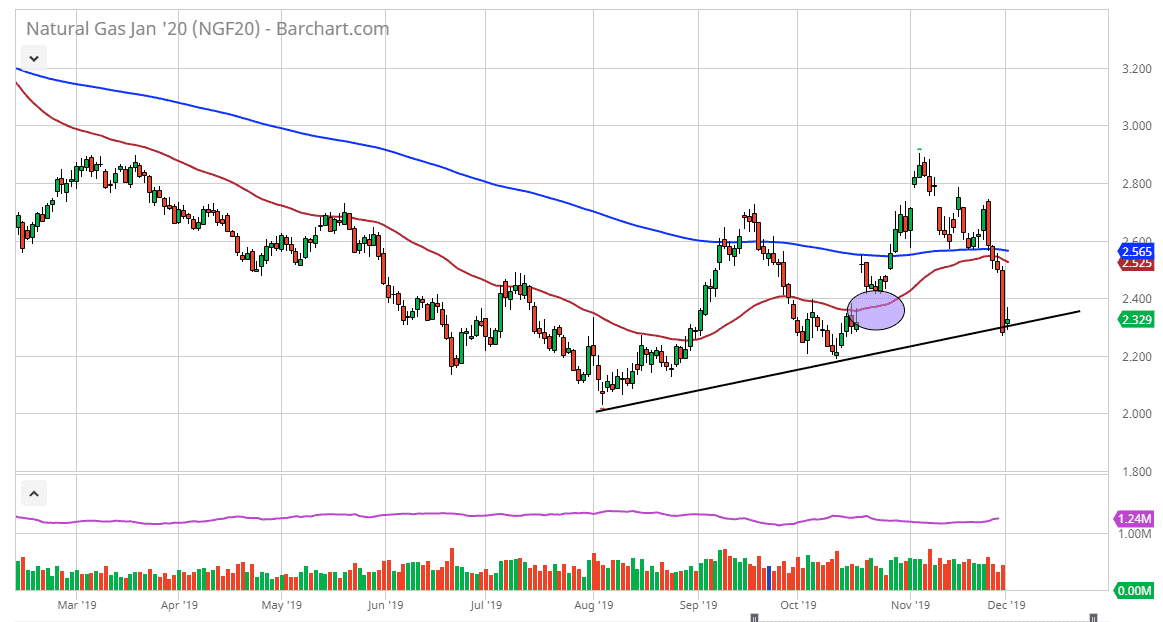

The natural gas markets initially rally during the day on Monday, as they had gotten a bit oversold during the trading session on Friday. After all, there was very little in the way of volume on Friday after was the day after Thanksgiving, so therefore most of the large trading firms in the United States simply weren’t bothered. We ended up falling enough to fill the gap, which of course is something that needed to happen as far as technical analysis is concerned, and under normal circumstances we should have buyers in that area. This is more than likely what led into the beginning of the trading session on Monday, but we have given back some of those gains. It is because of this that I believe the market is going to make a serious decision in the next couple of days.

Looking at the candlestick for the Monday session, you can see that we have gone back and forth and shown a lot of choppiness, in a relatively tight range. While it isn’t a signal to start buying in and of itself, but it is a sign that we are at least slowing down the massive selloff. At this point, the market looks very likely that we will kind of marble back and forth in this area. That being said, the market breaking above the highs of the Monday session could lead into a bigger move to the upside. The natural gas markets are extraordinarily cheap considering the time of year, but we do have a warmer weather forecast for the middle of December coming. That of course works against the value of natural gas, but it is only a matter of time before we get a couple of winter storms that will cause a massive spike in this market.

To the downside, if we were to break down below the $2.20 level, then we probably go down towards the $2.00 level underneath. That is a major area of psychological support, and as a result it’s very likely that it would attract a lot of attention. That being the case, I do believe that it’s only a matter of time before we turn right back around, but I believe that it’s a much more bullish sign if we can do it now near the uptrend line. With this, I get no interest in shorting, on simply looking for an opportunity to go long.