Bearish momentum is accumulating after this currency pair pushed into its resistance zone on the back of the low volume. The New Zealand and Canadian Dollars are both considered commodity currencies, where the former is more active in the soft commodity market and the latter in hard commodities. Global growth concerns have a bigger impact on hard commodities, which assisted the advance in the NZD/CAD. With breakdown pressures on the rise, a short-term corrective phase may emerge before a renewed push to the upside. You can learn more about a breakdown here.

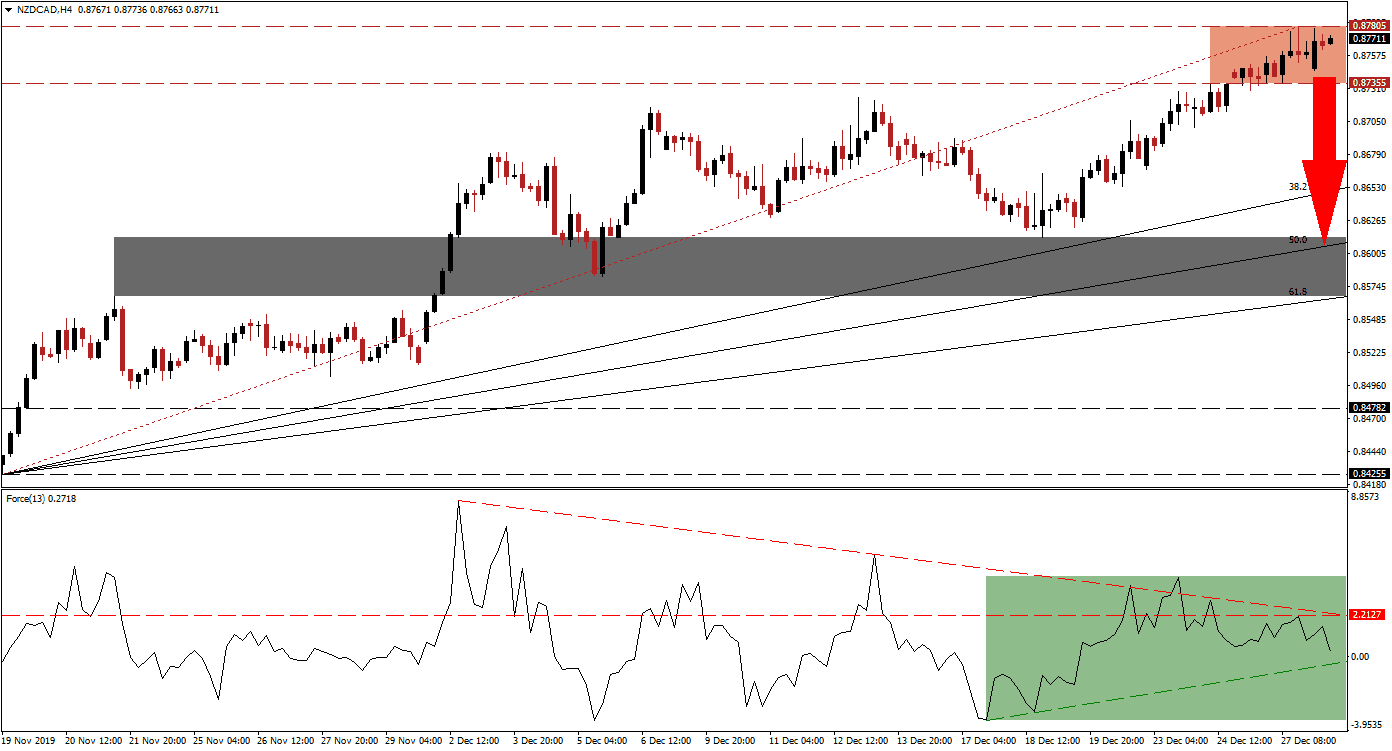

The Force Index, a next-generation technical indicator, shows the formation of a negative divergence as bearish momentum is expanding while the NZD/CAD extended its advance. After the descending resistance level rejected the Force Index, it converted its horizontal support level into resistance. This technical indicator remains in positive conditions but is closing in on its ascending support level, as marked by the green rectangle. A breakdown is favored to take the Force Index into negative conditions and place bears in control of price action.

Price action moved below its Fibonacci Retracement Fan trendline, adding to bearish developments in this currency pair. The NZD/CAD is anticipated to complete a breakdown below its resistance zone located between 0.87355 and 0.87805, as marked by the red rectangle. This is likely to lead to a profit-taking sell-off that will close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. A move below the intra-day low 0.87002 is favored to result in new net short positions. You can read more about the Fibonacci Retracement Fan here.

Given the long-term fundamental outlook of soft commodities versus hard commodities, the long-term uptrend in this currency pair is likely to remain intact. Price action is anticipated to extend its breakdown into the next short-term support zone located between 0.85669 and 0.86131, as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level is on the verge of crossing above this zone, with the 61.8 Fibonacci Retracement Fan Support Level enforcing the bottom range of it. A breakdown in the NZD/CAD below its support zone would require a fresh fundamental catalyst.

NZD/CAD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.87700

Take Profit @ 0.86100

Stop Loss @ 0.88100

Downside Potential: 160 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 4.00

A breakout in the Force Index above its descending resistance level could pressure the NZD/CAD into a breakout attempt. While the long-term outlook favors more upside, the technical conditions point towards a breakdown. Should this currency pair sustained a breakout, the next resistance zone is located between 0.88545 and 0.88880. More upside would depend on a change in short-term fundamental developments.

NZD/CAD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.88250

Take Profit @ 0.88850

Stop Loss @ 0.88000

Upside Potential: 60 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.40