Bullish momentum collapsed after the NZD/JPY pushed into its resistance zone and a breakdown is anticipated to follow. The New Zealand Dollar advanced despite the drop in third-quarter trade volumes reported yesterday. At the same time, the Japanese Yen came under pressure which resulted in a strong advance. As uncertainties are once again on the rise, safe-haven assets like the Japanese Yen are expected to attract fresh capital. This currency pair is expected to follow the plunge in bullish momentum and accelerate to the downside.

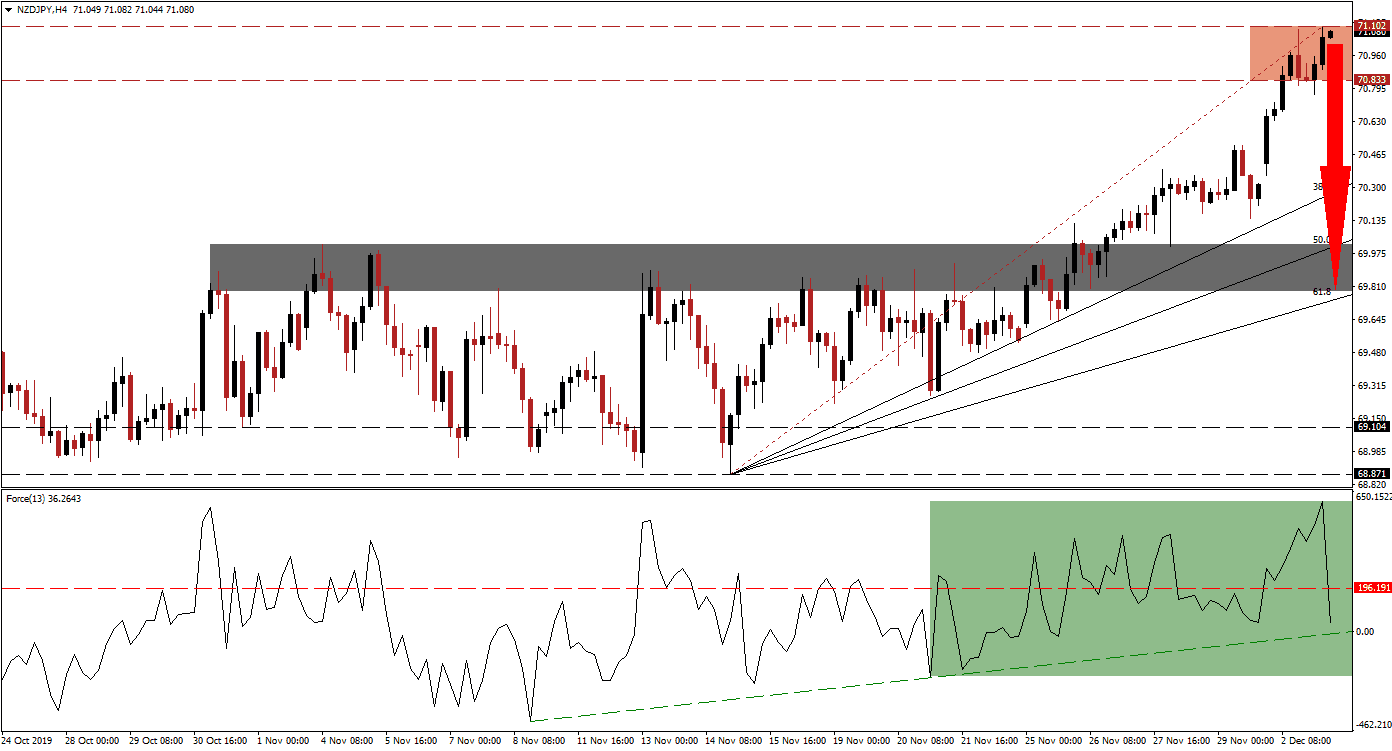

The Force Index, a next-generation technical indicator, shows the severe drop in bullish momentum after recording a fresh high together with the NZD/JPY. The magnitude of the reversal resulted in a breakdown in the Force Index below its horizontal support level, converting it into resistance as marked by the green rectangle. This technical indicator is now approaching its ascending support level and another breakdown is expected which would take it into negative conditions and place bears in charge of this currency pair. You can learn more about the Force Index here.

A breakdown in price action below its resistance zone, located between 70.833 and 71.102 as marked by the red rectangle, is additionally expected to invite a profit-taking sell-off. Forex traders are advised to monitor the intra-day low of 70.763, the low of a failed breakdown attempt, as a move lower is likely to accelerate a corrective phase. This should close the gap between the NZD/JPY and its ascending 38.2 Fibonacci Retracement Fan Support Level.

This currency pair will face its first test at its next short-term support zone located between 69.784 and 70.019 as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level just crossed above this zone with the 61.8 Fibonacci Retracement Fan Support Level approaching the bottom range. A move into this zone would keep the long-term uptrend intact, but a further breakdown cannot be ruled out. The next long-term support zone awaits the NZD/JPY between 68.871 and 69.104. You can learn more about a support zone here.

NZD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 71.050

Take Profit @ 69.800

Stop Loss @ 71.450

Downside Potential: 125 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.13

In case the Force Index can bounce off of its ascending support level and push above its horizontal resistance level, the NZD/JPY could attempt a breakout of its own. The plunge in bullish momentum suggests a breakdown in this currency pair is imminent, and a temporary breakout should be viewed as a good short-selling opportunity. Price action will face its next resistance zone between 71.690 and 71.977.

NZD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 71.650

Take Profit @ 71.950

Stop Loss @ 71.500

Upside Potential: 30 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.00