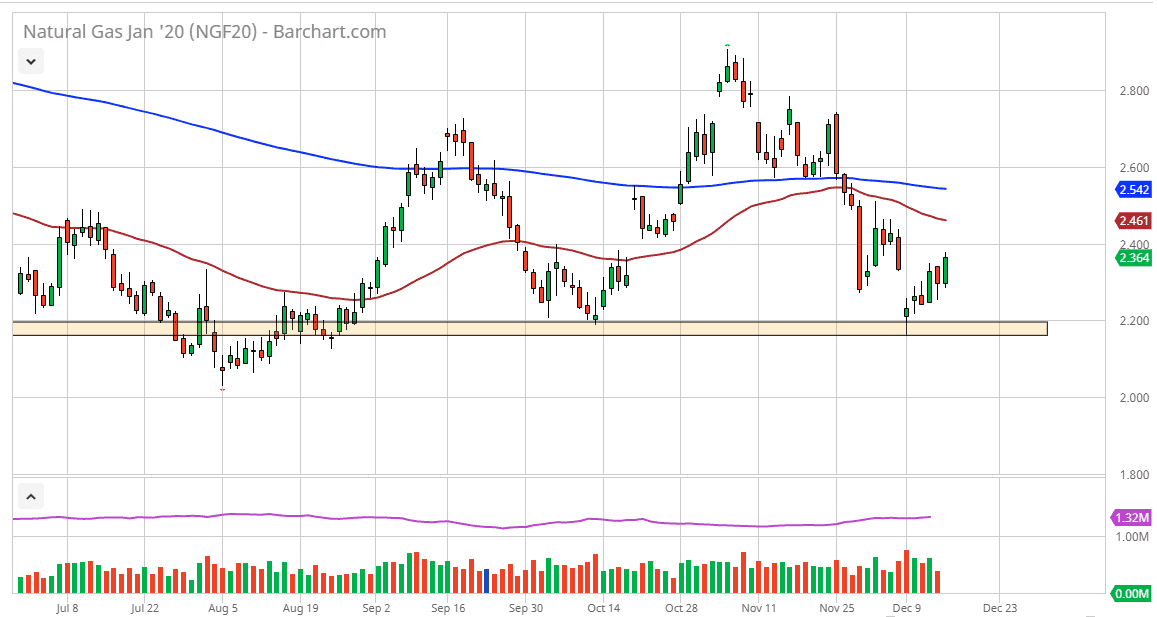

Natural gas markets have rallied nicely during the Monday session to kick off the week, reaching above the $2.35 level. The $2.40 level above is worth paying attention to, because quite frankly it is not only a large, round, psychologically significant figure, but it’s also the scene of a breakdown. This breakdown of course is worth paying attention to because there will be a lot of monetary flow in this area.

Natural gas markets have been dealing with an overextension of supply from drilling earlier this year, 17% more than the previous year. That being the case, the market is far over supplied as per usual. However, we also had the double whammy of warmer temperatures forecasted in December. That is starting to fall by the wayside as it typically will do, as whether prediction in the United States in the wintertime is notoriously difficult. With that, the fact that colder temperatures are coming it’s likely that we will continue to see buyers coming into the natural gas market. Ultimately, this has been a disastrous winter so far for the natural gas suppliers, and at this point any good news would be welcomed.

Ultimately, this is a market that doesn’t have a whole lot farther to fall, so a simple short covering rally may present itself at the first sign of cold temperatures. That being said, the market is likely to continue to see a lot of back and forth but if we can clear that $2.40 level it’s possible that we could make a run towards $2.50 next, and then the $2.60 level. All things being equal I do think that natural gas is likely to rally from here, and the fact that we have not only fill the gap from last week but have gone above it is a very bullish sign. As far as selling is concerned, although I certainly see where we could pull back occasionally, it’s very difficult to do so at these extraordinarily low levels. The $2.20 level seems to be massive support, and most certainly the $2.00 level underneath will be. In the meantime, though, I believe that buying dips probably continues to be a way forward, at least over the next several weeks. Sometime in January we will probably see massive selling. Having said that, sometimes the coldest winter temperatures come a bit later than usual, so that is still a threat as well.