Natural gas markets initially tried to rally during the trading session on Wednesday. The market pulled back a bit during the session as traders will have stepped away in order to await the figures coming out for Thursday trading. The storage figures of course are crucial as a sign of whether or not demand is picking up or not, and as a result it’s very likely that the reaction will be significant as per usual.

Remember, natural gas markets are a bit thinner than most other futures markets, so the storage figures that come out every week will knock it around quite a bit. We have seen a couple of major snowstorms as of late, and this of course will drive demand up for natural gas in the United States. Ultimately, with colder temperatures on the way, it’s likely that natural gas markets will continue to climb. Even if the announcement comes out rather bearish this week, it’s very likely that traders will look through that and any pullback will probably attract a lot of buying pressure.

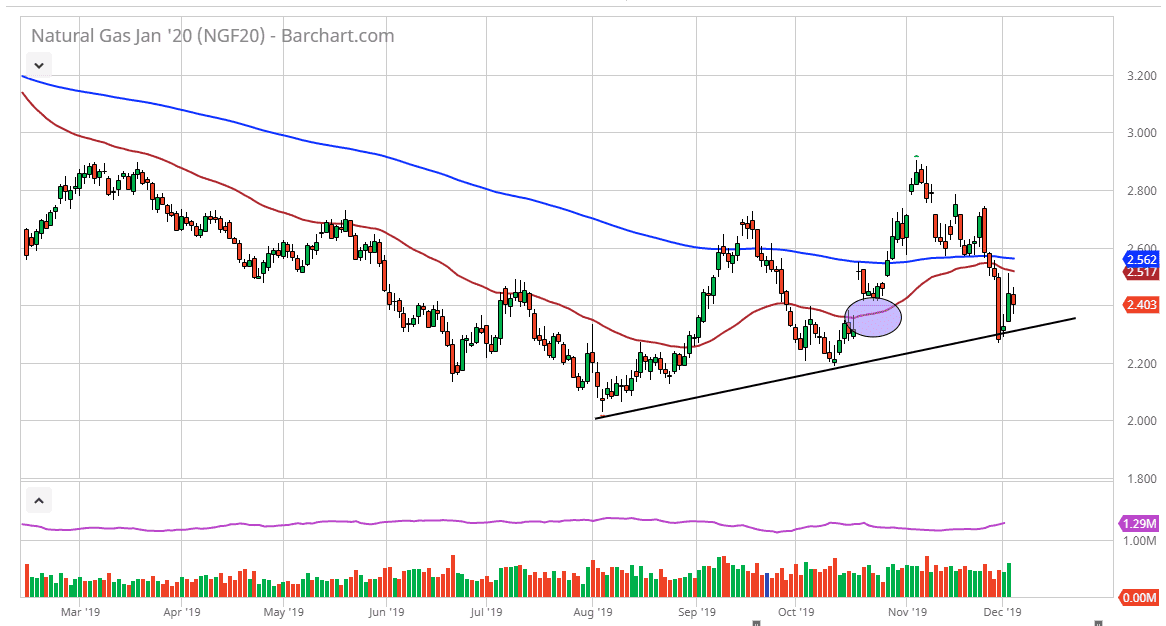

Underneath, the uptrend line should continue to keep this market afloat, and it should also be noted that the Friday session from last week selling off was due to not only negativity, but also a lack of volume. Remember, it was the day after Thanksgiving, so volume would have been a major issue. All things being equal, the market has been rising over time and I think it’s only a matter of time before we continue to see a lot of buyers. The lows are getting higher, just as the highs are. Ultimately, this is a market that is very seasonal, and this time a year tends to be relatively strong. That being said, US drillers had produced almost 14% more than the previous year, so it is taking quite a bit more work to chew through the supply in order to get that winter pop that we normally see. That tends to send this market somewhat parabolic, but so far, we still see quite a bit of supply. Given enough time though, the market should go higher, and this time of year is most certainly a better time to be buying then selling. Overall, it’s not until the middle or late part of January that I start to look for shorting opportunities. Pay attention to the trend line underneath, it should continue to have an effect on the market.