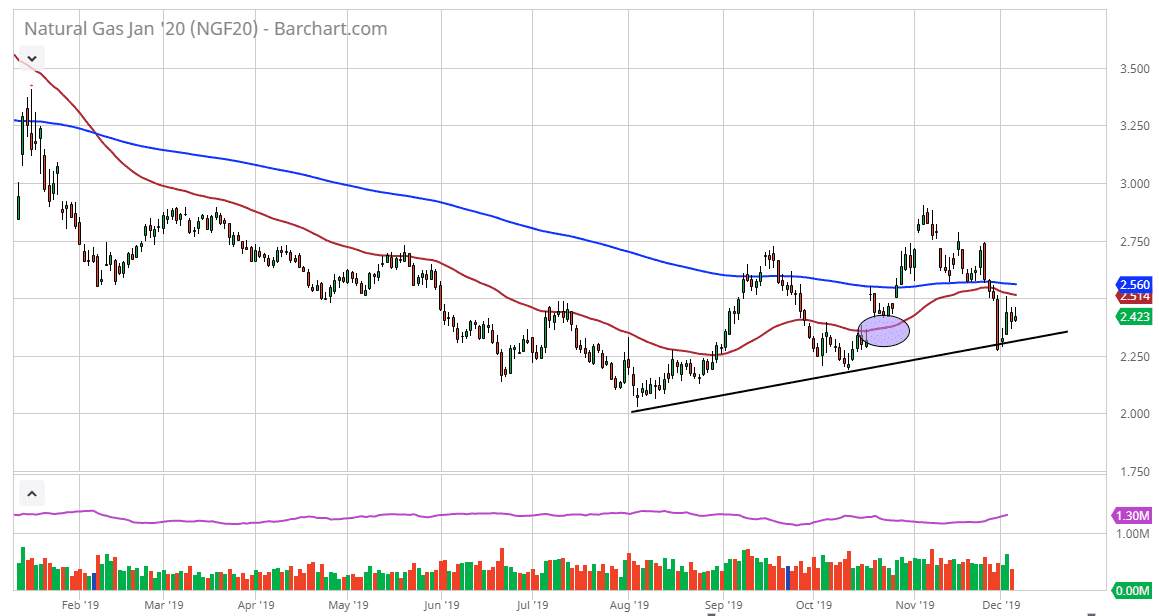

The natural gas markets initially tried to rally a bit during the trading session on Thursday but pulled back to show signs of concern with the jobs figure coming out on Friday. At this point in time, it’s very likely that we will continue to see support underneath, and at this point the trendline is something to pay attention to as it has held quite steady over the last couple of months, and it does suggest that perhaps we are going to try to grind to the upside.

At this point, the market looks very likely to see the moving averages above as a bit of resistance, but overall this is a market that is somewhat cyclical and we are most certainly at the peak of the high demand season as snowstorm start to take over in the United States and of course temperatures plunged. With that being the case, I have no interest in shorting this market I look for buying opportunities. Pullbacks at this point should be a buying opportunity, and therefore I think it’s only a matter of time before we continue to see buyers jump in and take advantage of dips.

It should be worth noting that the storage figures for Thursday came out at -19 million, as opposed to the expected -21 million. That being said, numbers are getting “less bad” for natural gas so it’s only a matter of time before we find reasons to go higher, not the least of which is going to be the snowstorms that have hit the northeastern part of the United States of the last week or so. Typically, the market moves back and forth due to weather reports this time a year, and at the first sense of freezing temperatures in America, we will see natural gas rally. However, this year is a little bit messier than usual because the natural gas drillers in the United States produce 14% more than the previous year. In other words, we have a lot of supply to chew through over the next couple of weeks. One thing is for sure, after we rally to the upside, the selloff will be brutal and just as quick as any snap pop to the upside. With this, I believe that we are simply going to continue grinding higher based upon this trendline, and the somewhat of a bullish channel that we have seen form.