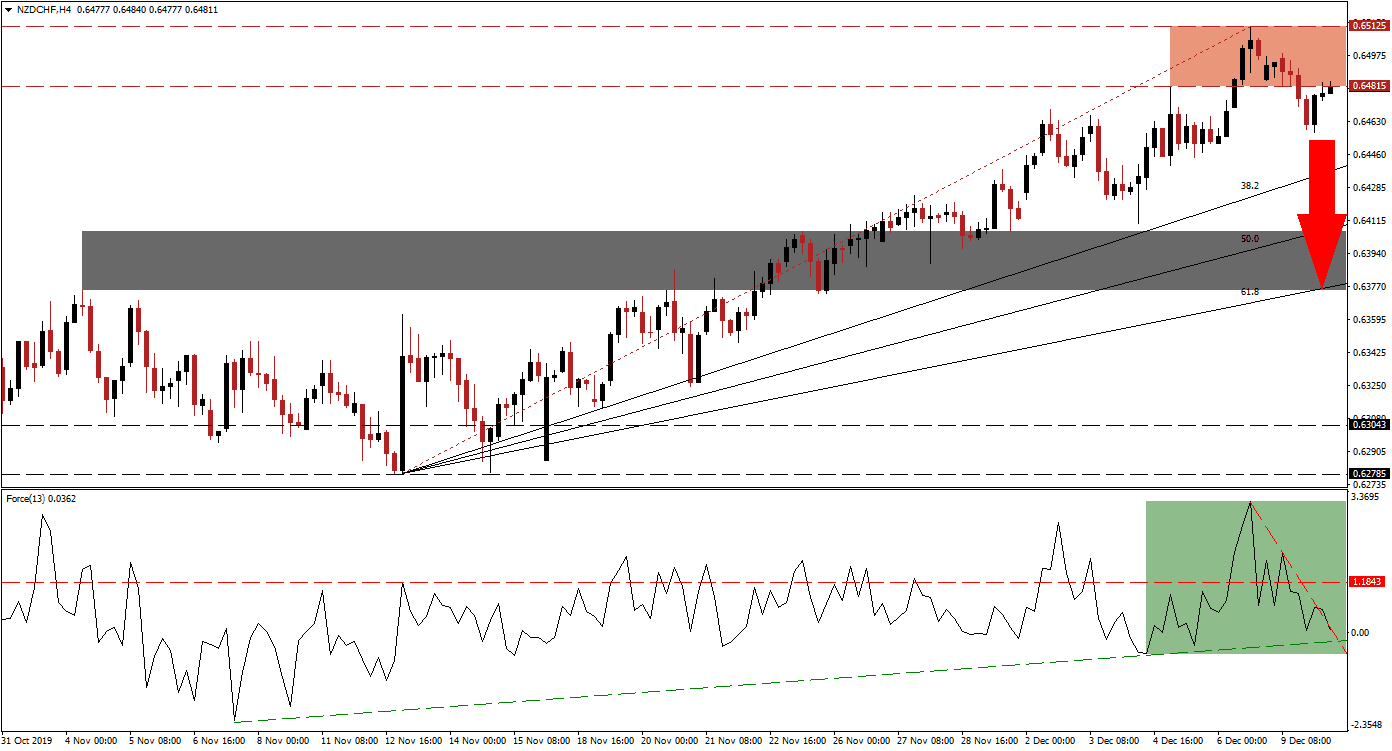

Economic data released out of New Zealand showed a contraction in truck traffic, suggesting fewer goods were moved domestically. The NZD/CHF was able to retrace its breakdown back into its resistance zone, a normal move following a pending price action reversal, and a good second entry opportunity for forex traders. Bearish momentum is on the rise and this currency pair is expected to enter a profit-taking sell-off; uncertainty over UK elections in two days and potential new tariffs in the US/China trade war at the end of the week, favor a higher Swiss Franc due to its safe-haven status.

The Force Index, a next-generation technical indicator, shows the rise in bearish momentum after this currency pair reached the top range of its resistance zone. The Force Index quickly contracted below its horizontal support level, turning it into resistance. A steep descending resistance level is pressuring this technical indicator to the downside, and a breakdown below its ascending support level is likely to follow. The Force Index already moved into negative territory, as marked by the green rectangle, and bears are in charge of the NZD/CHF. You can learn more about the Force Index here.

Another bearish development materialized after this currency pair moved below its Fibonacci Retracement Fan trendline. The breakdown in the NZD/CHF below its resistance zone, located between 0.64815 and 0.65125 as marked by the red rectangle, have made price action vulnerable to a corrective phase. Forex traders are advised to monitor the intra-day low of 0.64575, the low of the current breakdown; a move below this level is favored to result in more net sell orders, and drive this currency pair farther to the downside.

Price action is anticipated to push through its ascending 38.2 and 50.0 Fibonacci Retracement Fan Support Levels, and into its short-term support zone. This zone is located between 0.63747 and 0.64056, as marked by the grey rectangle, the 61.8 Fibonacci Retracement Fan Support Level just entered the support zone. A breakdown in the NZD/CHF would require a fresh fundamental catalyst, and a move into this zone will keep the long-term uptrend intact. You can learn more about a support zone here.

NZD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.64800

Take Profit @ 0.63750

Stop Loss @ 0.65150

Downside Potential: 105 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 3.00

In case of a disconnected between the Force Index and its descending resistance level, leading to a breakout above its horizontal resistance level, the NZD/CHF could be pressured to the upside. The next resistance zone awaits this currency pair between 0.65601 and 0.65930; more upside remains challenging given the existing fundamental conditions, and forex traders may consider short positions.

NZD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.65300

Take Profit @ 0.65900

Stop Loss @ 0.65000

Upside Potential: 60 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.00