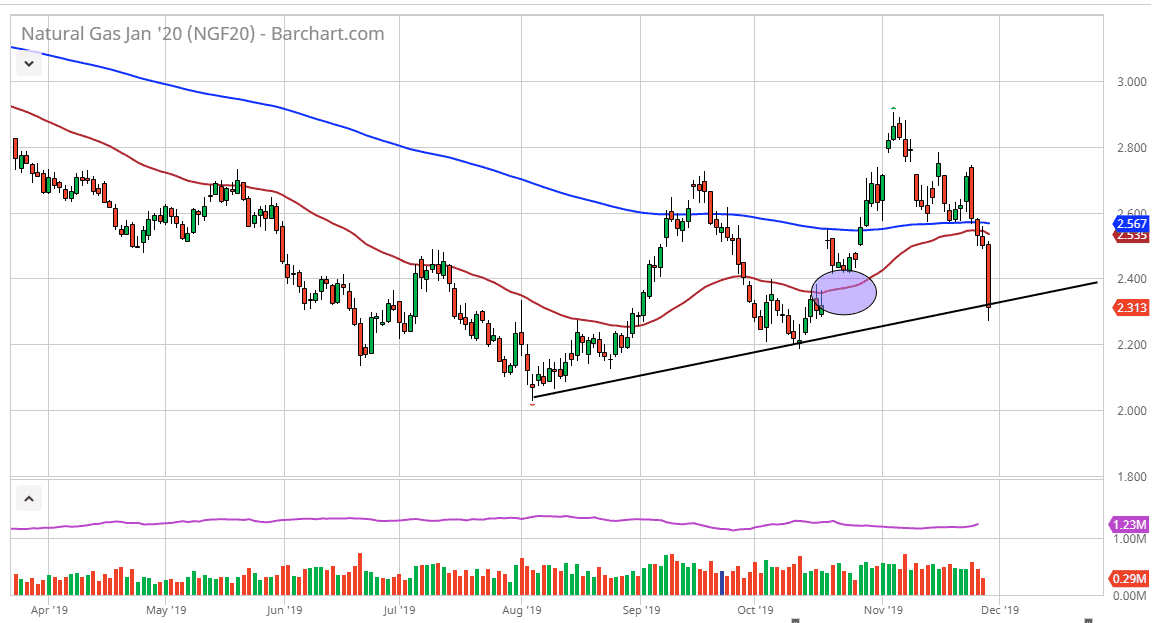

Natural gas markets have broken down over 7% during the trading session on Friday, but the problem that I have with getting overly excited about that is that it was the day after Thanksgiving. In other words, volume would be very minimal. That being said, there are a couple of things it should be paid attention to on the chart that suggests that a trade may be setting up.

Now that we have broken down significantly, we have also filled the gap that I have marked on the chart by the purple ellipse. With that being the case it’s very likely that the market will see a certain amount of support in this area. Beyond that there is also an uptrend line that is trying to form in the same area and just below is the psychologically important $2.25 level. That being said, the market is very unlikely to simply continue ripping lower, and I do think at the very least we probably get a little bit of a “relief rally.”

That being said, if we were to break down below the $2.25 level then it opens up the possibility of a move down to the $2.00 level after that. That area would be a crucial large number that simply must hold. If for some reason we found the market below that handle, it would be catastrophic for natural gas. This is the wrong time of year to be shorting natural gas although it obviously would have worked out quite well this past week. The weather forecast for the middle of December suggests warmer than usual temperatures, and that’s part of what is driving natural gas lower. Having said that, all it’s going to take is another storm or something like that to show up in order to turn this market back around. It happens every winter, we get some type of rip to the upside. It is because of that I have no interest in shorting this market this time a year. That being said, it’s almost impossible to buy natural gas until we get at least a couple of days’ worth of support or better yet, some simple stability would be nice. Granted, natural gas is oversupplied in a structural sense, but at the end of the day the temperatures will eventually work to the other side of the trade in get this thing going.