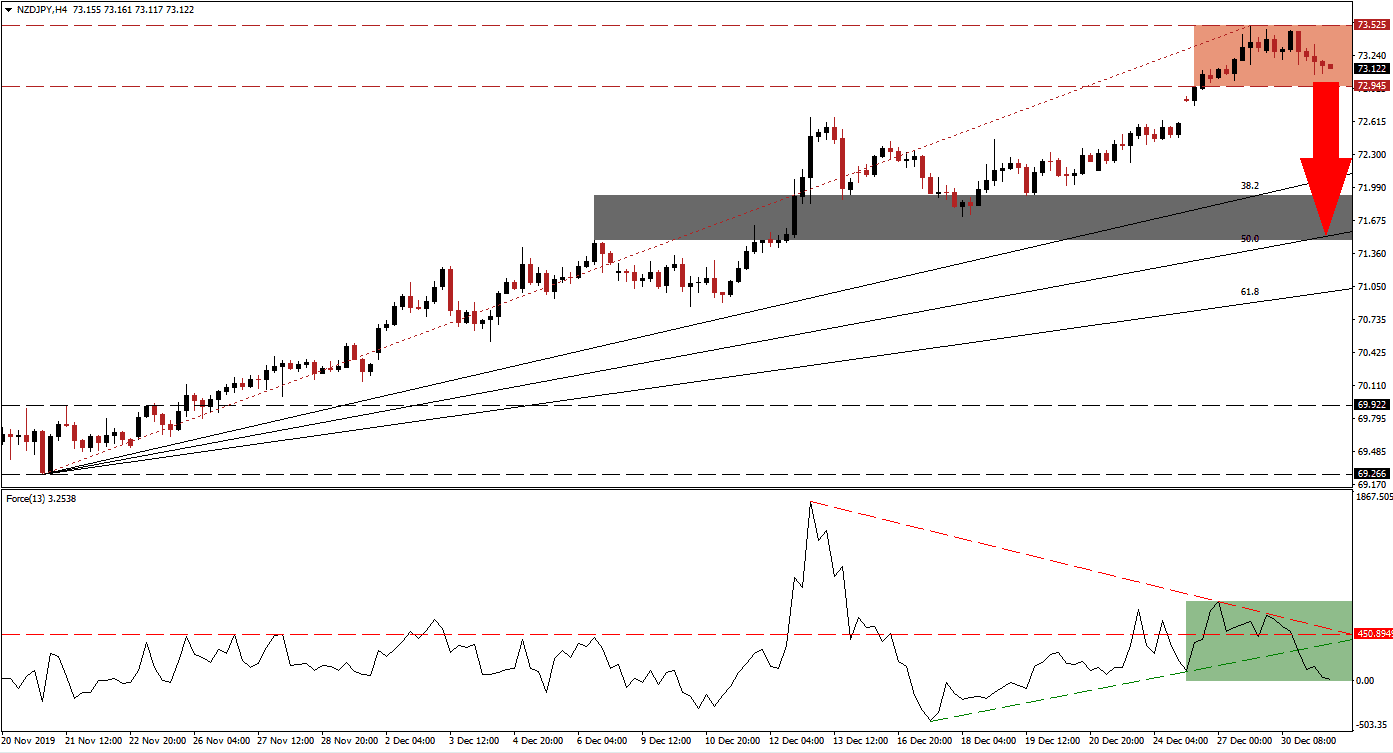

Thin trading volumes allowed the NZD/JPY to extend its rally over the past two weeks, but 2020 may see the return of a risk-off period. Global economic data continues to be weak, the latest confirmation was provided through this morning’s Chinese PMI data. The Japanese Yen is expected to benefit despite its slowing economy, as risk-averse traders prefer its currency as the primary safe-haven asset in the forex market. Bearish momentum is expanding after price action reached its resistance zone, and a breakdown is favored to follow.

The Force Index, a next-generation technical indicator, was able to briefly eclipse its horizontal resistance level after bouncing off of its ascending support level. Bullish momentum receded quickly, and a descending resistance level materialized. The Force Index was pushed to the downside, which led to a breakdown below its ascending support level, as marked by the green rectangle. This technical indicator is now anticipated to continue its contraction into negative conditions, placing bears in charge of the NZD/JPY. You can learn more about the Force Index here.

With bearish momentum expanding, a breakdown in this currency pair is pending. The NZD/JPY already moved below its Fibonacci Retracement Fan trendline, leading to an acceleration in downside pressures. A move below its resistance zone, located between 72.945 and 73.525 as marked by the red rectangle, is likely to initiate a sell-off. Forex traders are recommended to monitor the intra-day low of 72.769, the low following a price gap to the upside. A push below this level is anticipated to enhance the profit-taking sell-off. You can learn more about a price gap here.

A breakdown will close the gap between price action and its ascending Fibonacci Retracement Fan Support Level. Long-term fundamental for the New Zealand Dollar remains bullish throughout 2020, and the uptrend is expected to remain intact. The NZD/JPY should witness the loss in selling pressure once it reaches its short-term support zone. This zone awaits this currency pair between 71.492 and 71.916, as marked by the grey rectangle and enforced by its 50.0 Fibonacci Retracement Fan Support Level.

NZD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 73.150

Take Profit @ 71.750

Stop Loss @ 73.600

Downside Potential: 140 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.11

Should the Force Index sustain a breakout above its descending resistance level, the NZD/JPY is likely to attempt one of its own. Volatility is favored to remain elevated in the first two trading weeks of 2020, as portfolio managers position portfolios for the new trading year. The next resistance zone is located between 74.230 and 74.584, from where a further breakout will require a fresh catalyst.

NZD/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 73.850

Take Profit @ 74.550

Stop Loss @ 73.600

Upside Potential: 70 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.80