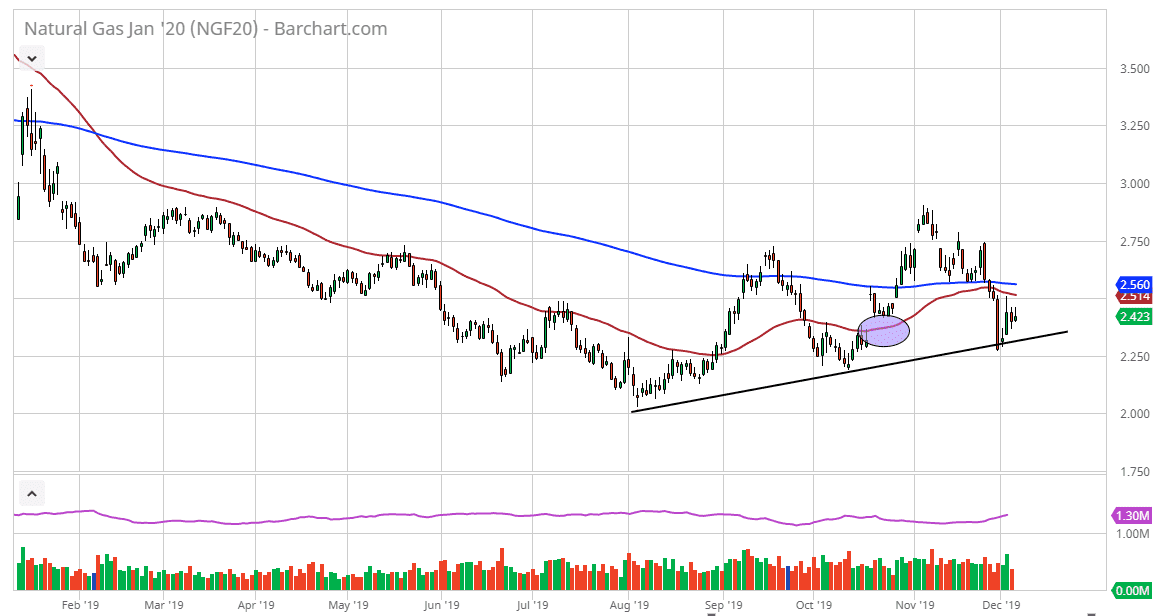

Natural gas markets have rolled over just a bit during the trading session on Friday, breaking below the $2.40 level. At this point, the market is likely to test the uptrend line underneath, which of course has been important more than once. At this point, it’s likely that we will continue to see buyers based upon this support area and of course the fact that the winter temperatures are starting to plummet in the United States. That being said, there has been a string of massive supply builds over the last year, and therefore it’s likely that we will see a lot of back and forth.

To the upside, the 50 day EMA above would cause resistance, just as the 200 day EMA well. The $2.60 level is a major barrier, and if we can break above there, the market is likely to go looking towards the $2.80 level. At this point, the market then probably goes looking towards the $3.00 level. I like the idea of buying dips going forward, but as the cold weather continues to cause issues. Ultimately, this is a market that will probably struggle to go higher in a clean move, but sooner or later we will get some type of cold weather that will where through the supply. At this point, the market looks very likely to continue to show signs of bullish pressure. Short-term pullbacks continue to be buying opportunities as long as we can stay above the uptrend line, then it should show signs of strength.

If we do break down below that uptrend line though, it opens up the door to the $2.20 level, perhaps even down to the $2.00 level. Ultimately, this is a market that is cyclical, and therefore it’s likely that we will see buyers given enough time. Overall though, this is a market that remains very erratic so you will have to be cautious and perhaps keep below leverage in order to take advantage of the move. A break above the highs of the last couple of days would be the first sign that we are going higher, and quite frankly we are just a snowstorm to away from causing major spikes in pricing. This is the cyclical trade that happens every year, but given enough time it’s likely that sellers will get involved in and start shorting somewhere in the middle of January.