Bearish momentum in the NZD/CAD is expected to pressure for more downside after price action completed a breakdown below its resistance zone. New Zealand reported an increase in its third-quarter current account deficit and dairy prices contracted sharply; New Zealand remains a major dairy exporter, and the economy is heavily exposed to soft commodities. Canadian data has been softer than what economists predicted but sufficed to add to the corrective phase in this currency pair.

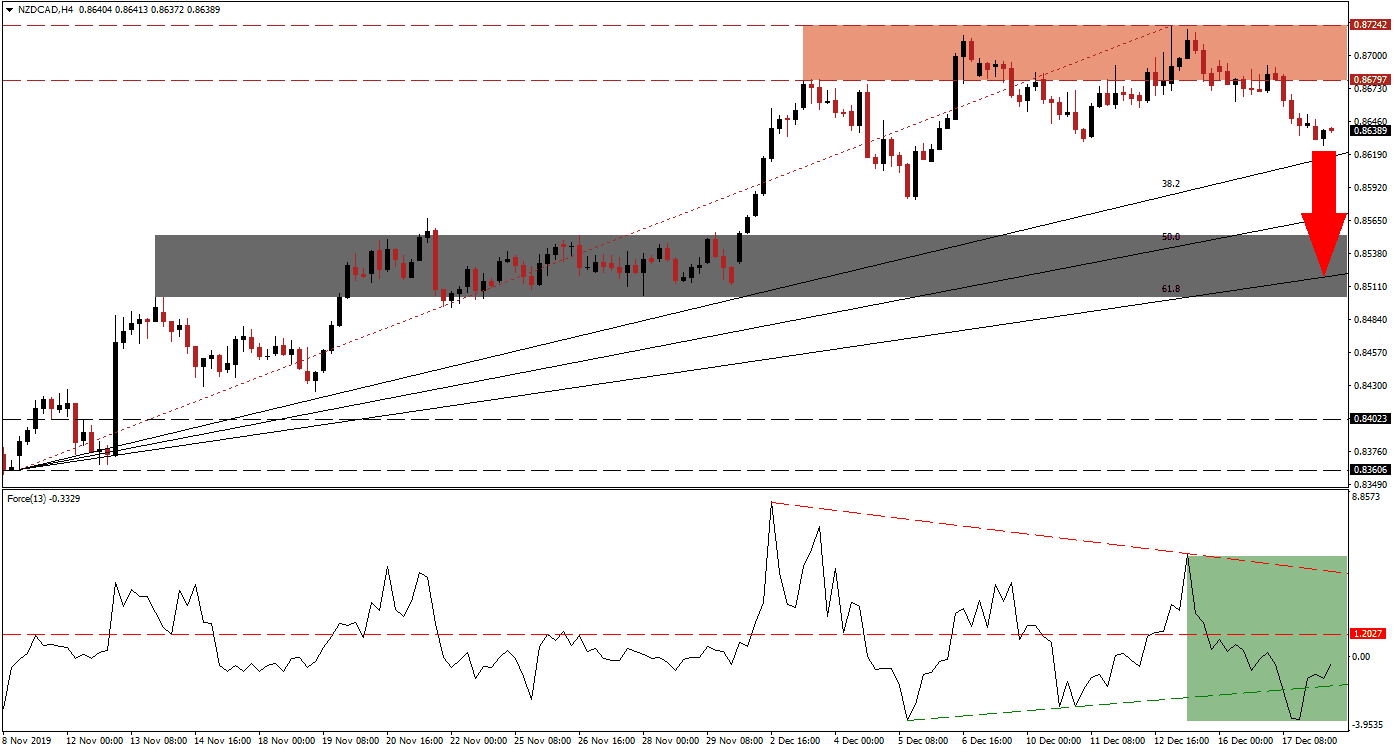

The Force Index, a next-generation technical indicator, indicates the loss in bullish momentum as it dropped below its horizontal support level and turned it into resistance. A brief dip below its ascending support level was quickly reversed, as marked by the green rectangle. The Force Index remains in negative conditions, and bears are in charge of the NZD/CAD; while more upside is possible, the descending resistance level is favored to keep the downtrend intact. You can learn more about the Force Index here.

Following the breakdown in price action below its resistance zone located between 0.86797 and 0.87242, as marked by the red rectangle, more downside is anticipated to follow. The NZD/CAD carries enough momentum for a breakdown below its ascending 38.2 Fibonacci Retracement Fan Support Level. Today’s Canadian inflation data may provide the next short-term fundamental catalyst as the Bank of Canada remains uncertain on future monetary policy due to contradicting economic reports.

Price action is favored to extend its corrective phase until it will reach its short-term support zone located between 0.85017 and 0.85526, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is crossing through this zone and expected to halt an extension of the breakdown sequence. Long-term fundamental prospects for the New Zealand economy remain sound with a stabilizing housing market and an increase in the minimum wage expected to support consumer spending in 2020. A move in the NZD/CAD into its support zone will keep the long-term uptrend intact.

NZD/CAD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.86400

Take Profit @ 0.85300

Stop Loss @ 0.86750

Downside Potential: 110 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 3.14

Should the Force Index push through its descending resistance level, the NZD/CAD could attempt a breakout above its resistance zone. This will reignite the long-term bullish advance in this currency pair, but an extension of the short-term correction will enhance the upside potential. The next resistance zone awaits price action between 0.87982 and 0.88178; more upside would require a fresh fundamental catalyst.

NZD/CAD Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 0.87100

Take Profit @ 0.88100

Stop Loss @ 0.86750

Upside Potential: 100 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.86